Crypto Industry News:

Economist Paul Beaudry, who is also deputy president of the Bank of Canada, believes that cryptocurrencies do not pose a threat to the economy at the moment. Paul Beaudry's position contrasts with a recent statement by the former US Secretary of State: Hillary Clinton sees cryptocurrencies as a threat.

No wonder that Canada was not only one of the first countries to approve the Bitcoin ETF, but also ranks fourth when it comes to the hash rate of the BTC network.

The deputy president of the Canadian central bank spoke about cryptocurrencies during the Ontario Securities Commission Dialogue 2021. The economist focused primarily on discussing threats that could affect the stability of the Canadian financial system.

Of course, there was a question about cryptocurrencies, to which Beaudry replied that, according to the Bank of Canada, cryptocurrencies do not develop in a way that could pose a threat to the financial system:

"Developing in a way that creates a systemic type of risk for a financial system".

Among other things, Beaudry's position was argued that cryptocurrencies were sidelined from the main financial system. With time, however, with the increasing capital influencing the crypto market and the increase in the number of people using digital assets, the risk will increase, which is why the bank closely monitors the cryptocurrency market and stablecoins.

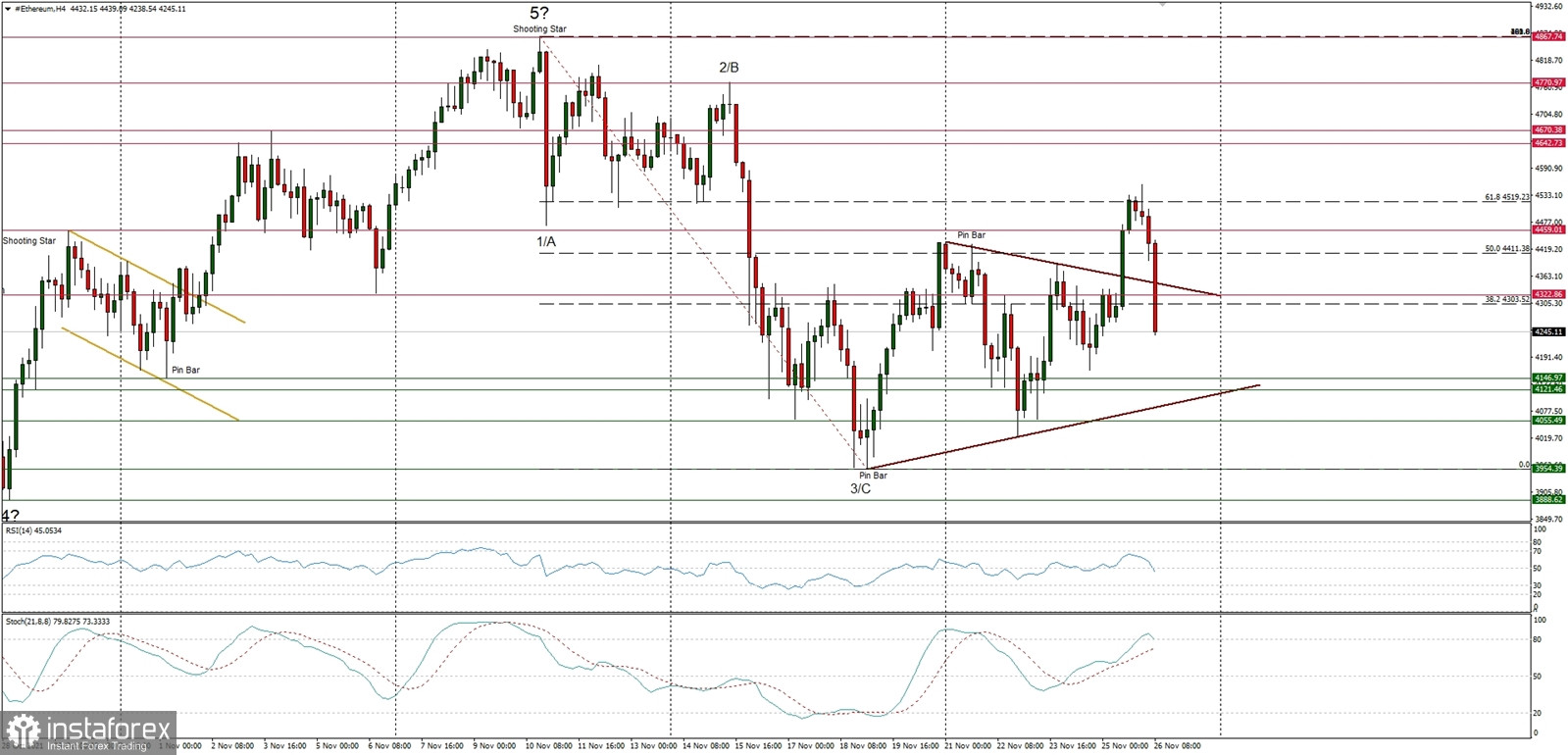

Technical Market Outlook

The ETH/USD pair has retrace 61% of the last wave down and then sharply reversed lower again as the bearish pressure intensify. The next target for bears is seen the level of $4,021 and any violation of this level would accelerate the down move towards the key short-term technical support seen at $3,954. Please notice, that the larger time frame trend remains up and there is no indication of the trend reversal yet.

Weekly Pivot Points:

WR3 - $5,566

WR2 - $5,159

WR1 - $4,752

Weekly Pivot - $4,357

WS1 - $3,938

WS2 - $3,564

WS3 - $3,134

Trading Outlook:

The next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română