The USD/CAD pair maintains a bullish bias despite a temporary decline. DXY's rally forced USD to take the lead again. Still, it remains to see what will really happen as the rate challenges a resistance area.

The Loonie has taken a hit from the Canadian Current Account which was reported at 1.4B far below 5.4B expected. On the other hand, the US dollar received a helping hand from the Pending Home Sales data which has come in better than expected.

Tomorrow, the Canadian GDP is expected to report a 0.0% growth. Furthermore, the US CB Consumer Confidence, Chicago PMI, and the Fed Chair Powell Testifies are likely to bring more action and volatility.

USD/CAD in the buyer's territory

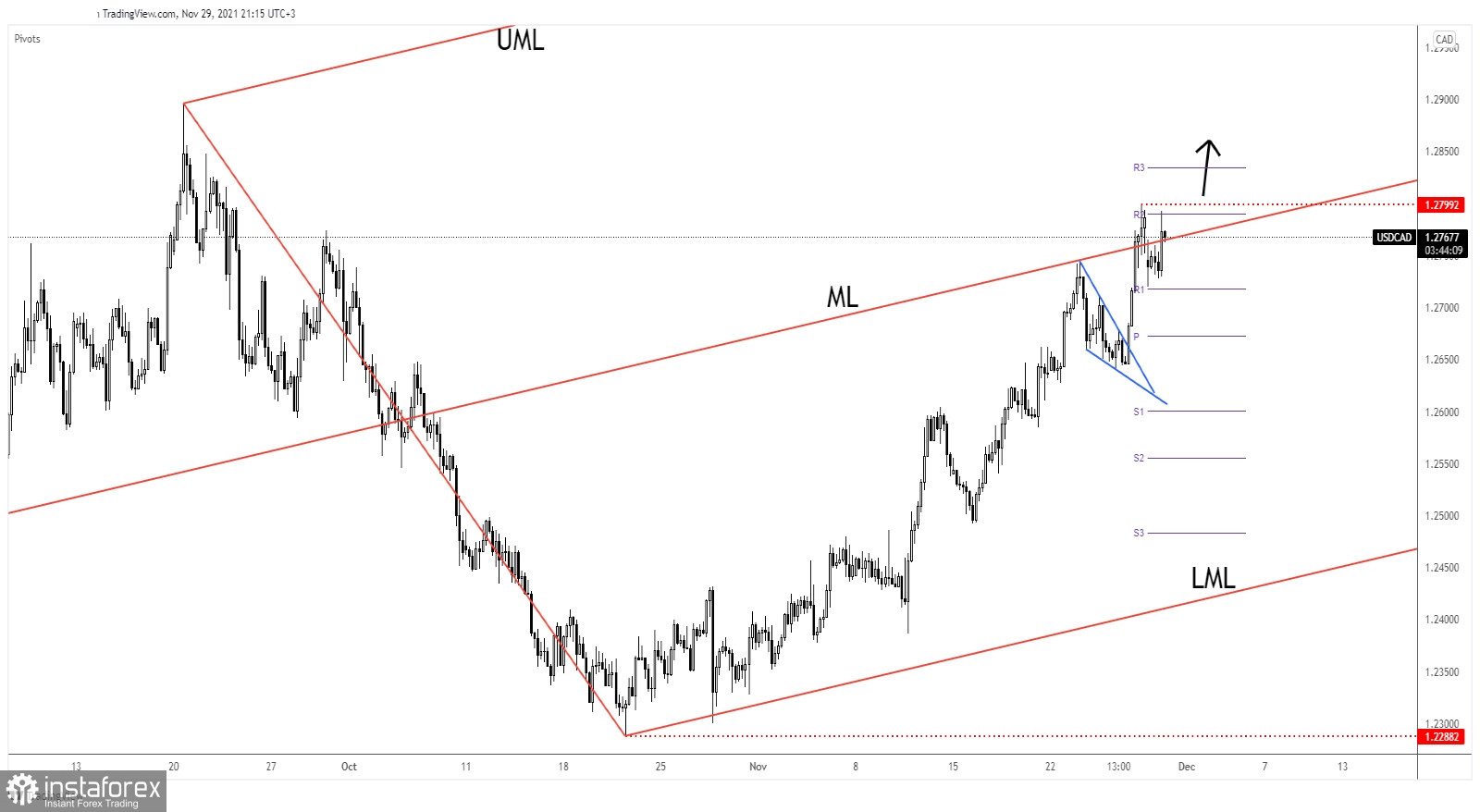

USD/CAD continues to challenge the Ascending Pitchfork's median line (ML) which represented a dynamic resistance. The price failed to stabilize above it in the previous attempt. It has retreated a little but the correction was only a temporary one.

The former high of 1.2799 stands as a static resistance. A new higher high, jumping and closing above it could signal an upside continuation. On the other hand, stabilizing below the median line (ML) could announce that the upside movement could be over.

USD/CAD prediction

A valid breakout above 1.2799 may bring new long opportunities and could validate further growth. On the other hand, closing and stabilizing below the median line (ML) followed by a new lower low, a bearish closure below 1.2720 could open the door for a larger drop.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română