Forecast for May 29:

Analytical review of currency pairs on the scale of H1:

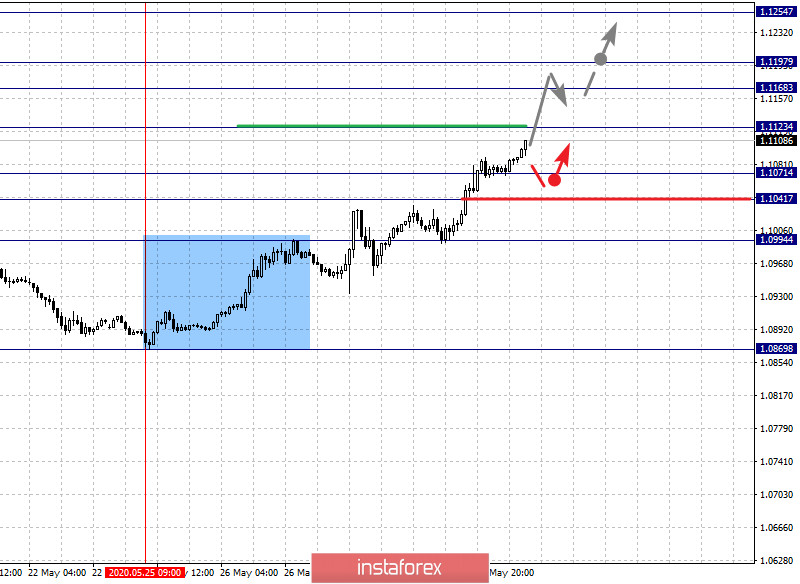

For the euro / dollar pair, the key levels on the H1 scale are: 1.1254, 1.1197, 1.1168, 1.1123, 1.1071, 1.1041 and 1.0994. Here, we are following the ascending structure of May 25. The continuation of the upward movement is expected after the breakdown of the level of 1.1123. In this case, the target is 1.1168. Price consolidation is in the range of 1.1168 - 1.1197. For the potential value for the top, we consider the level of 1.1254. Upon reaching which, we expect a downward pullback.

A short-term downward movement is expected in the range of 1.1071 - 1.1041, hence, there is a high probability of an upward reversal. The breakdown of the level of 1.1041 will lead to an in-depth correction. In this case, the target is 1.0994. This level is a key support for the ascending structure.

The main trend is the local structure for the top of May 25

Trading recommendations:

