Crypto Industry News:

Blockchain technology has opened up a wide variety of use cases across various sectors of the economy. As inflation rises, institutions and investors are looking for a way to generate income. In this area, the crypto industry offers great opportunities, often by innovating and improving an aspect, function, or asset already consolidated in the financial world to date.

Landshare (LAND), a platform operating on Binance Smart Chain, is trying to be a catalyst for further financial innovations. The platform allows its users to own real estate on the blockchain through a mechanism called Asset Tokenization, without the need for broker resources or management fees.

Thus, users buy tokens that represent their property - real estate. In this way, anyone can participate in the game, generate profits, use assets as collateral and more, without the need to maintain the physical integrity of the underlying asset or deal with the complexity of collecting rent.

The platform and its tokenization process are fully legal as the properties are owned by independent corporations, according to the official Landshare website. The shares of these companies are tokenized, making each investor a "legal shareholder" in the assets and the underlying real estate itself.

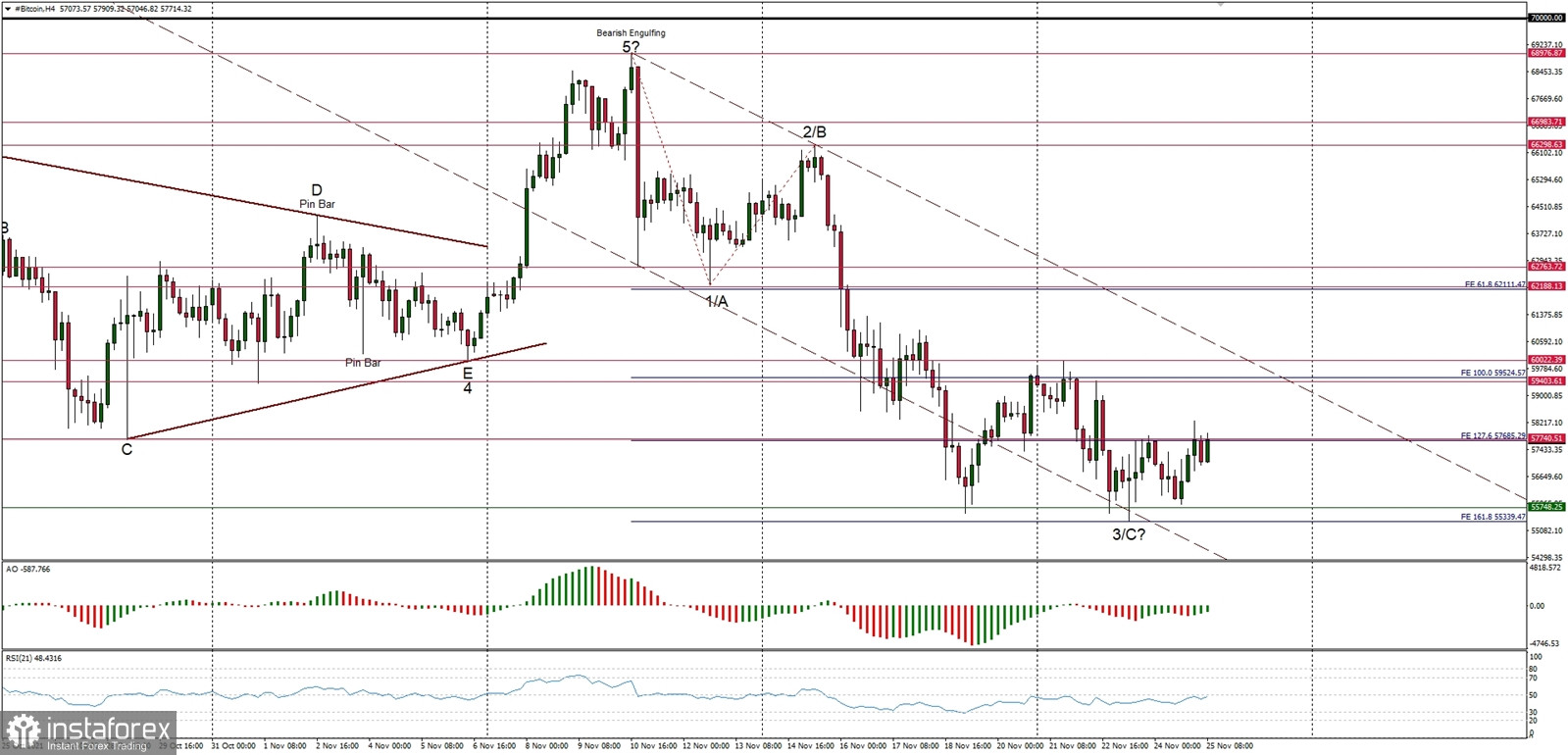

Technical Market Outlook

The BTC/USD pair keeps trading close to the recent bottom of the wave 3 again, which is located at the level of $55,758. The new, marginal lower low was made at the level of $55,333 during the test, but the whole H4 candle looks like a Pin Bar anyway. The nearest technical resistance is seen at the level of $57,740 and the local technical support at $55,747. The momentum remains weak and negative despite the potential low of the wave 3/C, so any violation of the level of $55,785 would extend the correction towards the level of $55,747 or below. Only a sustained breakout above the level of $62,767 would change the outlook to more bullish.

Weekly Pivot Points:

WR3 - $75,582

WR2 - $70,896

WR1 - $64,654

Weekly Pivot - $60,209

WS1 - $54,112

WS2 - $49,298

WS3 - $43,190

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $52,943 is clearly broken on the daily time frame chart (daily candle close below $52,000).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română