Gold is trading in the green at 1,829.97 and it seems strong enough to approach and reach new highs. As you already know from my previous analyses, XAU/USD was somehow expected to resume its upside journey after ignoring the 1,800 psychological level.

Earlier today, the PPI came in line with expectations while the Core PPI was reported worse than expected. As long as DXY continues falling, the yellow metal may extend its growth.

Tomorrow, the US Consumer Price Index is expected to report a 0.6% growth in October versus 0.4% growth in September, while the Core CPI may register a 0.4% growth in the last month compared to only 0.2% in September. The US inflation data could be decisive and could shake the markets. Most likely, XAU/USD will register sharp movements in the short term.

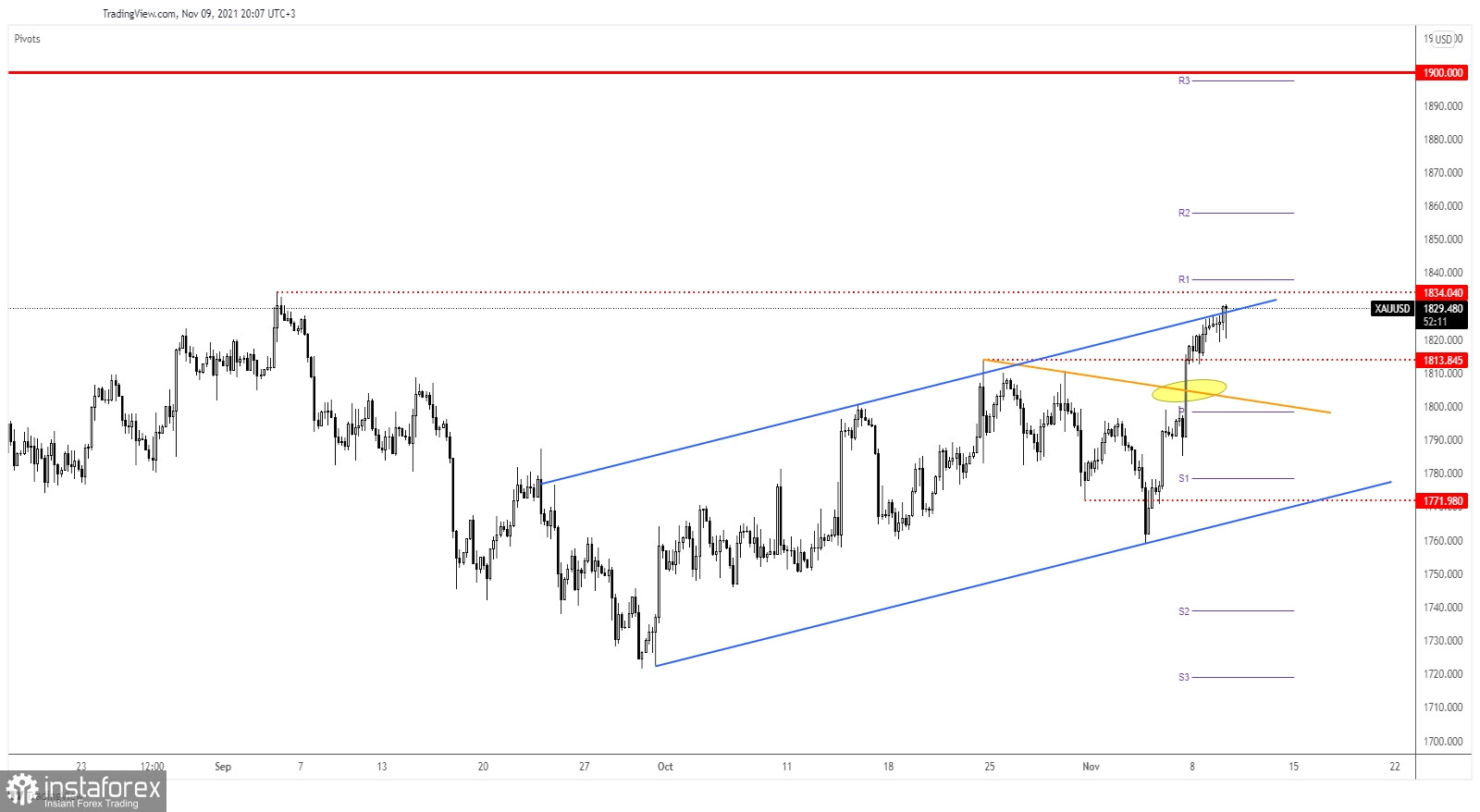

Gold up channel breakout

XAU/USD has managed to jump and close above the channel's upside line. The level of 1,834.04 stands as a static resistance, as an upside obstacle. Stabilizing above the upside line and making a valid breakout through 1,834.04 could validate further growth.

On the other hand, finding strong resistance at 1,834.04 and failing to stay above the upside line could announce a potential drop. Actually, a temporary decline was somehow expected after its leg higher.

Gold prediction

Personally, I would like to see a temporary consolidation above 1,813.84 before the price resumes its growth. Importantly, gold is near the resistance, so you should be careful.

Jumping, closing, and stabilizing above 1,834 could confirm an upside continuation and could bring new long opportunities.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română