The stubborn growth of the single European currency throughout the past week was sometimes puzzling. Especially on Friday, when, according to all the laws of the genre, it should have become cheaper. Although it must be admitted that US data does not cause much enthusiasm, so there is no particular reason for the dollar to rise. But we can say that all questions were answered. on the weekend. After all, American cities were swept by a wave of protests, which often turned into clashes with the police. It got to the point that curfews were imposed in a number of cities. Moreover, the protests did not begin on the weekend, but much earlier. They just gradually increased and reached their peak this weekend. One of the reasons is another sad case of a policeman killing a young black guy. But, probably, the main reason is that people are tired. People are already losing their jobs en masse, and under the conditions of the limited quarantine regime they have no chance of finding a new one. Restrictive measures in the United States are lifted somehow slowly and strangely. And in some states they don't want them removed at all just yet. Europe, which is gradually and systematically softening restrictive measures, looks much more attractive against this background. At least it looks like a calmer place. The European Central Bank is expected to take some concrete steps to support the economy.

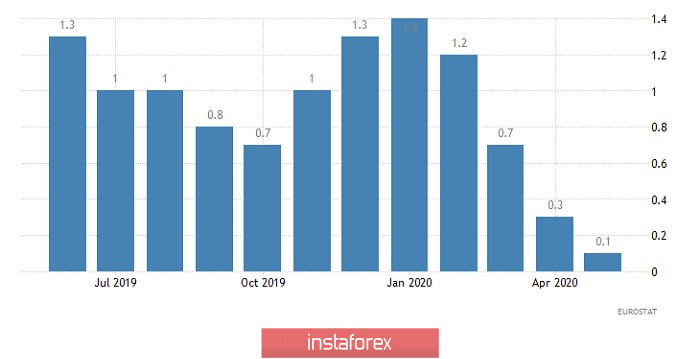

Nevertheless, if we look at macroeconomic statistics, then the single European currency has every reason for concern. According to preliminary data, inflation slowed down from 0.3% to 0.1%. This, of course, is not deflation yet, but with one foot already there. Moreover, in monthly terms, consumer prices have already decreased by 0.1%. But the market behaved as if this data was not there.

Inflation (Europe):

We must admit that US data are quite surprising in their absurdity. Data on personal income and expenses for April do not fit into the framework of formal logic. So, expenses decreased by 13.6%, which is quite understandable. However, personal income in a strange way grew by 10.5%, which in the face of an unprecedented increase in unemployment, to put it mildly, looks very strange. Moreover, income data even caused a temporary increase in the dollar. But quite quickly, investors saw strange discrepancies, and the dollar resumed its weakening.

Personal Income (United States):

The single European currency may well continue to grow due to the final data on the index of business activity in the manufacturing sector. This same index should grow from 33.4 to 39.5. Moreover, this is the data for May, that is, it turns out that European industry is at least beginning to see at least some glimmers of hope.

Manufacturing Business Activity Index (Europe):

However, the surge of violence in the United States was so strong that the police had no choice but to harshly suppress all possible protests. This should lead to a reduction in mass gatherings, as well as the level of violence. In addition, the total data on the index of business activity in the manufacturing sector should show an increase in the index from 36.1 to 39.8. That is, in the United States, industry sees the possibility of at least some improvement in the situation. So in the afternoon, the dollar may well try to win back at least part of its previous losses.

Manufacturing Business Activity Index (United States):

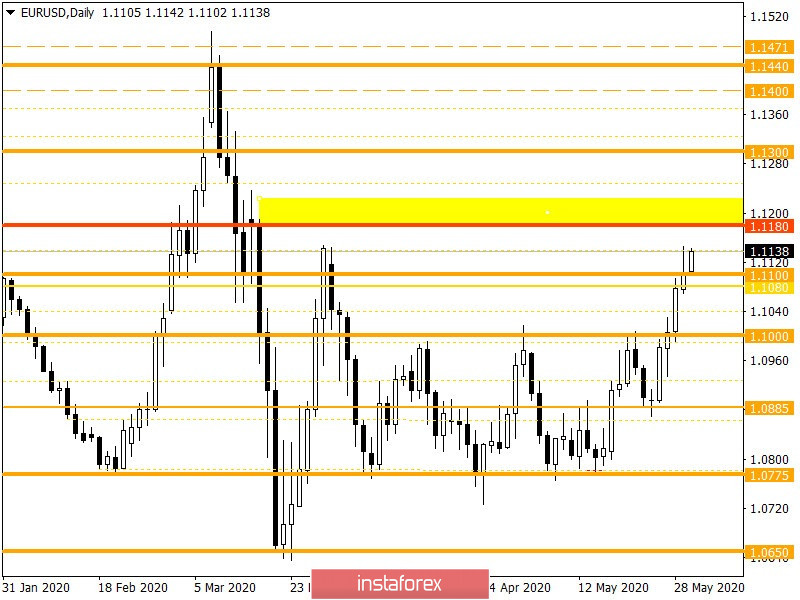

From the point of view of technical analysis, we see an upward movement, on the basis of which a number of price levels have been passed, eventually completing a two-month formation of a flat, as well as changing the clock component of the current period. Regarding the details, we can highlight reaching the March 27 high at 1.1147, which played the role of local resistance.

In terms of a general review of the trading chart, the daily period, you can initially see a significant change in price since March, where the quote moved from the compression stage to the movement process.

It can be assumed that if the value of 1.1150 falls, the upward trend will continue towards 1.1180-1.1200, where deceleration with the subsequent formation of a rebound is not excluded, which will be expressed as a correction in the future.

Specifying all of the above into trading signals:

- Buy positions should be considered higher than 1.1150 in the direction of 1.1180-1.1200.

- We consider selling positions in terms of price rebound from the 1.1180-1.1200 area, in the case of initial slowdown.

From the point of view of a comprehensive indicator analysis, we see that the indicators of technical instruments are focused on the upward trend, signaling a purchase.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română