Good day!

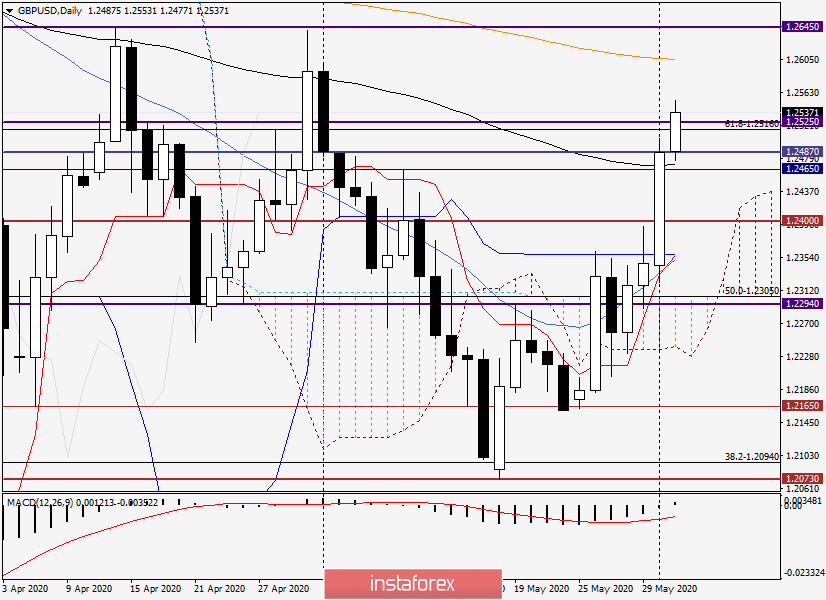

Daily

Market sentiment has changed, and now the US dollar is not favored. Against this background, the US currency is under pressure from many major competitors. In particular, the British pound demonstrated an impressive strengthening against the US dollar in yesterday's trading.

As a result of strong growth, the pound/dollar currency pair tested an important technical and psychological level of 1.2500 yesterday. Having shown Monday's trading highs at 1.2505, the pair could not hold above this significant mark, after which it rolled back and ended the session at 1.2487, which in itself is quite good for players to increase the rate. As a rule, such iconic levels as 1.2500 rarely breaks through on the first attempt, thus, nothing is surprising in a pullback from 1.2500. Much more important is the breakdown of sellers' resistance at the iconic level of 1.2400 and 1.2462. As you can see, at the moment of writing this review, the pound/dollar is already trading above 1.2500, near 1.2513. Here it should be noted that the price zone of 1.2490-1.2525 is very strong and has repeatedly had a significant impact on the price direction of the instrument. If the pair continues to rise and manages to gain a foothold above 1.2525, the next target of the bulls for the pound will be the 200 exponential moving average, which passes at 1.2605, and the decisive influence on the further direction of the British currency will be determined in the area of 1.2645, where there is very strong resistance from sellers. However, the pair still needs to grow to these prices. Given the upcoming important events of the current week, many things may change. Although it has been repeatedly noticed that the market uses even the most important statistics to move in the chosen direction. I do not doubt that Friday's block of data on the US labor market will have its pros and cons. Everything is the will of the market.

In the meantime, increased risk appetite among investors contributes to the weakening of the US dollar, which was perceived by market participants as a safe asset in the context of the rampant COVID-19 pandemic. Many experts believe that the economic downturn in the European Union and the UK has already touched bottom, and now there is a recovery. However, it is still very fragile and slow. However, it cannot be otherwise, the coronavirus epidemic has caused serious economic damage.

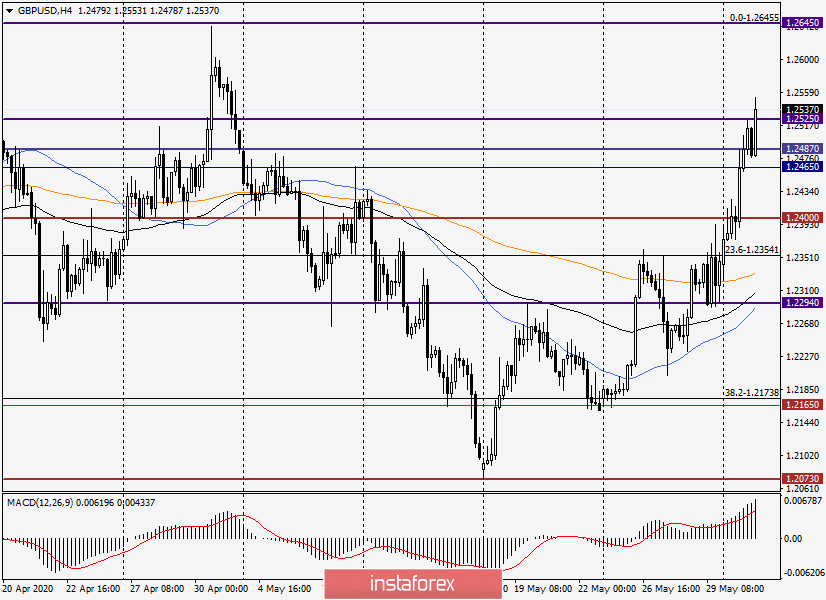

H4

In this timeframe, the strong growth of the pound is even more visible. Today, the pair has already been at 1.2553, but has pulled back a little and is trading at 1.2523 at the end of the review. Naturally, with such an obvious upward trend, it is worth considering buying the pound/dollar pair as the main trading idea. At the same time, buying right here and now, at the peak of the market, is not very comfortable. I recommend waiting for the consolidation above 1.2525, and on the pullback to the price zone of 1.2525-1.2500 to plan purchases. The confirmation signal for opening long positions on the pound will be the candlestick patterns typical for growth in the selected zone. I suggest fixing purchases at 1.2555, 1.2585, and 1.2603.

If the pair returns to 1.2500 and falls below the broken resistance level of 1.2487, forming bearish candlestick patterns, the breakout of 1.2500 will have to be recognized as false and, after another attempt to rise above the psychological level of 1.2500, open sales with the nearest goals in the area of 1.2460-1.2420.

At the moment, the "Briton" confirms yesterday's forecast of a high probability of an upward scenario. However, the price area of 1.2500-1.2600 is very difficult, so I recommend buying a pair after corrective pullbacks or after fixing the above important and significant levels.

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română