Buy: 1.1125 Take profit: 1.1168

Buy: 1.1198 Take profit: 1.1254

Sell: 1.1070 Take profit: 1.1041

Sell: 1.1039 Take profit: 1.1000

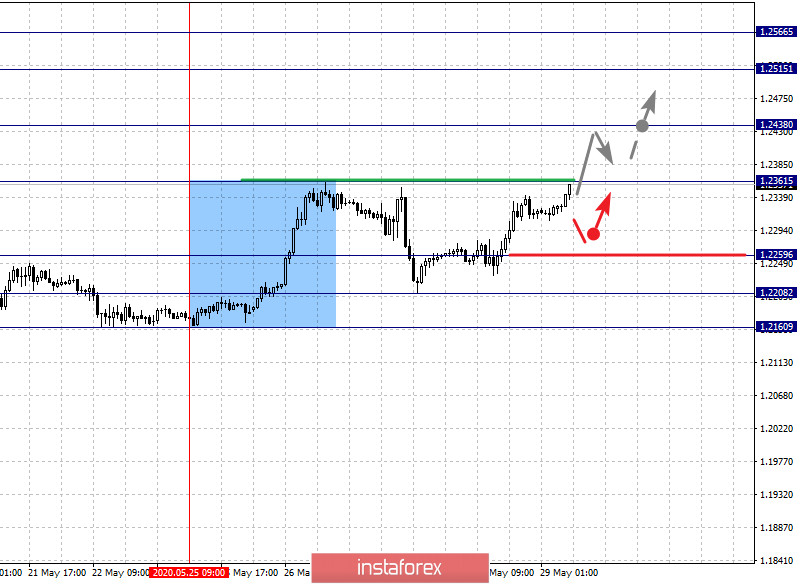

For the pound / dollar pair, the key levels on the H1 scale are: 1.2566, 1.2515, 1.2438. 1.2361, 1.2259, 1.2208 and 1.2160. Here, we are following the ascending structure of May 25.The continuation of the upward movement is expected after the breakdown of the level of 1.2361. In this case, the target is 1.2438. Price consolidation is near this level. The breakdown of the level of 1.2440 should be accompanied by a pronounced upward movement. Here, the target is 1.2515. For the potential value for the top, we consider the level of 1.2566. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is expected in the range of 1.2259 - 1.2208. The breakdown of the last value will lead to the cancellation of the upward structure from May 25. In this case, the first target is 1.2160.

The main trend is the local structure of May 25

Trading recommendations:

Buy: 1.2361 Take profit: 1.2436

Buy: 1.2440 Take profit: 1.2515

Sell: 1.2257 Take profit: 1.2210

Sell: 1.2206 Take profit: 1.2160

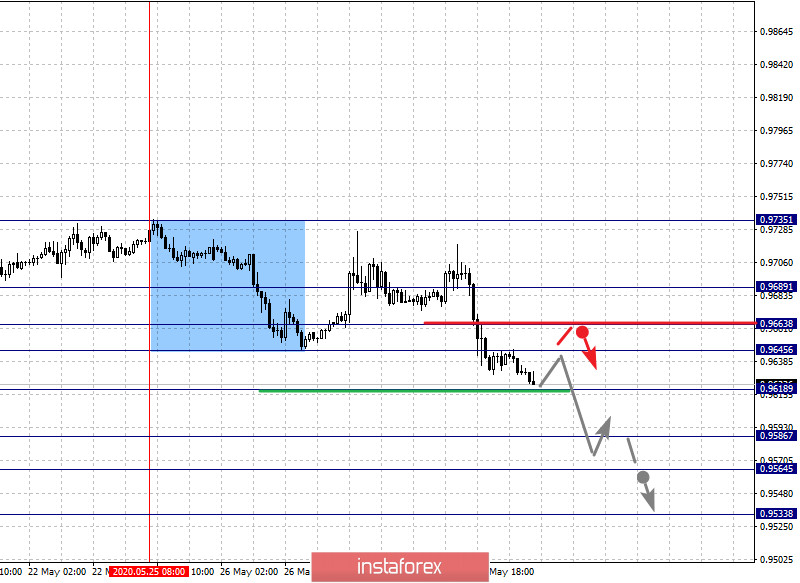

For the dollar / franc pair, the key levels on the H1 scale are: 0.9735, 0.9689, 0.9663, 0.9645, 0.9618, 0.9586, 0.9564 and 0.9533. Here, we are following the descending structure of May 25. The continuation of the downward movement is expected after the breakdown of the level of 0.9618. In this case, the target is 0.9586. Short-term downward movement, as well as consolidation is in the range of 0.9586 - 0.9564. For the potential value for the bottom, we consider the level of 0.9533. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 0.9645 - 0.9663. The breakdown of the last level will lead to an in-depth correction. In this case, the target is 0.9689. This level is a key support for the bottom.

The main trend is the descending structure of May 25

Trading recommendations:

