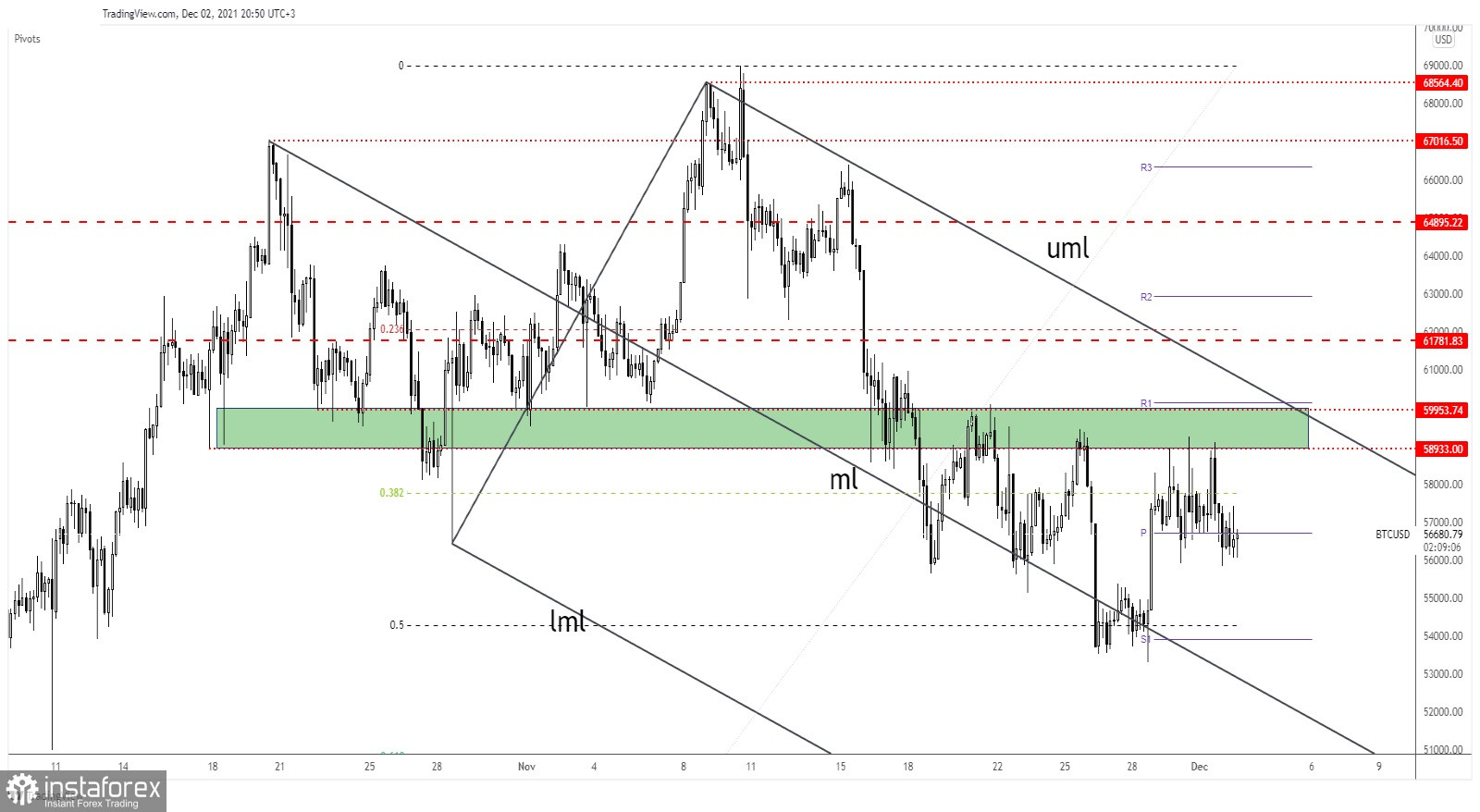

Bitcoin slipped lower after its failure to make a new higher high. In the short term, the pressure remains high, so we cannot exclude a potential drop. It was traded at 56,437.63 at the moment of writing far below 59,099.64 yesterday's high.

Technically, the crypto signaled that the upside is limited and that the price could come back down trying to accumulate more bullish energy before really developing a strong leg higher. In the last 24 hours, BTC/USD is down by 3.06% and by 5.02% in the last 7 days.

BTC/USD upside seems limited

BTC/USD registered only false breakouts above the 58,933 static resistance and now it is traded back below the weekly pivot point (56,712.93). It has also failed to stabilize above the 38.2% retracement level.

Stabilizing below the pivot point could signal a deeper drop. the former low of 55,918.80 stands as the immediate downside obstacle. Dropping and closing below it may activate a further drop towards the weekly S1 (53,915.99).

Bitcoin prediction

In the short term, it's trapped between 55,918.80 and 58,933 levels. A downside breakout from this range could signal a further drop and could bring new short opportunities. On the other hand, moving sideways followed by a valid breakout above the 58,933 and through the Descending Pitchfork's upper median line (uml) could signal an upside continuation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română