Crypto Industry Outlook:

The Bank of Russia will only fully adopt the central bank's digital currency (CBDC) if the digital ruble meets several conditions in the pilot tests, Governor Elvira Nabiullina said.

Nabiullina spoke about the digital ruble to the State Duma's Financial Markets Committee, revealing more details on the introduction of CBDC.

The Bank of Russia will only accept CBDC after it has made sure that the rubles can be easily converted from cash to digital and non-cash ruble and only on a one-to-one ratio.

"It should be a real, full-fledged ruble, with no discounts or anything else," noted Nabiullina, adding that the central bank expects to test the digital ruble for at least a year before it is actually released to the market.

Nabiullina stressed that the digital ruble should not affect local inflation:

"We assume that the introduction of the digital ruble will in no way accelerate inflation and will not affect inflation" - she noted.

Russia experienced a huge spike in inflation during the COVID-19 pandemic. According to official figures from the national statistics service Rosstat, domestic inflation reached its highest level in almost six years, rising 8.1% in October. The Bank of Russia reportedly expects it to cut its inflation rate to 5% or 6% no earlier than 2023.

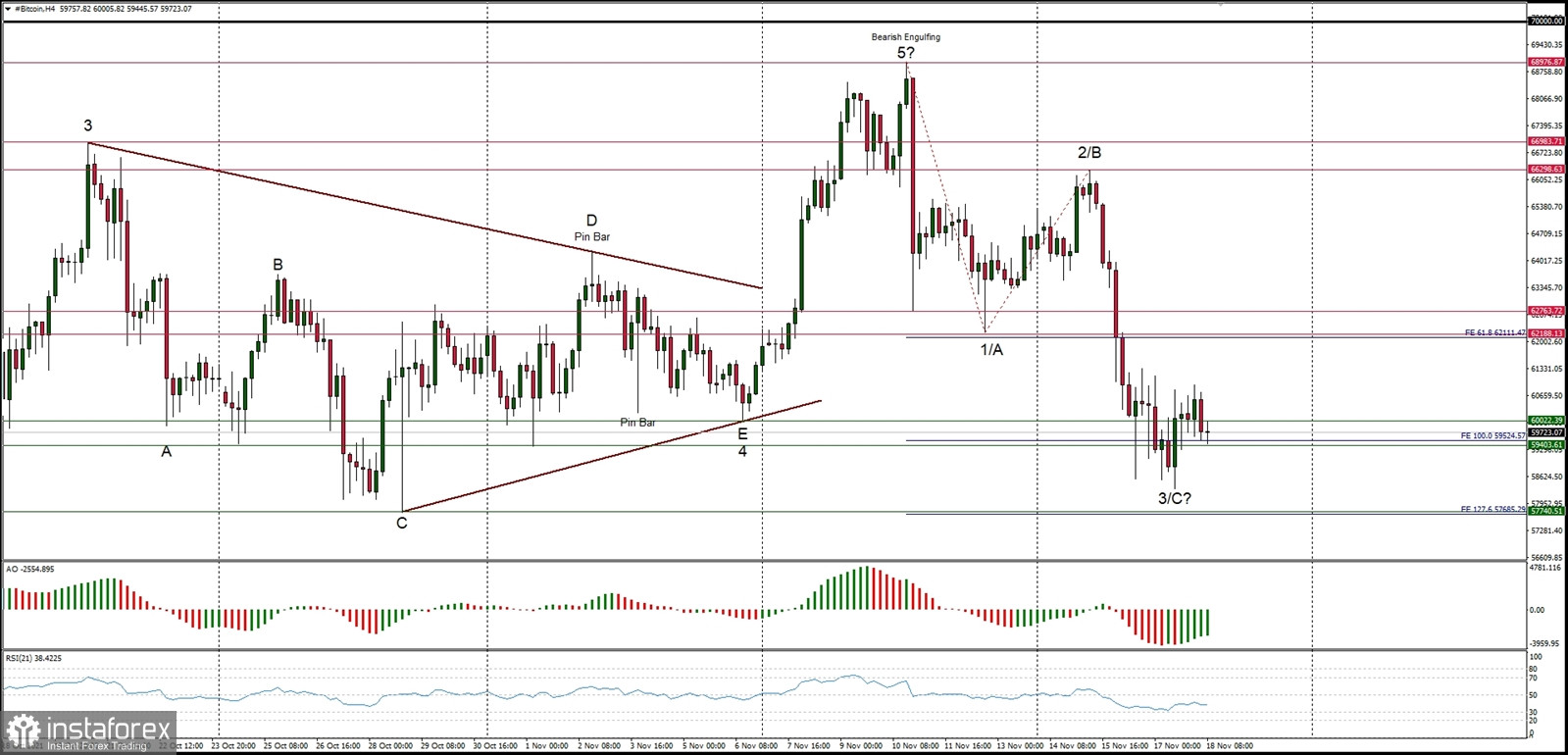

Technical Market Outlook

The BTC/USD pair is about to terminate the ABC corrective cycle at the level of $57,685 and might bounce towards the technical resistance seen at the level of $62,188. The next big target for BTC is seen at $70,000, but the first target for the wave 5 is located at $70,508. Nevertheless, the wave 5 might had been terminated at the level of $68,987 already and now the market is developing the corrective cycle. The momentum is weak and negative, which supports the short-term bearish outlook for BTC. The nearest technical support is seen at the level of $57,740.

Weekly Pivot Points:

WR3 - $74,186

WR2 - $71,563

WR1 - $67,476

Weekly Pivot - $68,414

WS1 - $60,726

WS2 - $58,026

WS3 - $54,090

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. This scenario is valid as long as the level of $52,943 is clearly broken on the daily time frame chart (daily candle close below $52,000).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română