Crypto Industry News:

Ethereum co-founder Vitalik Buterin has proposed a new cap on the block's total transaction data to reduce gas costs in the ETH network.

Buterin highlights concerns about high tier 1 transaction fees for batch bundles and a significant amount of time to implement:

"Therefore, a short-term solution is desirable to further reduce rollup costs and encourage the transition across the entire ecosystem to rollup-oriented Ethereum."

Buterin has made a cost reduction proposal that aims to reduce the load level and the risk of damaging the network. He believes that "1.5MB is enough to prevent most security threats."

Regarding advice to the Ethereum community, Vitalik wrote:

"It is worth rethinking your stance on multidimensional resource limits. Look at them as a pragmatic way to achieve moderate increases in scalability while maintaining security."

If accepted, the implementation of the proposal will require a scheduled network upgrade. This update also means that miners will have to follow a new rule that prevents new transactions from being added to a block when the total size of call data reaches its maximums.

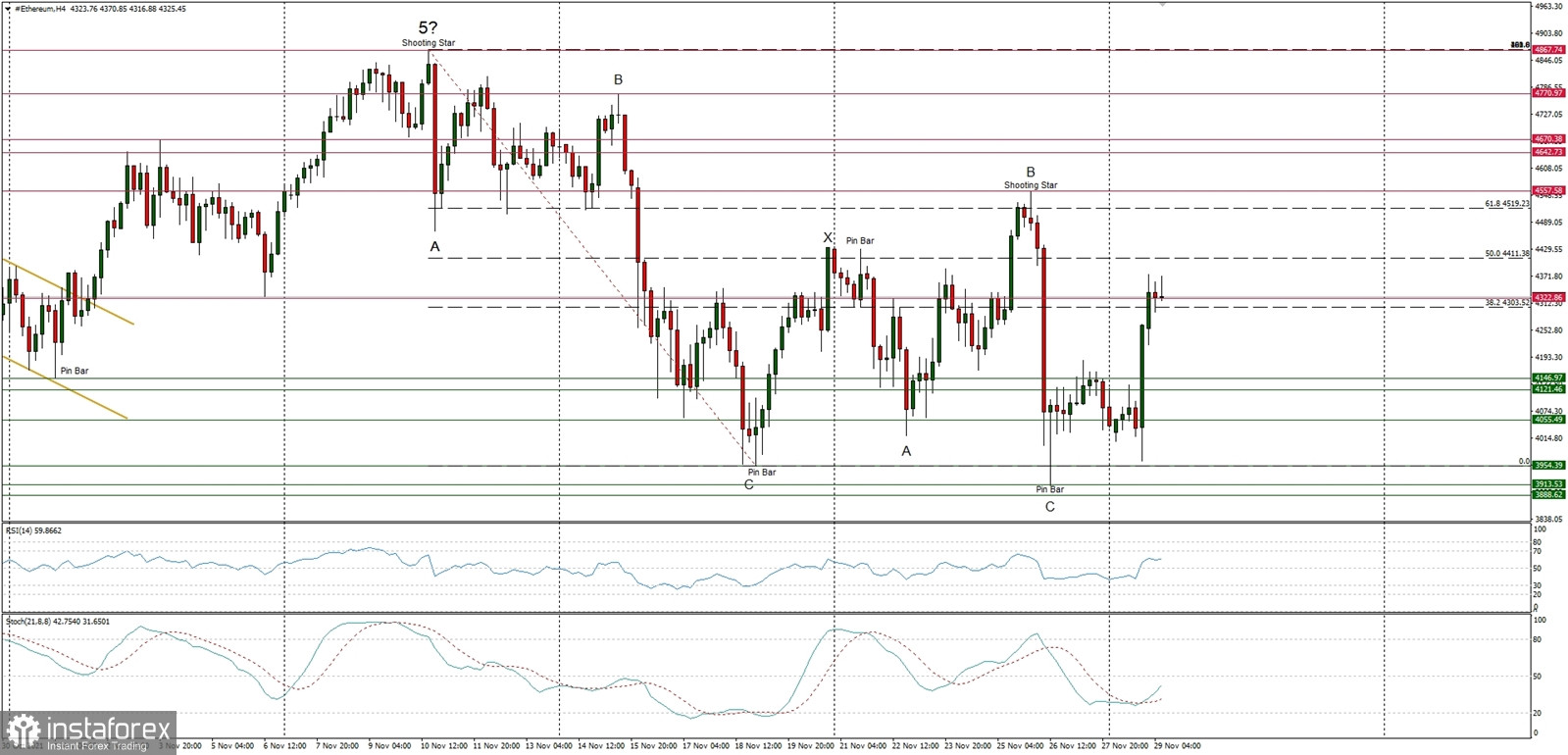

Technical Market Outlook

The ETH/USD pair has bounced from the level of $3,910 after a Pin Bar candlestick pattern was made. The ABCxABC complex corrective pattern might have been completed at this level and now the market is ready to resume the up trend again. The recent local high was made at the level of $4,375, but in order to confirm the up trend continuation bulls must break through the wave B high located at $4,555. The nearest technical support is seen at the level of $4,185 and $4,121. The larger time frame trend is still up.

Weekly Pivot Points:

WR3 - $5,126

WR2 - $4,890

WR1 - $4,581

Weekly Pivot - $4,237

WS1 - $3,938

WS2 - $3,595

WS3 - $3,100

Trading Outlook:

The ABCxABC complex corrective cycle might be terminated, so the next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română