The price of gold plunged in the short term as the US Dollar appreciated versus other major currencies. Technically, the price action signaled that the upside movement was over, so the sell-off was natural.

The yellow metal was trading at 1,788.29 at the time of writing above 1,782.04 today's low. After dropping by 5.07% from 1,877.14 to 1,782.04 today's low, Gold could try to rebound, but we still have to wait for strong confirmation before taking action.

XAU/USD has rebounded also because the Flash Manufacturing PMI was reported at 59.1 below 59.3 expected, while the Flash Services PMI dropped unexpectedly from 58.7 to 57.0 points, whereas specialists expected potential growth to 59.1 points.

XAU/USD to hit support

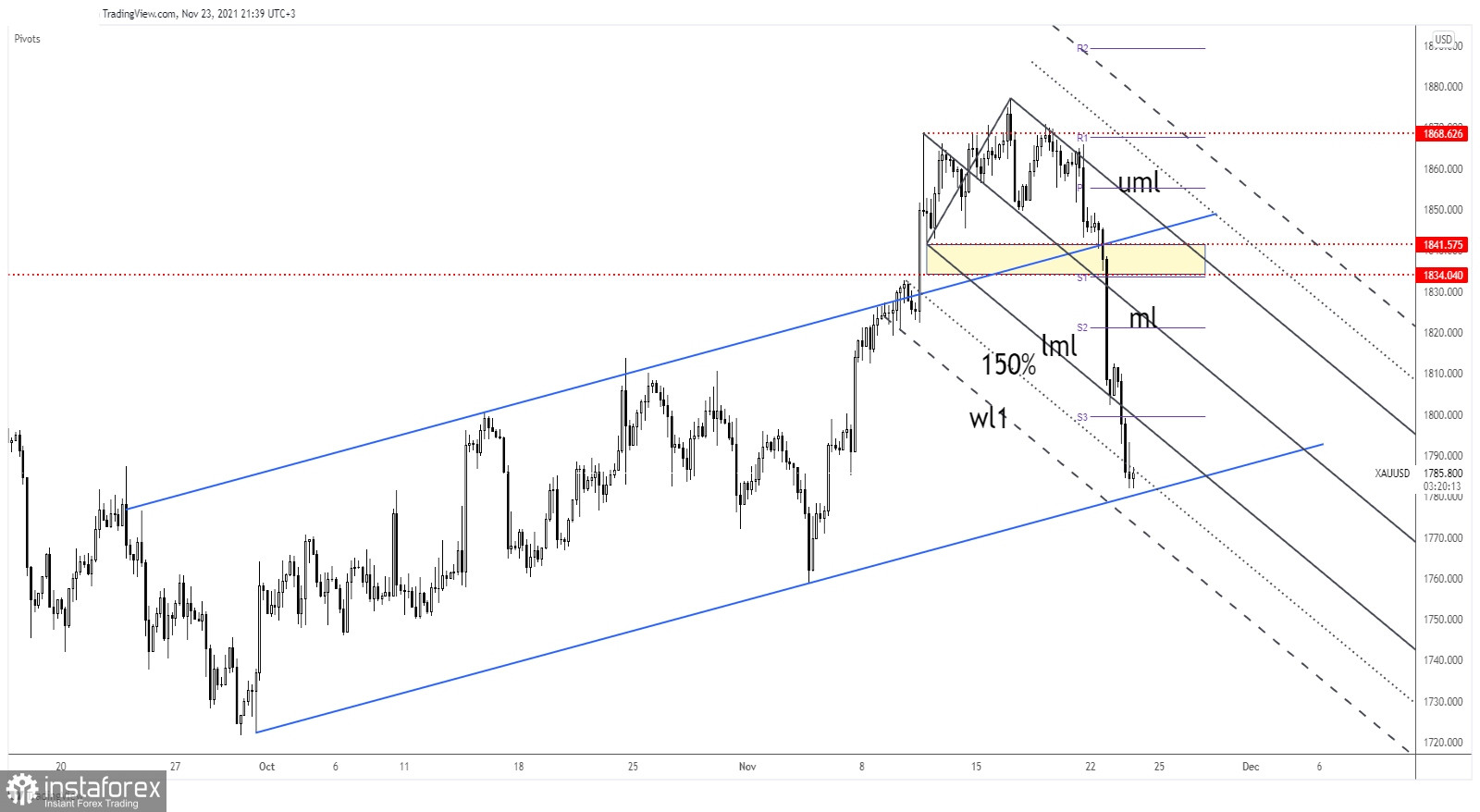

Gold plunged after retesting the 1,868.62 resistance level. It has ignored the up channel's upside line and the 1,834.04 level. Now, it was almost to reach the uptrend line which stands as a dynamic support.

Despite the current rebound, the bias remains bearish as long as it stays under the Descending Pitchfork's lower median line (lml). Personally, I still believe that Gold could approach and reach the uptrend line.

Making a valid breakdown below the uptrend line could invalidate a potential rebound and could open the door for a larger drop.

XAU/USD prediction

Gold could develop a significant upside movement only if the price action develops a strong bullish pattern here above the uptrend line. It could extend its drop as long as it stays below the Pitchfork's lower median line (lml) and if it makes a valid breakdown through the uptrend line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română