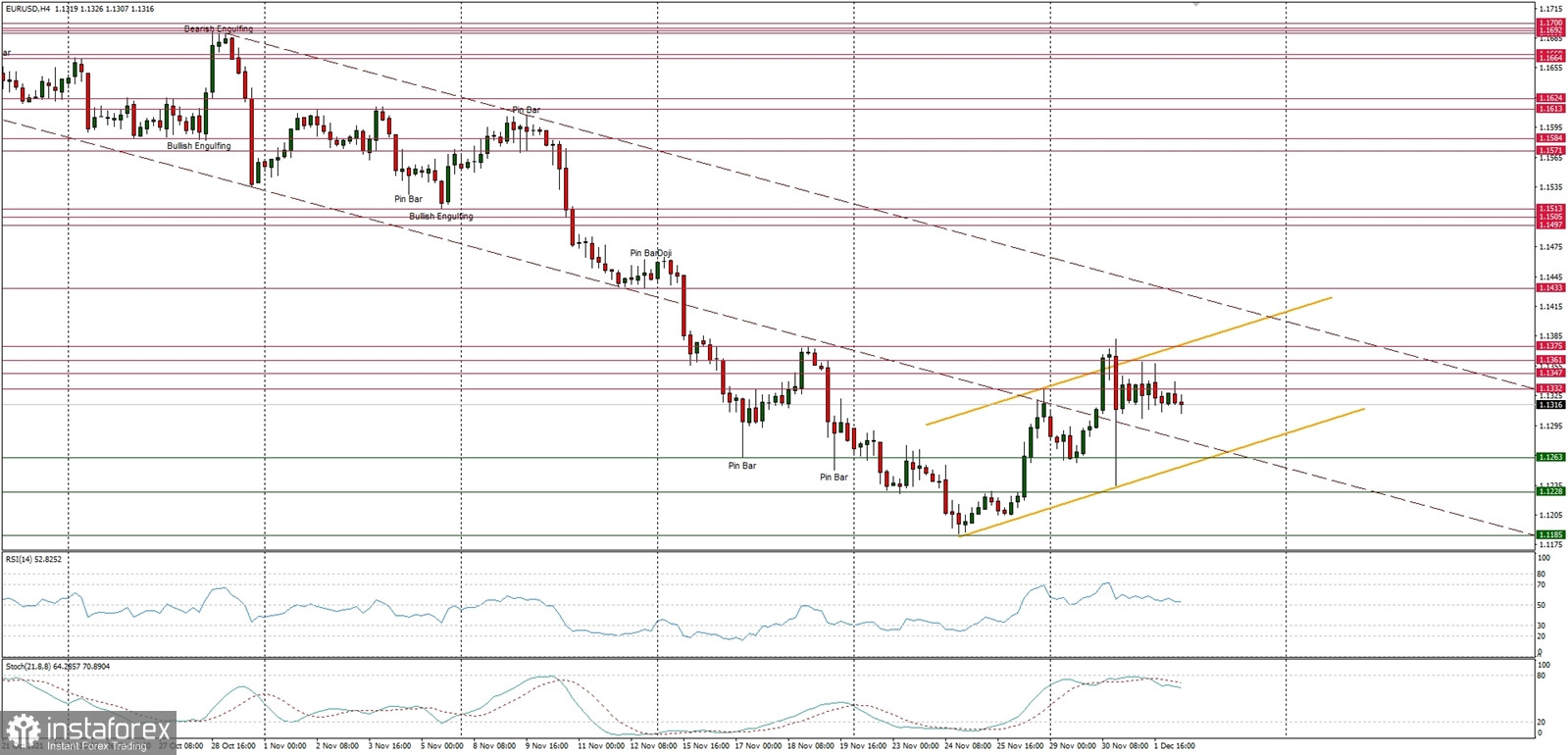

Technical Market Outlook

The EUR/USD pair has bounced from the level of 1.1185, but keeps getting rejected from the key short-term technical resistance (supply zone) located between the levels of 1.1347 - 1.1375. Any violation of this supply zone would open the road towards the technical resistance located at 1.1433, but so far - no avail. The nearest technical support is seen at the level of 1.1263, so this level must be kept clean in order for the bounce to be continued. The strong and positive momentum supports the short-term bullish outlook for the EUR, however it does not look like a trend change or down trend termination.

Weekly Pivot Points:

WR3 - 1.1526

WR2 - 1.1423

WR1 - 1.1382

Weekly Pivot - 1.1279

WS1 - 1.1237

WS2 - 1.1137

WS3 - 1.1090

Trading Outlook:

The market is in control by bears that pushed the price way below the level of 1.1501 and 1.1360, which was the lowest level since November 2020. The next important long-term target for bears is seen at the level of 1.1166. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1909 and 1.2000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română