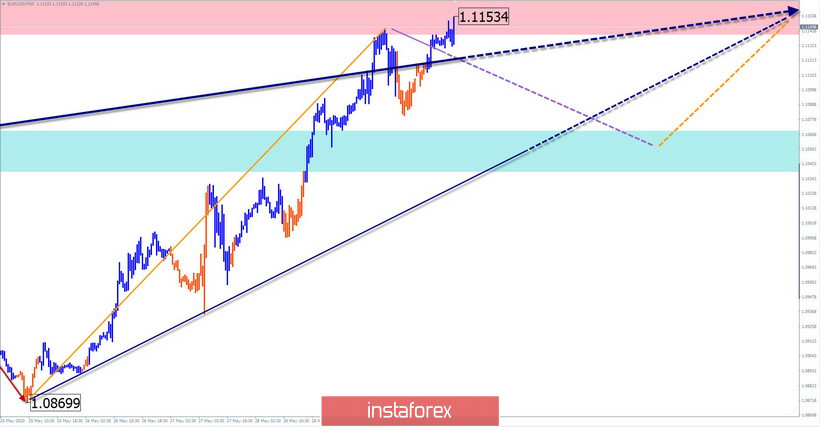

Analysis:

The current trend of the euro was determined by the upward wave formed on May 20th. The price fluctuation logged last week showed that the final part of the wave (C) began its formation on May 7th. The price hit a strong zone of the potential reverse.

Outlook for EUR/USD:

In the nearest 24 hours, there is a high possibility of a redound. However, the pair will hardly decline lower than the support level. At the end of the day, there could be a second attempt to move up.

Potential reverse points:

Resistance:

- 1.1140/1.1170

Support:

- 1.1140/1.1170

Recommendations:

During the next 24 hours, trading on the euro can be performed according to the intraday chart. It is a good idea to lower lots for selling positions due to a small expected drop. Traders should pay special attention to buy signals near the support level.

AUD/USD

Analysis:

Since March 19th, the Australian dollar trend has been determined by the upward wave. Last week, the price broke a strong resistance level, which, at the moment, is supporting the price.

Outlook for AUD/USD:

During the European trading session, there is a high possibility of a short-term rebound. However, the pair will hardly decline lower than the support level. At the end of the day, the price may resume climbing and hit the resistance zone.

Potential reverse points:

Resistance:

- 0.6820/0.6850

Support:

- 0.6730/0.6700

Recommendations:

Today, it is better to open buy deals. Signals may appear near the support zone. Sell deals are not recommended due to high risks.

Explanation: in simplified wave analysis (SWA), waves consist of 3 parts (A-B-C). We usually analyze the incomplete wave. The solid background of the arrows shows the formed structure, and the dotted one shows the expected movements.

Please note that the wave algorithm does not take into account the duration of the tool's movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română