From the point of view of complex analysis, we can see that the long positions returned the quotes to its starting levels.

The past trading day had two bursts of activity in relation to the accumulation at 1.1270 / 1.1320, during which the quotes managed to pass the border of 1.1270 at the beginning of the European trading session. In the afternoon, however, the market sentiment changed, which dragged down the US dollar under a flurry of sales, throwing the euro in the peak area of 1.1350 / 1.1380.

Being overbought did not hinder the market participants, so the correction did not acquire the necessary scale of recovery. It was only more than 500 points, which indicates overheating, in which if even a minimal change happens in the market sentiment, a technical correction will appear on the market. Many are currently guided by the area of interaction of trade forces 1.1440 / 1.1500, so a technical correction could occur if the quotes were able to touch its borders.

To change the market tact, the quotes have to consolidate above 1.1500 on daily charts. However, only do so if you want to give the quotes new levels.

As discussed in the previous review, traders worked on a correction from the quote 1.1270, towards the levels 1.1200-1.11180. However, the market decided otherwise, materializing an alternative scenario, which eventually brought profit.

[Buying positions were opened above 1.1325, towards 1.1350-1.1380.]

In terms of volatility, a 139% acceleration relative to Tuesday was recorded, which confirmed the exit of quotes from accumulation. The market dynamics spoke for themselves, and the coefficient of speculative positions indicates the fact of activity.

Looking at the daily chart, traders should periodically enter the daily periods so as not to forget that the global trend from 2008 has been and remains downward, and all changes in market tacts, which were described above, relate to the medium-term trend in February 2018.

In another note, the news published yesterday contained preliminary data on the eurozone's first quarter GDP. The report revealed that the pace of economic recession was 3.1%, better than the previous estimate of 3.2% and better than the current forecast of a decline of 3.3%. Nevertheless, the scale of the economic crisis still has no boundaries, so investors will continue to pessimistically consider the current reports.

Market reaction to such data was expressed with an immediate stop in the decline, after which the euro turned back upwards.

In the afternoon, the data on job vacancies in the US was published, which showed a decrease from 6.011 thousand to 5,046 thousand, lower than the forecasted 5,300 thousand vacancies. The figure is in contrast with the recent report of the US Department of Labor, which showed an increase in the number of new jobs. The JOLTS data suggests that there is a discrepancy, which investors have definitely drawn attention to.

With regards to general news, ECB member Isabel Schnabel expressed her thoughts on a lower interest rate. She said that the current purchase of assets seems to be a more suitable tool to stimulate the eurozone economy.

Today, the main event is the announcement of the decisions of the Fed with regards to economic recovery, in which many are nervous, despite the Fed's repeated statements that it does not plan to touch the interest rate unnecessarily. Its main goal is to monitor and adjust previously taken steps to support the US economy.

In terms of statistics, the US inflation rate is to be published, the forecast for which is a decline from 0.3% to 0.2%. The indicator plays a major role in the decisions for monetary policy, so investors consider it the most relevant right now because of the upcoming Fed decisions.

Further development

Analyzing the current trading chart, we can see that the quotes converged in the area of last week's high 1.1350 / 1.1380, in which a slowdown and slight pullback was observed. The desire to maintain a bullish mood is still present, but the activity of speculators, as well as the overheating of long positions in the area of interaction of the trading forces 1.1440 / 1.1500, are also visible.

Sooner or later, the bullish mood will bring the quotes near the area of 1.1440 / 1.1500, but only a consolidation above 1.1500 in the daily period will change the medium-term tact. In addition, the speculative mood is still very much present, so be prepared as even a small change caused by external news could provoke a sharp turn, which will lead to a technical correction.

Thus, based on the above information, we present these trading recommendations:

- If the quotes consolidate below 1.1330, open sell positions after a rebound from the area 1.1350 / 1.1380, towards 1.1300 and 1.1250.

- Buy positions higher than 1.1400, towards 1.1440-1.1480.

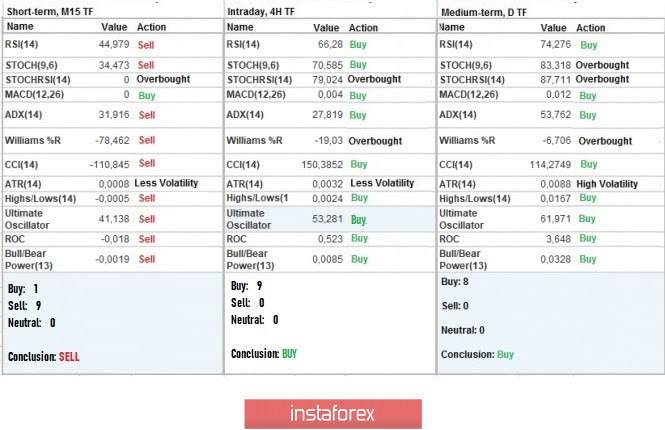

Indicator analysis

Analyzing the different sectors of timeframes (TF), we can see that the indicators of hourly and daily periods signal buy, not only because of the return of the quotes to the area 1.1350 / 1.1380, but also because of the constant movement of the pair .

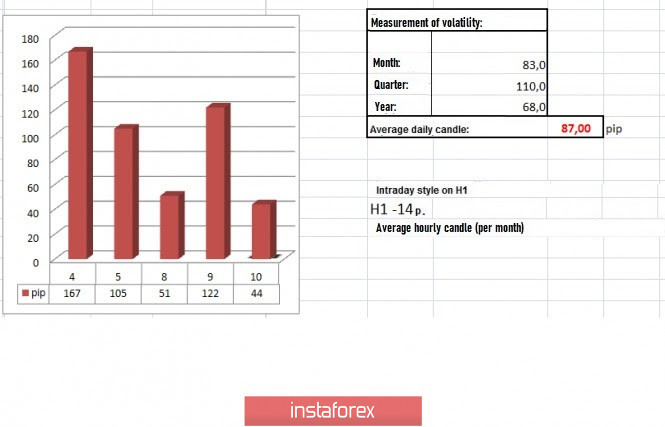

Volatility per week / Measurement of volatility: Month; Quarter Year

The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year.

(June 10 was built, taking into account the time of publication of the article)

The volatility of the current time is 44 points, which is still a low value for the market. It is assumed that the upcoming results of the Fed meeting, as well as the speculative mood of market participants, will raise market activity.

Key levels

Resistance Zones: 1.1300; 1.1440 / 1.1500; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100

Support Areas: 1,1300; 1,1180; 1.1080 **; 1,1000 ***; 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***.

* Periodic level

** Range Level

*** Psychological level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română