The rally of the euro halted ahead of the upcoming ECB meeting, which will discuss further decisions on interest rate in the eurozone. Although many expect the monetary policy to remain unchanged, some experts predict that the European regulator may decide to lower the deposit rate by another 10 basis points, which could adversely affect the euro. Nevertheless, the demand for the currency will increase, more so if the ECB takes on the expansion of its asset purchase program by about € 250 billion.

A new aid package for economic recovery in the eurozone may be a signal to build up long positions in risky assets. However, the upcoming new forecasts from the ECB may negatively affect the euro, as economists will assess the labor market and inflationary pressures in the eurozone. The regulator is sure to focus on the worsening economic prospects, but this could lead to a larger increase in the asset buyback program, not by 250, but by € 500 billion.

Other factors that limit the growth of the euro are the problems in fiscal policy within the EU and the tensions between the US and China. The current rally of the euro, which has been observed recently, can be attributed to the weakening US dollar, which is under pressure due to unrest in many US cities. The ongoing riots and mass protests in the streets of the US started after the death of African-American George Floyd on May 25 at the hands of the police, one of whom squeezed his neck with his knee for eight minutes.

Donald Trump, to restore order, sent troops to major US cities to frighten citizens and suppress riots. However, it failed, so yesterday, the US president said that he no longer considers it necessary to attract the military to suppress riots in the country. US Defense Secretary Mark Esper was also opposed to such an idea.

Meanwhile, the US Fed expanded credit access to several municipalities. The states are to independently determine which cities will buy debt under the upcoming lending program, and the changes are expected to help more than 100 issuers.

The injection of liquidity arranged by the Fed also gave great effects to the economy. The US stock market now has returned to its pre-crisis levels, having reacted positively to news on the US labor market and business activity in the US service sector.

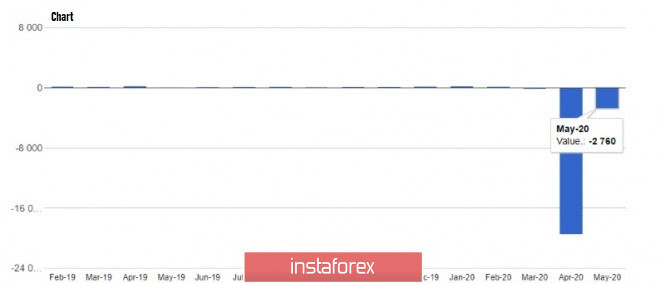

According to data from ADP and Moody's Analytics, the rate of layoffs still exceeds the rate of employment, but the situation is improving now, as the number of jobs in the US private sector only decreased by 2.76 million in May, much better from the previous 19.6 million drop in April. Most likely, the peak of dismissals that began due to the coronavirus pandemic has stopped, and now that many states start return to work as usual, the figure will gradually decline.

A report on new orders for manufacturing goods was also published yesterday, which revealed a 13.0% drop in the index in April, amounting to $ 384.3 billion. Economists expected the index to fall by 12.5%.

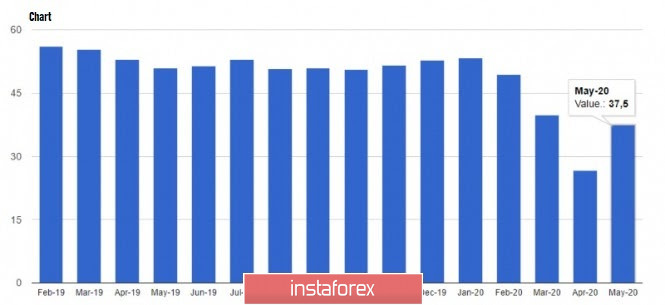

The decline in business activity in the US services sector has also slowed down, with the IHS Markit reporting the final PMI in May as 37.5 points, up from the previous low value of 26.7 points in April. Values above 50 indicate an increase in activity, while values below indicate a decline.

The European Commission put forward a proposal yesterday to allocate about € 24 billion for the restoration of EU agriculture. It will be part of the € 750 billion economic assistance program that was announced in the middle of last week, which will be borrowed in the financial markets. However, creating said fund requires a lot of approvals and various kinds of decisions, as the process must go through first with the European Council and various political parties of the European Union in the European Parliament. Currently, the European Commission is actively working to promote this program, but the matter has not yet reached a real discussion.

The most active controversy on the approval of the said program is expected to be between the north and south of the EU, as the plan will require rather difficult and compromise decisions, especially with the northern EU countries, with which there is now the deepest disagreement . According to reports, approximately 40% of the amount of 500 billion can be used to save the economies of Italy and Spain, which can lead to quite serious questions about the size of the shares of grants and loans. The Netherlands, Denmark, Austria and Sweden have long opposed such a plan.

As for the current technical picture of the EUR/USD pair, demand for the risky assets have started to dwindle down ahead of the upcoming ECB meeting. A breakout from the support level of 1.1190 will lower demand even further, which will push the quotes to lows 1.1120 and 1.1040. Demand will only recover after a breakout from the resistance level of 1.1255, which will heat up speculators and lead to a sharp bullish movement in the highs of 1.1295 and 1.1350.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română