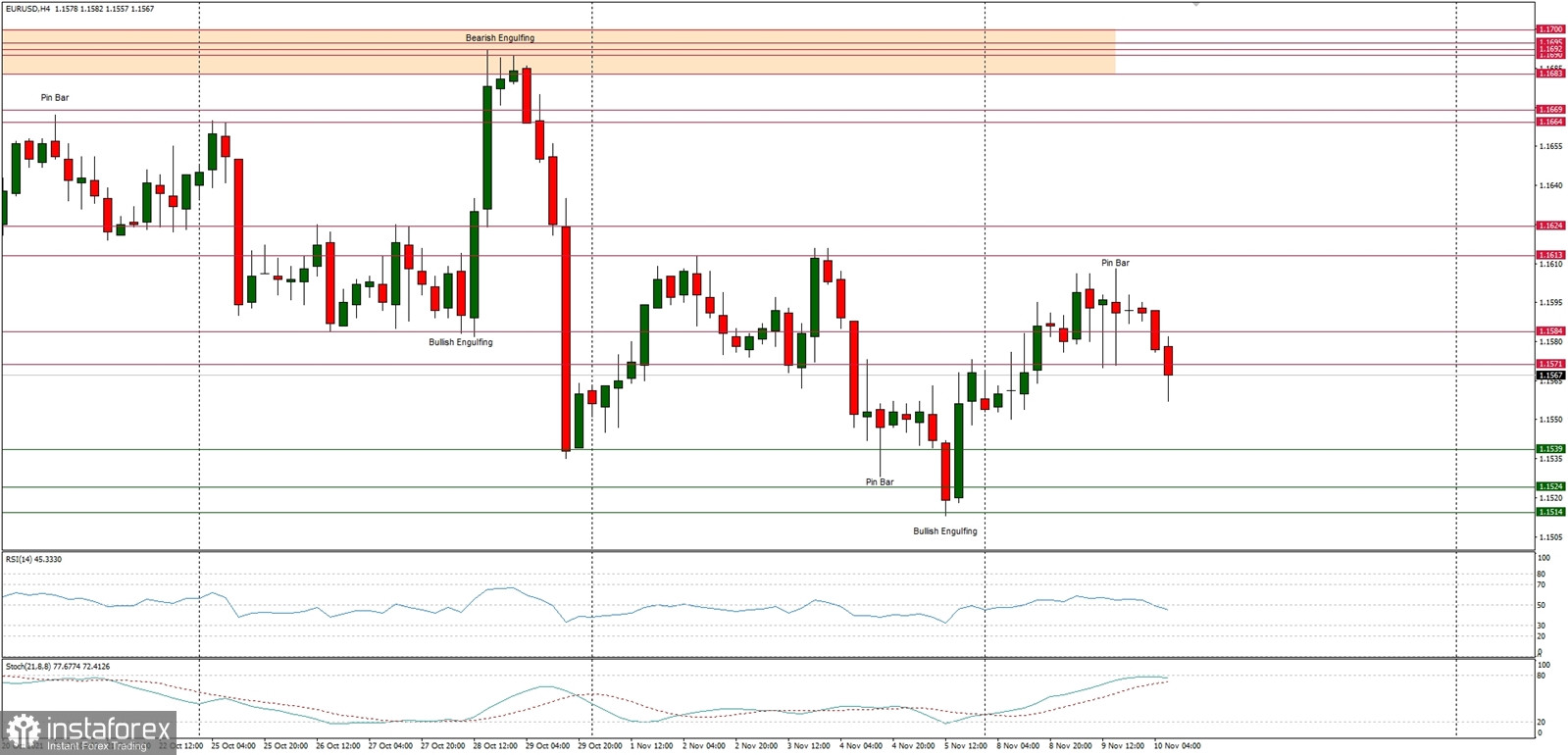

Technical Market Outlook

The EUR/USD pair has bounced from the level of 1.1514 and the bulls have managed to hit the level of 1.1607. The bounce had ended with a Pin Bar candlestick pattern and the move up was terminated, so the market has reversed down. The larger time frame trend remains down and any violation of the technical support located at 1.1571 will be negative for bulls in the short-term. On the other hand, the nearest key technical resistance is located at the mentioned level of 1.1613, so this level need to be broken before bull might try to break higher towards the level of 1.1624 and above. Nevertheless, despite the bounce, the momentum is hardly positive, so the bears are still in control of the market.

Weekly Pivot Points:

WR3 - 1.1716

WR2 - 1.1666

WR1 - 1.1608

Weekly Pivot - 1.1563

WS1 - 1.1509

WS2 - 1.1471

WS3 - 1.1405

Trading Outlook:

The market is in control by bears that pushed the prices towards the level of 1.1501, which is the lowest level since November 2020. The next target for bears is seen at the level of 1.1497. The up trend can be continued towards the next long-term target located at the level of 1.2350 (high from 06.01.2021) only if bullish cycle scenario is confirmed by breakout above the level of 1.1909 and 1.2000.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română