Buy : 0.9645 Take profit: 0.9661

Buy : 0.9665 Take profit: 0.9687

Sell: 0.9616 Take profit: 0.9590

Sell: 0.9584 Take profit: 0.9566

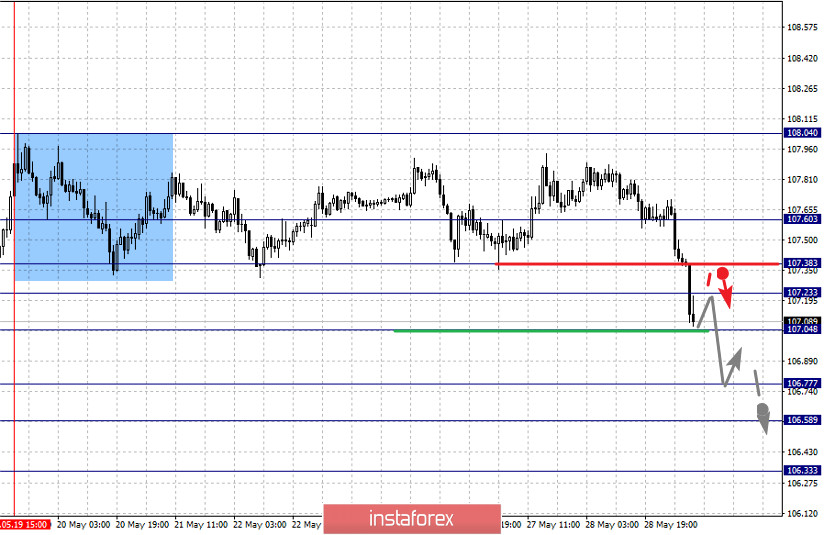

For the dollar / yen pair, the key levels on the scale are : 107.60, 107.38, 107.23, 107.04, 106.77, 106.58 and 106.33. Here, we are following the development of the downward cycle of May 19. The continuation of the downward movement is expected after the breakdown of the level of 107.04. In this case, the target is 106.77. Short-term downward movement, as well as consolidation are in the range of 106.77 - 106.58. For the potential value for the bottom, we consider the level of 106.33. Upon reaching which, we expect an upward pullback.

A short-term upward movement is possible in the range of 107.23 - 107.38. The breakdown of the last level will lead to an in-depth correction. Here, the goal is 107.60. This level is a key support for the downward structure.

The main trend: the downward cycle of May 19

Trading recommendations:

Buy: 107.23 Take profit: 107.36

Buy : 107.40 Take profit: 107.60

Sell: 107.02 Take profit: 106.80

Sell: 106.76 Take profit: 106.60

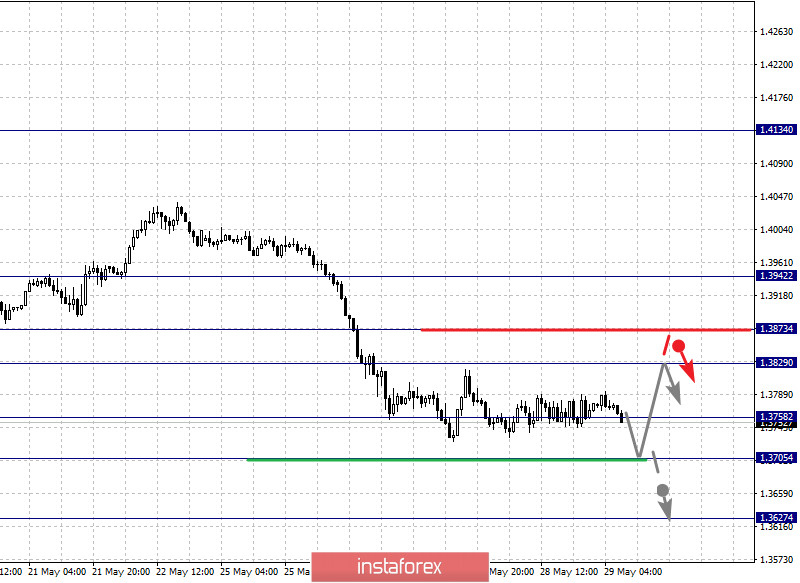

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3942, 1.3873, 1.3829, 1.3758, 1.3705 and 1.3627. Here, we are following the development of the medium-term downward cycle of May 14. A short-term downward movement is expected in the range of 1.3758 - 1.3705. The breakdown of the latter level will allow us to expect movement to a potential target - 1.3627. Upon reaching this level, we expect consolidation, as well as an upward pullback.

