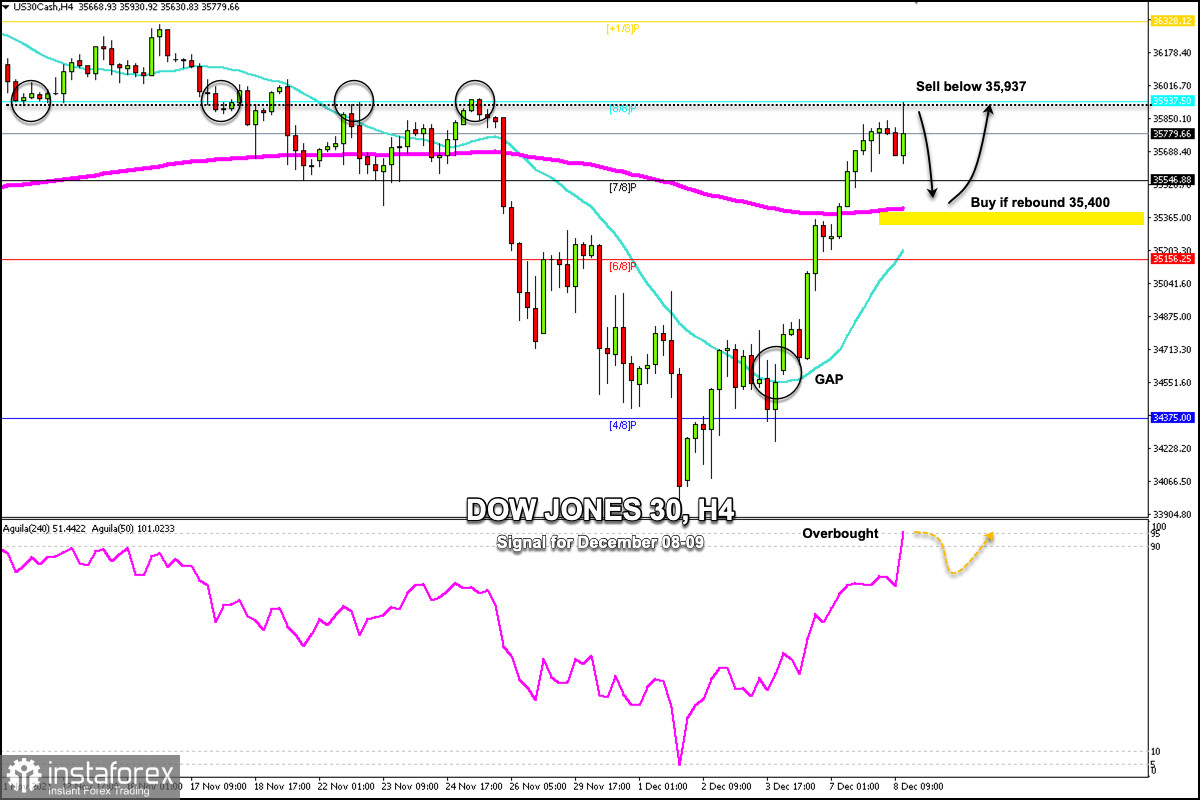

On December 7, the Dow Jones 30 (#INDU) managed to break the EMA 200 and quickly reached the resistance zone of 8/8 Murray. The 35,937 zone and the psychological level of 36,000 are located at 8/8 of Murray. In the past, it acted as strong resistance. As you can see, we have circled the attempts to break this zone on the 4-hour chart.

Therefore, we expect that below this resistance, the DJ30 can make a technical correction and fall towards the 200 EMA located at 35,450.

A technical bounce around the 200-day moving average will give us an opportunity to buy the Dow Jones with targets towards the psychological level of 36,000. If it surpasses this resistance, it could reach the 36,328 zone of +1/8 of Murray, which represents extreme overbought.

The eagle indicator reached the 95-point zone,which represents extreme overbought. It is imminent that in the next few hours there will be a technical correction of the Dow Jones. Therefore, you can sell below 8/8 of a Murray with targets at 34,400.

Considering that 35.937 is a strong resistance level and the 200 EMA (35,400) is a strong support level, it is expected that the DJ30 may rebound and consolidate in the next few days between the mentioned levels.

If it breaks down within the zone above Murray's 8/8 and trades above this resistance, the bullish move to 36,350 is expected to continue. On the contrary, below the 200 EMA, the Dow Jones could resume its bearish movement and fall until covering the GAP that it left at the beginning of this week.

Our trading plan for the next few hours is to sell below the 8/8 Murray and wait the technical bounce around the 200 EMA at 34,400. The eagle indicator is showing an overbought signal and could support our bearish strategy.

Support and Resistance Levels for December 08 - 09 2021

Resistance (3) 36,328

Resistance (2) 36,219

Resistance (1) 36,004

----------------------------

Support (1) 35,546

Support (2) 35,390

Support (3) 35,252

***********************************************************

A trading tip for DJ30 on December 08 - 09, 2021

Sell below 35,937 (8/8) with take profit at 35,400 (200 EMA), stop loss above 36,070.

Buy in case of a rebound at 35,400 (200 EMA) with take profit at 35,750 and 36,000 (8/8), stop loss below 35,340.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română