Crypto Industry News:

El Salvador continues to lead in Bitcoin adoption, while President Nayib Bukele announced the launch of Bitcoin City, which will be initially financed with 1 billion Bitcoin bonds. Dollars.

The initiative was first announced by Bukele at the Bitcoin Week conference in El Salvador to celebrate Bitcoin's adoption in the country and increase citizen participation.

Well-known cryptocurrency companies, including cryptocurrency exchanges, will be actively involved in the development of Bitcoin City by launching a securities platform for storing Bitcoin bonds.

The president predicts Bitcoin City will become a fully functional city with residential areas, shopping malls, restaurants, a port, "everything around Bitcoin". What's more, residents are only subject to VAT, which, according to Bukele, will be used to pay for the municipality's bonds and for public infrastructure and city maintenance.

At the conference, Blockstream security director Samson Mao explained the feasibility of acquiring $1 billion Bitcoin bonds and that $500 million worth of Bitcoin bonds will be subjec to a five-year lock-in period, which will effectively eliminate invested capital from global circulation.

Technical Market Outlook

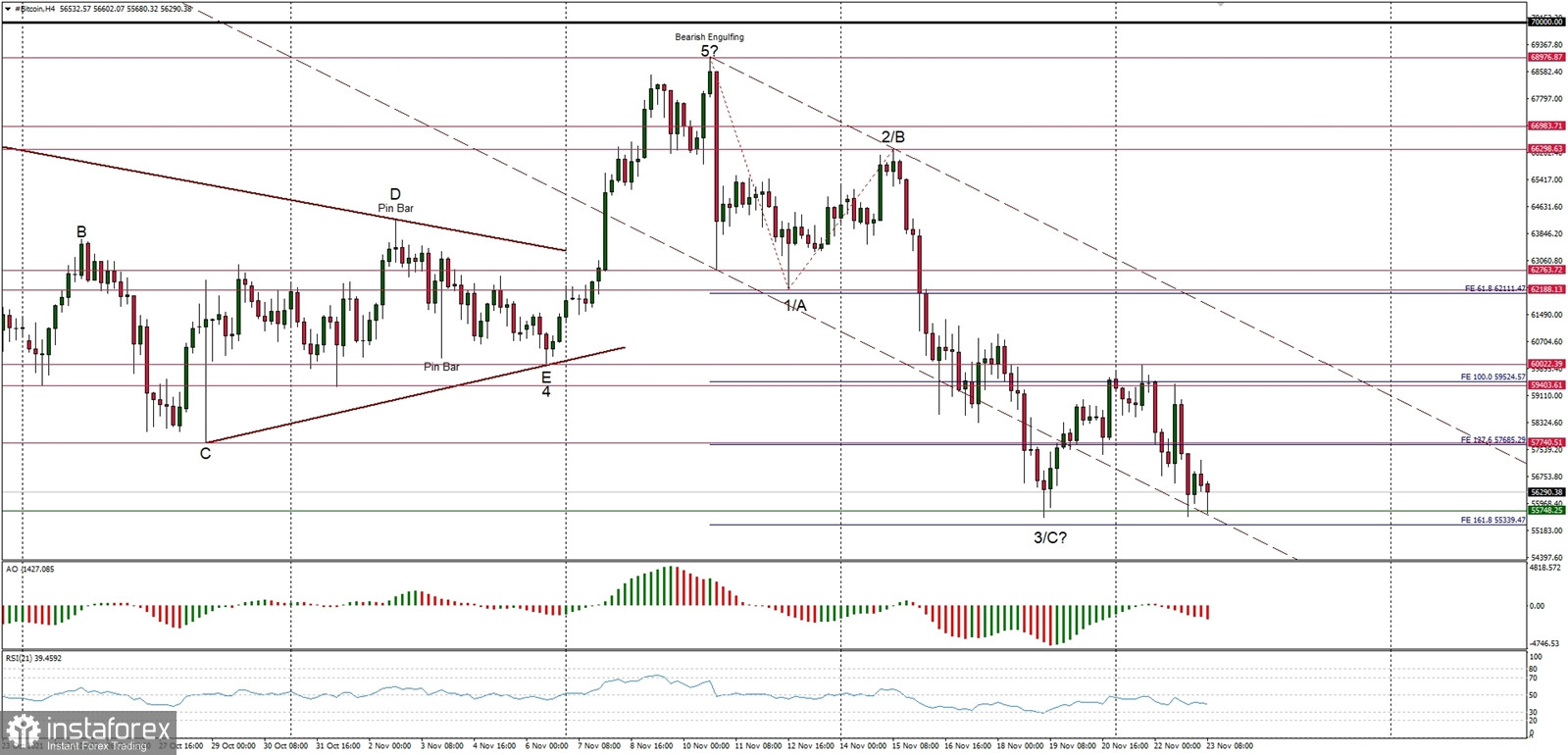

The BTC/USD pair is testing the bottom of the wave 3 again, which is located at the level of $55,758. The momentum remains weak and negative despite the potential low of the wave 3/C, so any violation of the level of $55,785 would extend the correction towards the level of $55,747 or below. Only a sustained breakout above the level of $62,767 would change the outlook to more bullish.

Weekly Pivot Points:

WR3 - $75,582

WR2 - $70,896

WR1 - $64,654

Weekly Pivot - $60,209

WS1 - $54,112

WS2 - $49,298

WS3 - $43,190

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $52,943 is clearly broken on the daily time frame chart (daily candle close below $52,000).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română