Crypto Industry News:

Total Blocked Value (TVL) in Ethereum's Tier 2 networks hit a new record as gas charges continue to rise, fueling further adoption. TVL across various protocols and Tier 2 networks hit a record $ 5.64 billion.

Second tier scaling solutions provide significantly higher transaction throughput and lower transaction fees, and their adoption increased significantly in November, where the highest average gas charges in the history of the Ethereum network were recorded.

Tier 2 TVL has more than doubled since early October, rising 110% from $ 2.68 billion to its current level. The average Ethereum transaction fees are currently around $ 40. They hit around $ 65 on November 9, and have risen 700% in the last four months.

Gas prices vary depending on the operation. A simple ERC-20 token transfer can currently cost around $ 45, while a more complex interaction with smart contracts or Uniswap swaps can cost as much as $ 140, according to Etherscan.

Registering a name with the Ethereum Name Service can cost hundreds of dollars on the gas, even though an actual domain name costs just a few dollars a year.

Since October, multi-chain-compatible decentralized financial platforms have seen record inflows as investors and developers try to avoid the Ethereum network due to rising gas charges.

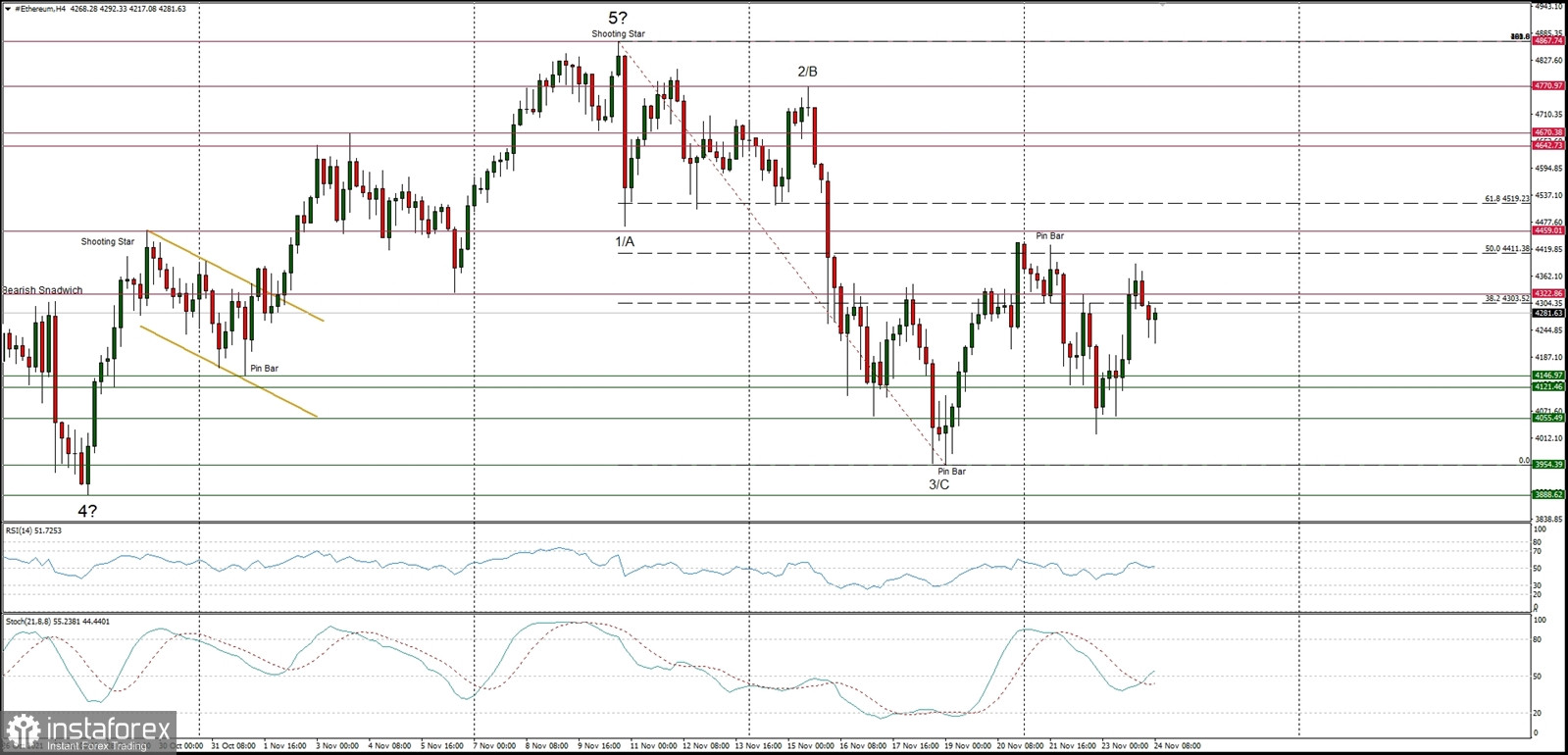

Technical Market Outlook

The ETH/USD pair keeps consolidating in a narrow range after a bounce from the technical support located at $4,055. The market conditions on the H4 time frame chart are coming off the overbought conditions, so a deeper down move might occur, targeting the level of $4,021. Any violation of this level would accelerate the down move towards the key short-term technical support seen at $3,954. Please notice, that the larger time frame trend remains up and there is no indication of the trend reversal yet.

Weekly Pivot Points:

WR3 - $5,566

WR2 - $5,159

WR1 - $4,752

Weekly Pivot - $4,357

WS1 - $3,938

WS2 - $3,564

WS3 - $3,134

Trading Outlook:

The next long-term target for ETH is seen at the level of $5,000. Nevertheless, in order to continue the long-term up trend, the price can not close below the technical support at the level of $2,906. The level of $1,728 (61% Fibonacci retracement of the last big impulsive wave up) is still the key long-term technical support for bulls. The level of $3,677 is the key mid-term technical support for bulls.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română