There was an obvious profit-taking, which led to a small local strengthening of the dollar on world markets, in anticipation of the outcome of the Fed meeting, which will be known today, on Wednesday.

The appreciation of the dollar, as well as the decline in world stock indices caused by profit taking, on the one hand, is explained by the risks of possible changes in the near future of the monetary rate of the us regulator, which may lead to a reduction in stimulus measures in the wake of a more vigorous recovery of the national economy than the Fed had previously expected. On the other hand, the normal desire of market participants to take profits after a multi-day June rally. It was supported by the smooth exit not only of America, but also other economically significant countries from strict quarantine measures.

As for the Fed's final decision, the markets believe that the regulator will not plan to change its course of supporting the economy until some adequate sustainable signals for its recovery are outlined. Therefore, all attention will be paid to the rhetoric of the head of the Central Bank, J. Powell.

We believe that he will be optimistic in assessing the dynamics of the first steps of the country's exit from restrictive measures due to the coronavirus pandemic. If he does not touch on the prospective reduction of incentive measures in his speech, in view of the adjusted forecast of the U-shaped economy recovery for the V-shaped one, and confirms that the current rate will continue for a long period of time, this will serve as a signal for investors and may fully cause the resumption of growth demand for risky assets. In this case, the US dollar will be under pressure again.

On this wave, we should expect the resumption of growth in commodity currencies against the dollar, as well as the recovery of the upward dynamics of the euro and pound sterling. The dollar/yen may also turn up.

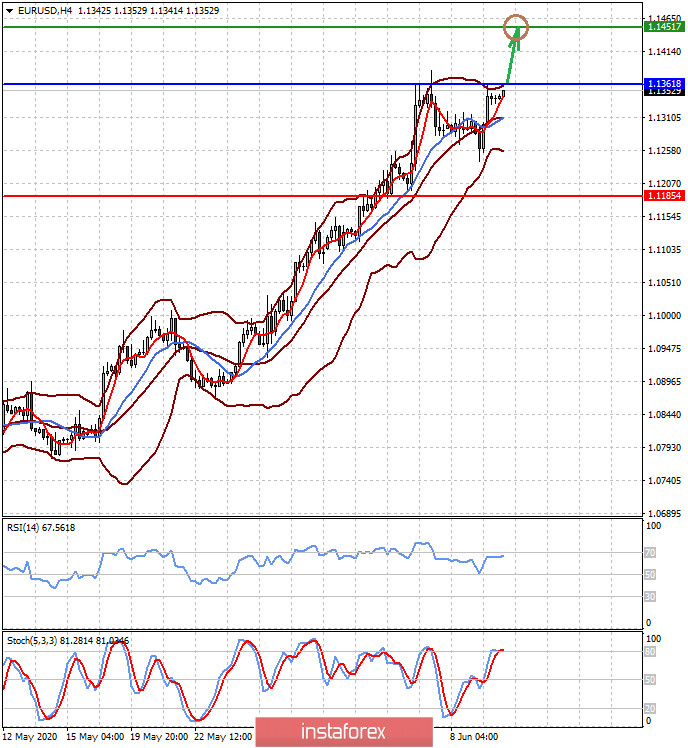

Forecast of the day:

The EUR/USD is trading below the level of 1.1360 in anticipation of the Fed's final monetary policy decision. If it turns out to be as we expect, then the pair breaking the level of 1.1360 will rush to the level of 1.1450, with the prospect of further rising to the level of 1.1500.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română