A short-term upward movement is possible in the range of 1.3829 - 1.3873. The breakdown of the latter level will lead to the development of an in-depth correction. Here, the potential goal is 1.3942. We expect the initial conditions for the upward cycle to be formed to this level.

The main trend is the medium-term downward trend of May 14

Trading recommendations:

Buy: 1.3829 Take profit: 1.3870

Buy : 1.3875 Take profit: 1.3940

Sell: 1.3756 Take profit: 1.3709

Sell: 1.3703 Take profit: 1.3637

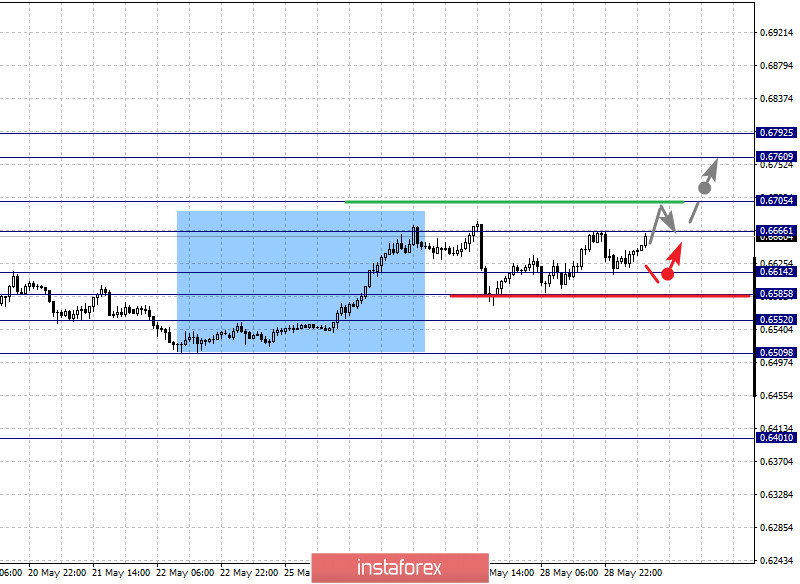

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6792, 0.6760, 0.6705, 0.6666, 0.6614, 0.6585, 0.6552 and 0.6509. Here, we are following the development of the upward cycle of May 15.The continuation of the upward movement is expected after the breakdown of the level of 0.6666. In this case, the target is 0.6705. Price consolidation is near this level. The breakdown of the level of 0.6705 should be accompanied by a pronounced upward movement. Here, the target is 0.6760. For the potential value for the top, we consider the level of 0.6792. Upon reaching which, we expect consolidation, as well as a downward pullback.

Consolidated movement is possible in the range of 0.6614 - 0.6585. The breakdown of the last level will lead to an in-depth correction. Here, the target is 0.6552. This level is a key support for the upward structure and its breakdown will lead to the formation of initial conditions for the downward cycle. In this case, the target is 0.6509.

The main trend is the upward structure of May 15

Trading recommendations:

