Technical outlook:

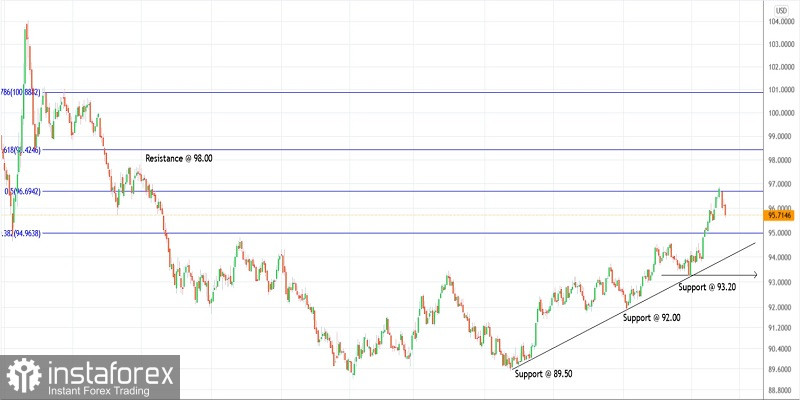

The US dollar index has dropped near to initial support around 95.50 before pulling back. The index has almost taken out the daily support, confirming bears are back in control. Short-term traders might book profits now around 95.60-70 and sell higher again. Positional traders might want to hold for now and add more on a pullback towards 96.40-50 zone.

The index is well poised to continue dropping towards the next support seen at 93.20 mark. Prices need to stay below 96.88 to keep the bearish structure intact, going forward. Immediate price resistance is seen through 98.00 mark, while support comes in around 93.20 levels respectively. A break below 93.20 will confirm further down side through 92.00 and 89.50 in the next several weeks.

The overall wave structure continues to remain bearish against 98.00 mark. Also note that prices have reversed lower from 96.88, which is close to the Fibonacci 0.50 retracement of entire drop between 104.00 and 89.20 levels respectively.

Trading plan:

Potential drop toward 89.20 against 97.00 mark

Good luck!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română