At the moment of writing, the EUR/USD pair was trading in the red at 1.1576 level after failing to stay near 1.1608 today's high. Technically, the price reached a resistance area, so a new bearish momentum is natural.

Also, the currency pair drops as the Dollar Index rallies. The index ended its correction and now it looks to trade higher. Fundamentally, the eurozone ZEW Economic Sentiment was reported higher at 25.9 points versus 20.6 expected and compared to 21.0 in the previous reporting period. Furthermore, the German ZEW Economic Sentiment surged from 22.3 to 31.7 points, whereas specialists expected a potential drop to 20.3 points. Despite positive data, the euro failed to keep the pair higher.

On the other hand, the US data came in mixed. The PPI registered a 0.6% growth matching expectations, while the Core PPI rose only by 0.4% versus 0.5% expected.

EUR/USD new sell-off

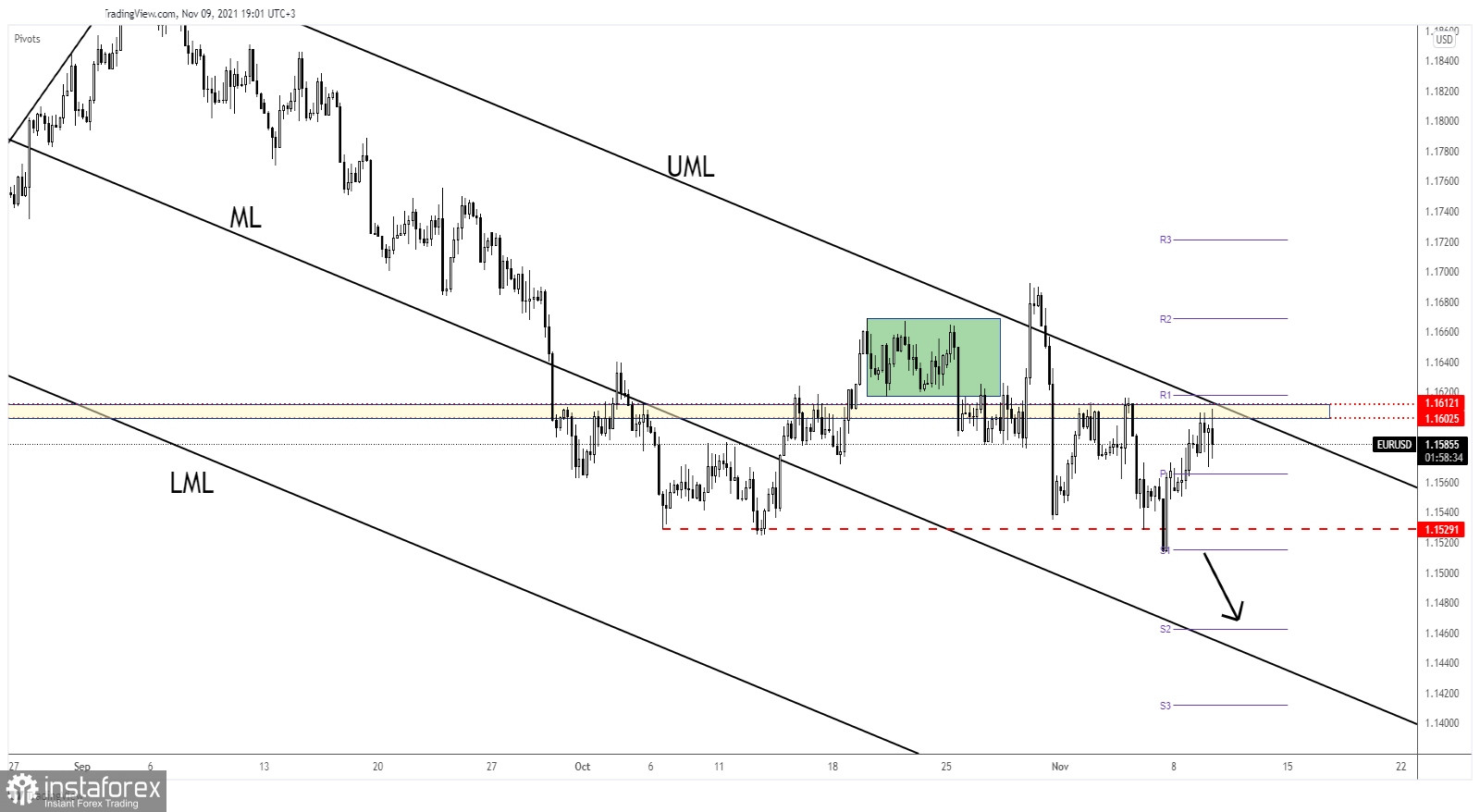

As you can see on the H4 chart, EUR/USD rebounded after registering a major bullish engulfing on the 1.1529 level. Now, it has reached 1.1602 - 1.1612 resistance area where it has found supply again.

It has failed to reach and retest the Descending Pitchfork's median line (UML) signaling strong pressure. Still, it remains to see what will really happen as the rate failed to approach and reach the Descending Pitchfork's median line (ML) signaling that the downside movement is over.

EUR/USD forecast

Staying near the Descending Pitchfork's upper median line (UML) could announce an imminent upside breakout. Making a valid breakout above the upper median line (UML) and taking out the 1.1602 - 1.1612 area, a new higher high, could signal an upside reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română