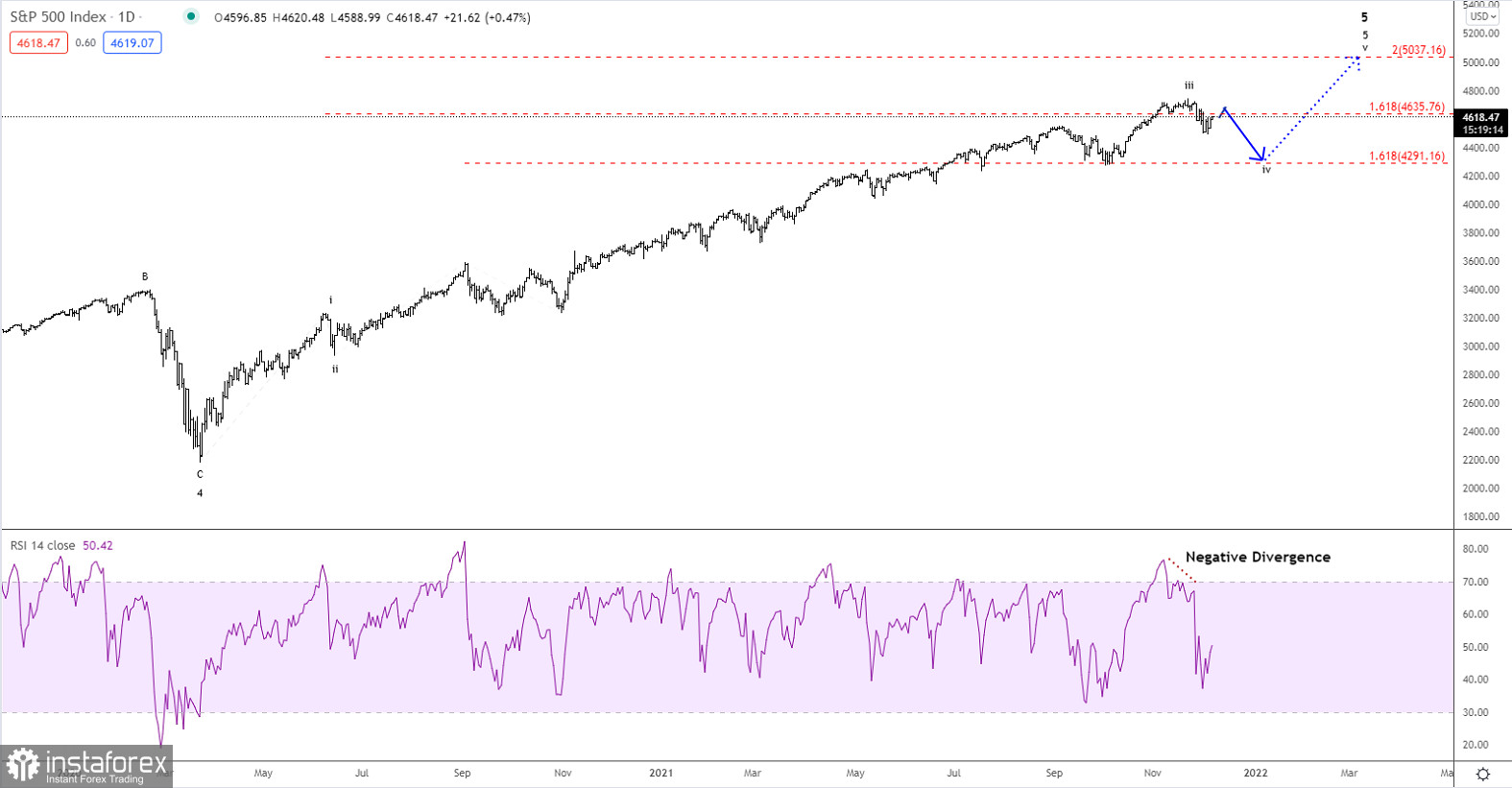

The S&P 500 has made a nice rally from June 2020 to a peak in November at 4,744. This was slightly above the 161.8% extension target, which we normally would expect wave 3 to hit. It did so building a negative divergence, which also is common for the peak of wave 3 and therefore we are likely to see a temporary correction in wave 4 before the final rally higher to at least 5,037 and maybe even higher.

As wave 2 was a simple correction, we should expect wave 4 to much more complex and time-consuming. The minimum target for wave 4 is seen near 4,300, but wave 4 could be deeper than that and continue towards 4,053 before turning higher in wave 5 towards 5,037.

So for now expect some difficult weeks/months ahead before renewed bullishness in wave 5.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română