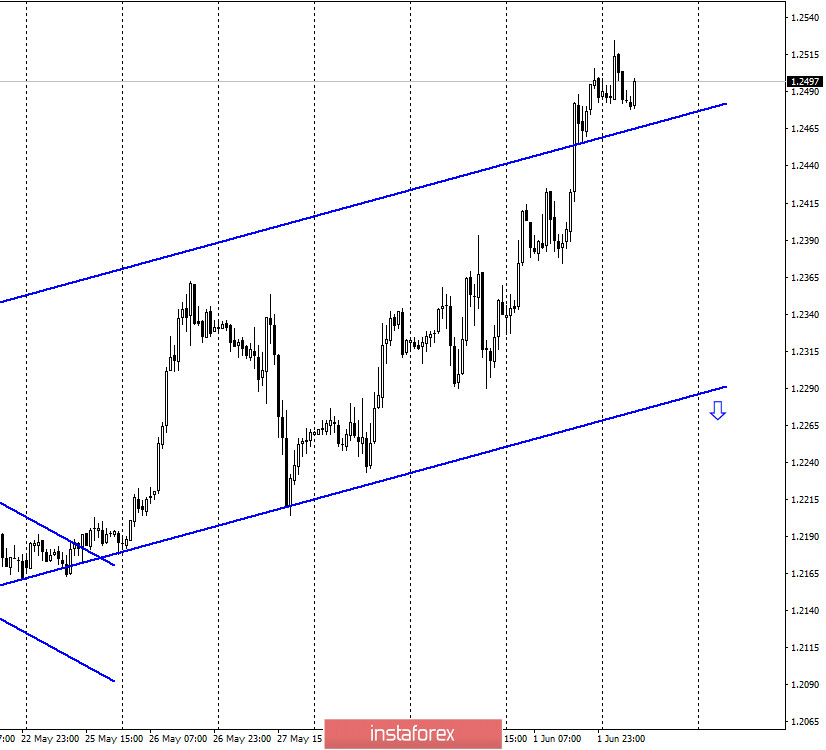

GBP/USD – 1H.

Hello, traders! According to the hourly chart, the pound/dollar pair continues the growth and even performed a close over the upward trend corridor. Thus, the "bullish" mood among traders clearly remains at this time. The only reasons for the growth of the British pound remain unclear at a time when the country cannot or does not want to conclude an agreement with the European Union on Brexit, which threatens it with serious financial problems that will be layered on the existing ones due to the same Brexit and because of the coronavirus pandemic. Boris Johnson is increasingly criticized by the British, as well as by Europeans, who believe that the Prime Minister does not want to make a deal with the EU or is simply bluffing to get more favorable terms of the agreement. One way or another, in the meantime, the UK is heading for a financial crisis that will be much stronger than the one caused by the coronavirus epidemic. If many countries can begin a full-scale recovery in 2021, the UK may continue to experience problems.

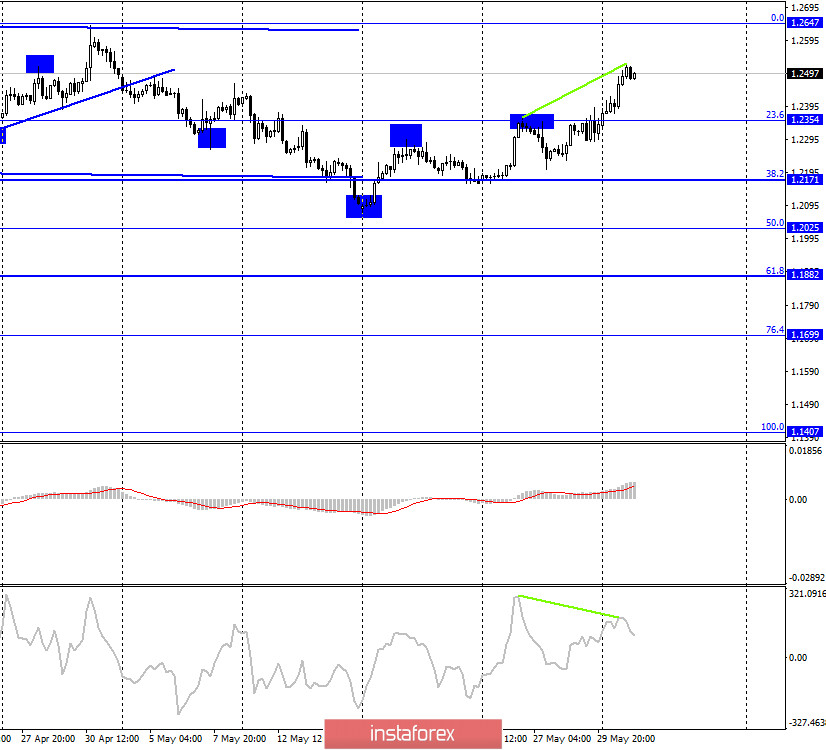

GBP/USD – 4H.