Buy: 0.6666 Take profit: 0.6705

Buy: 0.6707 Take profit: 0.6760

Sell : 0.6614 Take profit : 0.6587

Sell: 0.6583 Take profit: 0.6552

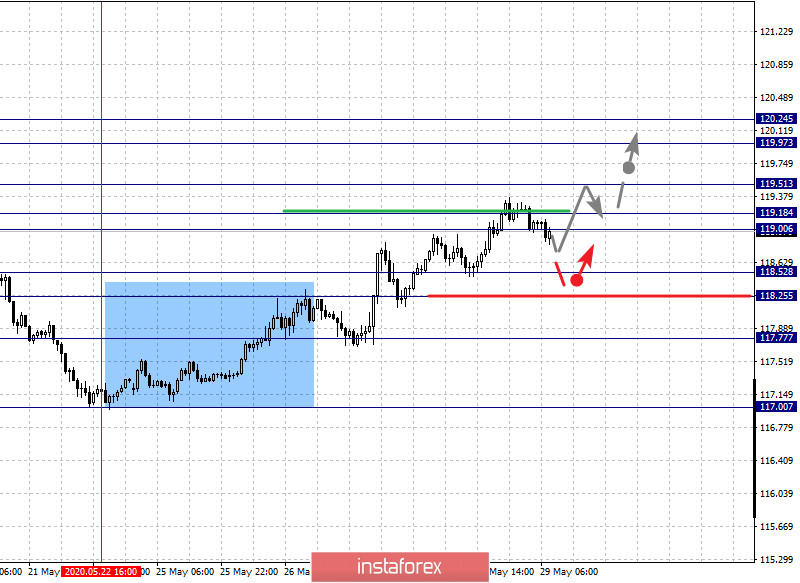

For the euro / yen pair, the key levels on the H1 scale are: 120.24, 119.97, 119.51, 119.18, 119.00, 118.52, 118.25 and 117.77. Here, we continue to monitor the ascending structure of May 22. The continuation of the upward movement is expected after passing through the noise range of 119.00 - 119.18. In this case, the target is 119.51. Price consolidation is near this level. The breakdown of the level of 119.51 should be accompanied by a pronounced upward movement. Here, the goal is 119.97. For the potential value for the top, we consider the level of 120.24. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possible in the range of 118.52 - 118.25, hence, the high probability of an upward reversal. The breakdown of the level of 118.25 will lead to in-depth correction. Here, the goal is 117.77. This level is a key support for the top.

The main trend is the local ascending structure of May 22

Trading recommendations:

Buy: 119.18 Take profit: 119.50

Buy: 119.53 Take profit: 119.95

Sell: 118.52 Take profit: 118.27

Sell: 118.23 Take profit: 117.85

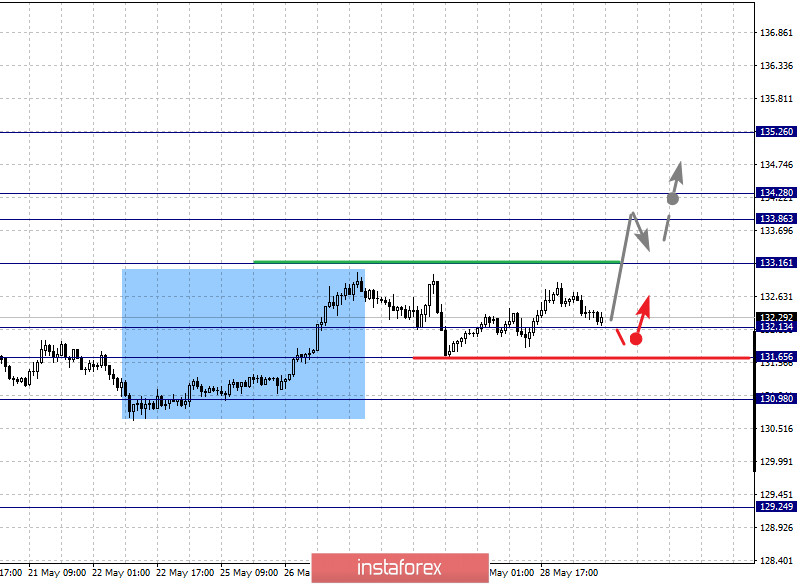

For the pound / yen pair, the key levels on the H1 scale are : 135.26, 134.28, 133.86, 133.16, 132.13, 131.65 and 130.98. Here, we are following the development of the ascending structure of May 15. The continuation of the upward movement is expected after the breakdown of the level of 133.16. In this case, the target is 133.86. Price consolidation is in the range of 133.86 - 134.28. For the potential value for the top, we consider the level of 135.26. Upon reaching which, we expect consolidation, as well as a downward pullback.

A short-term downward movement is possible in the range of 132.13 - 131.65. The breakdown of the last level will lead to an in-depth correction. Here, the potential target is 130.98. This level is a key support for the upward structure.

The main trend is the upward structure of May 15

Trading recommendations:

Buy: 133.16 Take profit: 133.86

Buy: 134.30 Take profit: 135.25

Sell: 132.13 Take profit: 131.66

Sell: 131.63 Take profit: 131.00

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română