GBP/USD 1H

The pound/dollar resumed the upward movement on Thursday, turning upward near the ascending trend line. Thus, the bulls held the market in their hands. Nevertheless, over the past day they were not able to update local highs, which provoked the construction of a downward trend line, and now the pair is stuck in a kind of triangle. Since the pair rebounded from the new trend line just a few hours ago, we are now expecting a downward movement to the rising trend line and the Kijun-sen line. Talk about the future prospects of bulls or bears will be possible after the pair leaves this triangle. We are still more inclined towards a new fall in the British currency.

GBP/USD 15M

The lowest channel of linear regression is again directed upwards on the 15-minute timeframe, showing the mood of traders on May 28, but the higher channel turned sideways and showed a lateral trend, according to which a drop to 1.2210 can begin today.

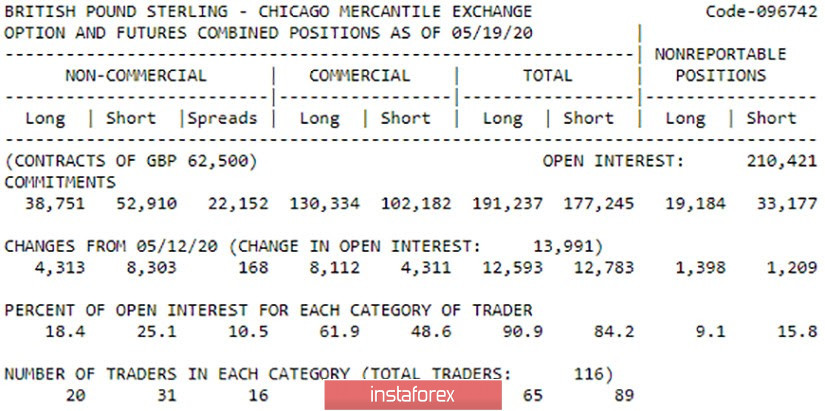

COT Report

The latest COT report showed that the total number of buy and sell transactions among large traders per week increased by 29,000 and in equal proportions. Thus, large traders began to more actively trade the pound. This became noticeable by the increased volatility of the pair at the beginning of the current trading week. During the reporting week, professional traders continued to actively sell the British currency (+8303 sales contracts) and were much less active in acquiring purchase contracts (total +4313). Thus, from our point of view, the mood for the GBP USD pair remains more downward. It is on the basis of this conclusion that we expect the pound to be sold, although it should be recognized that this week the pound is still more expensive than cheaper, but this growth cannot be called strong and confident.

The fundamental background for the British pound remains negative. The calendar of UK macroeconomic events is completely empty this week, and yesterday, statistics from overseas supported the dollar rivals. However, there is also no positive news from Great Britain. In June, Boris Johnson intends to hold talks with Brussels in person, and on July 1, the parties are likely to officially announce the completion of the "transition period" on December 31, 2020. It is on this day that the final break will take place between London and Brussels. Johnson's negotiations with Ursula von der Leyen are almost the last hope that at least some kind of agreement will be signed between the parties. If not, another blow will be dealt to the British economy. That is, it will face another reduction, and, recall, according to the latest information, the epidemic of the coronavirus and Brexit can cost the country from 33% to 50% of GDP in 2020. The budget deficit will be huge and the missing funds will have to be borrowed, which will have to be paid to ordinary British taxpayers for years.

We have two main options for the development of the event on May 29:

1) The initiative for the pound/dollar pair remains in the hands of the bulls, however, further upward movement will be possible only after breaking the downward trend. As soon as this happens, we recommend opening new purchases of the British pound with a target resistance level of 1.2399. Take Profit will be about 60 points in this case.

2) Sellers temporarily remain in the shadow, but will be ready to join the game below the ascending trend line and below the area of 1.2196-1.2216. If the pair is fixed below this area, we advise selling the GBP/USD pair while aiming for the May 18 low at 1.2073. In this case, Take Profit will be about 110 points.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română