On the 4-hour chart, the pound/dollar pair closed above the corrective level of 23.6% (1.2354) and continues the growth in the direction of the Fibo level of 0.0% (1.2647). Today, a bearish divergence has formed in the CCI indicator, which allows traders to count on a reversal in favor of the US currency and a slight fall in the direction of the corrective level of 23.6% (1.2354). Closing of quotes above the divergence peak will increase the chances of continued growth.

GBP/USD – Daily.

On the daily chart, the pair's quotes secured above the corrective level of 23.6% (1.2355), which increases the probability of continuing growth in the direction of the next Fibo level of 0.0% (1.2646).

GBP/USD – Weekly.

On the weekly chart, the pound/dollar pair performed a false breakdown of the lower trend line and rebound from it. Thus, until the pair's quotes are fixed under this line, there is a high probability of growth in the direction of two downward trend lines.

Overview of fundamentals:

On Monday, the UK released only the PMI business activity index for the manufacturing sector, which did not cause any interest among traders. Now the British pound is growing, probably due to the same events in the US. However, at any moment, the growth may stop since the information background in the UK is no better.

News calendar for the US and UK:

On June 2, no economic reports will be released in the UK and the US. Traders will be interested in events in America today, as well as information from the fourth stage of negotiations between Britain and the European Union.

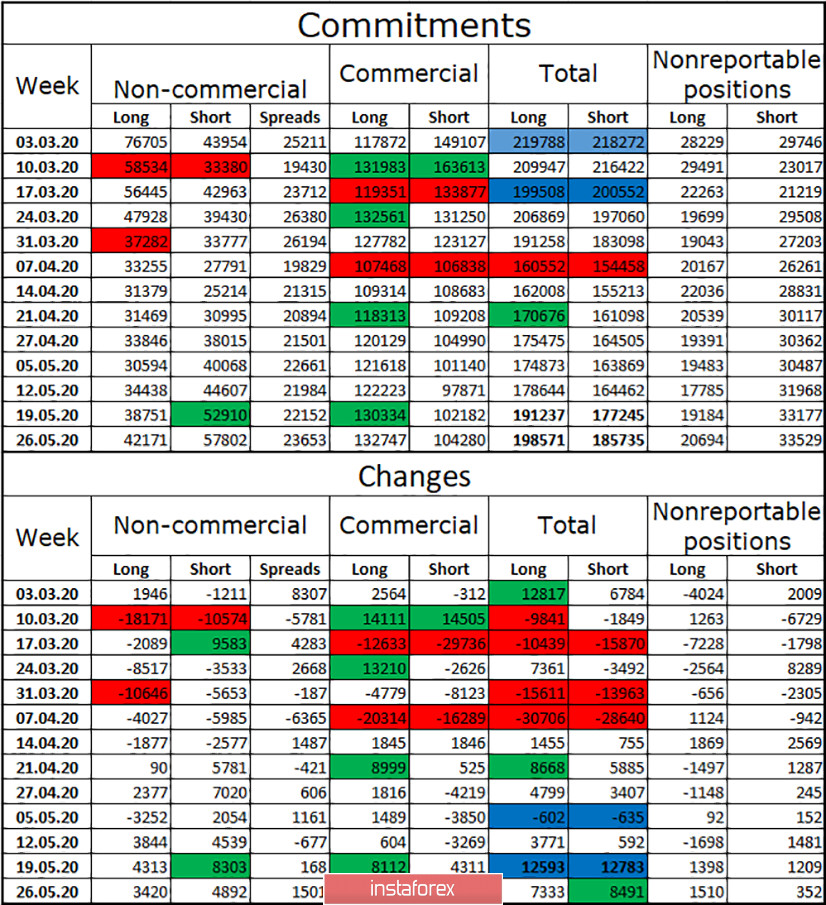

COT (Commitments of Traders) report:

The latest COT report showed that large speculators of the currency market for the reporting week mainly opened new short-contracts. Their number in the hands of the "Non-commercial" group increased by almost 5,000. Long-term contracts were opened less willingly by speculators. And this is the main difference with the euro, whose long contracts were opened much more willingly. Thus, we can even say that during the reporting week, the "Non-commercial" group, which is considered to be the engine of the market, strengthened its "bearish" mood. The total number of short contracts held by the company also remains higher (58 thousand – 42 thousand). The total number of new short contracts (the "Total" column) also increased more strongly than the long one during the reporting week. So I can conclude that the pound is unlikely to continue growing or it will be strong.

Forecast for GBP/USD and recommendations to traders:

I recommend making new sales of the pound in the current conditions with the goals of 1.2354 and 1.2171 if the pair closes under the trend corridor on the hourly chart. You can buy the English currency now since the pair remains inside the trend corridor. However, a reversal in favor of the dollar can be performed near its upper border, and a bearish divergence has formed on the 4-hour chart. Thus, it may be better to wait for new signals to buy.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română