To open long positions on GBP/USD, you need:

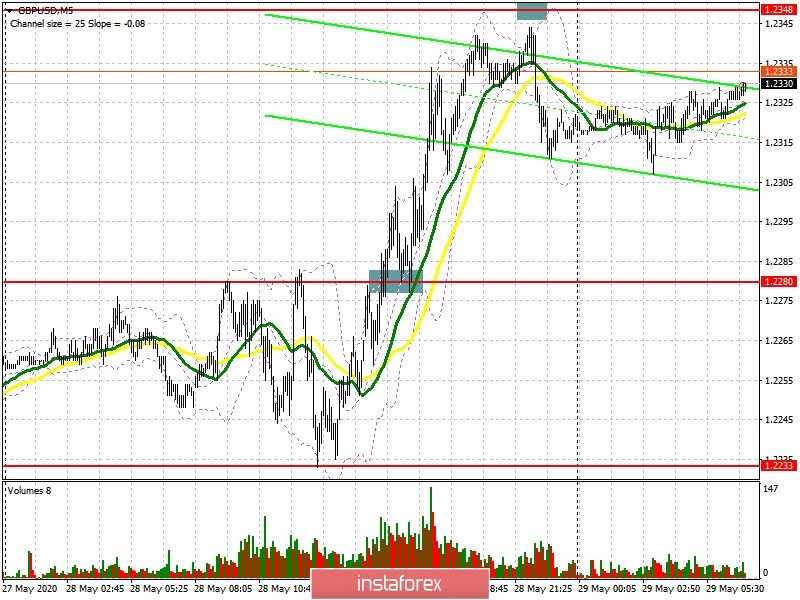

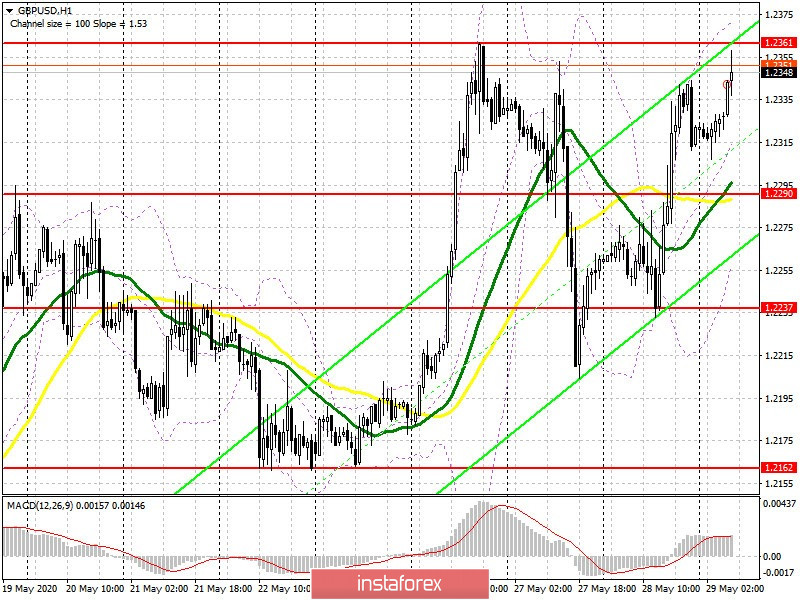

The British pound managed to defend the 1.2237 level yesterday, and after a break and consolidation above the resistance of 1.2290, demand only intensified, which allows us to expect a return to this week's highs. If you look at the 5-minute chart, you will see how a breakthrough with consolidation at resistance 1.2290, and then a test of this level from top to bottom was an excellent signal for opening long positions in GBP/USD, which I pointed out in yesterday's review on the second half of the day. Now the bulls' task is to break through and consolidate above this week's high at 1.2361, since such a scenario will lead to a major upward trend of GBP/USD, formed on May 15, 2020 with the update of levels 1.2423 and 1.2463, where I recommend taking profit. If the pressure on the pound returns in the first half of the day, I recommend considering new long positions only after forming a false breakout in the region of 1.2290 or buying GBP/USD immediately for a rebound from support 1.2237, with the aim of an upward correction of 20-30 points at the end of this week .

To open short positions on GBP/USD, you need:

The task of sellers in the first half of the day is forming a false breakout in the region of this week's high, where resistance 1.2361 passes, which may increase pressure on the pound, as buyers will stop trying to break even higher at the end of this month. An equally important task for the bears is the return of GBP/USD to the support area of 1.2290, since consolidating below this range can lead to forming a new downward impulse that can break below 1.2237. With a growth scenario above this week's high, it's best not to rush into opening short positions, but rather wait for the levels 1.2423 and 1.2463 to be updated, where you can sell immediately for a rebound in the expectation of a correction of 20-30 points at the end of the day.

Signals of indicators:

Moving averages

Trade is conducted above 30 and 50 moving averages, and the market is again on the side of pound buyers.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger bands

Growth will be limited by the upper level of the indicator at 1.2361, a breakthrough of which will lead to a new wave of growth for the pound. In case of decrease, support will be provided by the lower border of the indicator 1.2280, from which you can see purchases.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Moving Average Convergence / Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit traders are speculators, such as individual traders, hedge funds and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long nonprofit positions represent the total long open position of nonprofit traders.

- Short nonprofit positions represent the total short open position of nonprofit traders.

- The total non-profit net position is the difference between the short and long positions of non-profit traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română