Gold climbed higher in the short term after failing to stabilize under the 1,769.80 former low. At the moment of writing, it was seen at 1,785.30 far below 1,793.15 today's high. The Dollar Index is strongly bearish, that's why the US dollar falls versus its rivals. USD's further depreciation could help the yellow metal to grow.

In the short term, gold could change little. Traders are likely to be focusing on the United States inflation data. The CPI and the Core CPI figures will be released on Friday and may shake the markets.

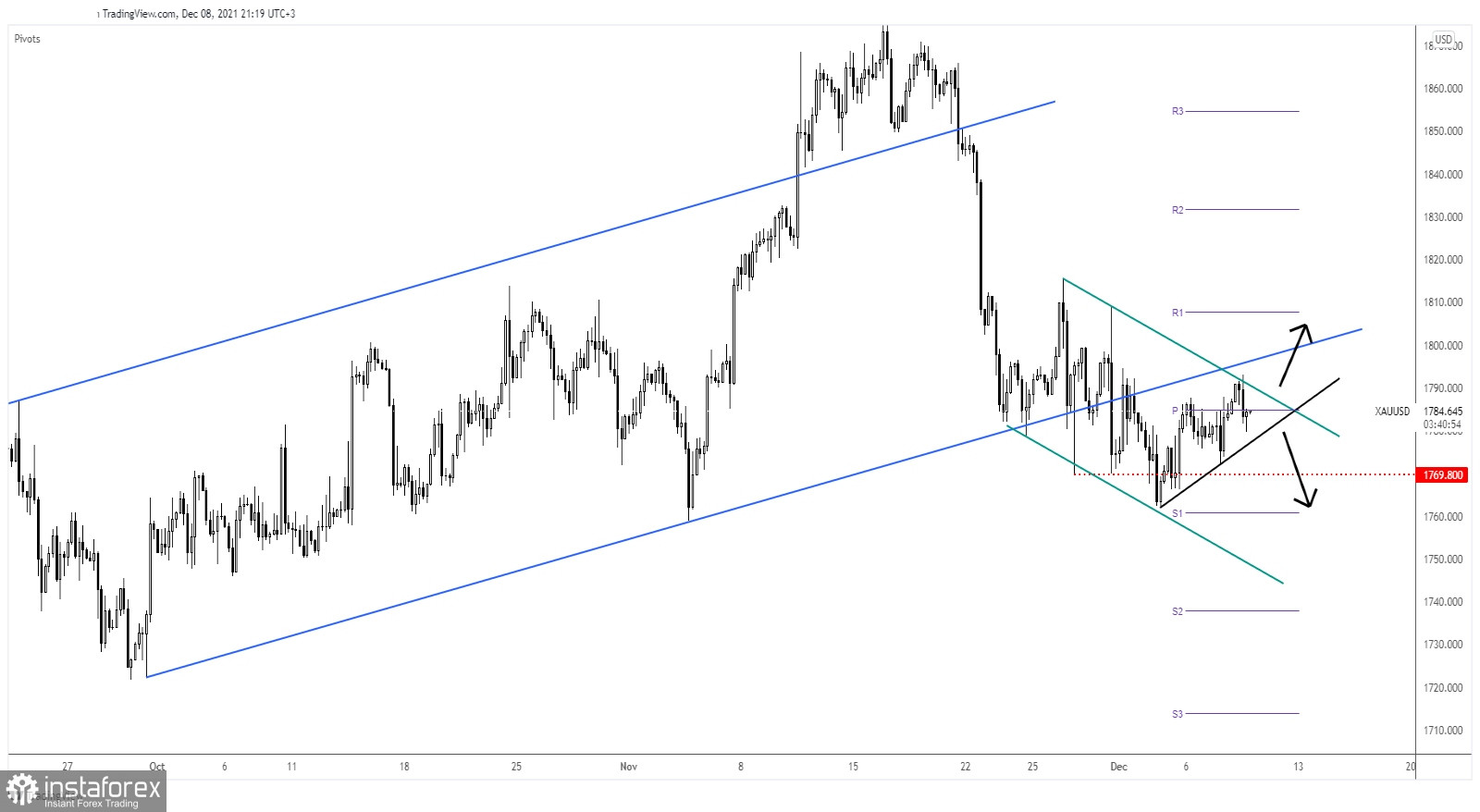

XAU/USD at crossroads

XAU/USD reached the downtrend line but it has registered only a false breakout with great separation through this level. Now, it's fighting hard to be able to stay near the weekly pivot point of 1,784.87.

As long as it stays above the immediate uptrend line, gold may try again to take out the dynamic resistance represented by the downtrend line. The major uptrend line stands as dynamic resistance, an upside obstacle.

XAU/USD outlook

Staying under the downtrend line and dropping below the minor uptrend line could open the door for a new downwards movement.

On the contrary, staying above the minor uptrend line and making a valid breakout through the downtrend line could signal potential further growth.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română