EUR/USD plunged after reaching 1.1613 today's high. It was traded at the 1.1581 level above the 1.1575 daily low. The pair registered a rebound only because the Dollar Index dropped after its amazing rally.

Fundamentally, the euro took a hit from the eurozone economic data today. The Final Manufacturing PMI dropped from 58.5 to 58.3 points, the German Final Manufacturing PMI was reported at 57.8 below 58.2 estimates, while the Spanish Manufacturing PMI fell from 58.1 to 57.4, though experts expected potential growth to 58.2 points.

EUR/USD more declines in view

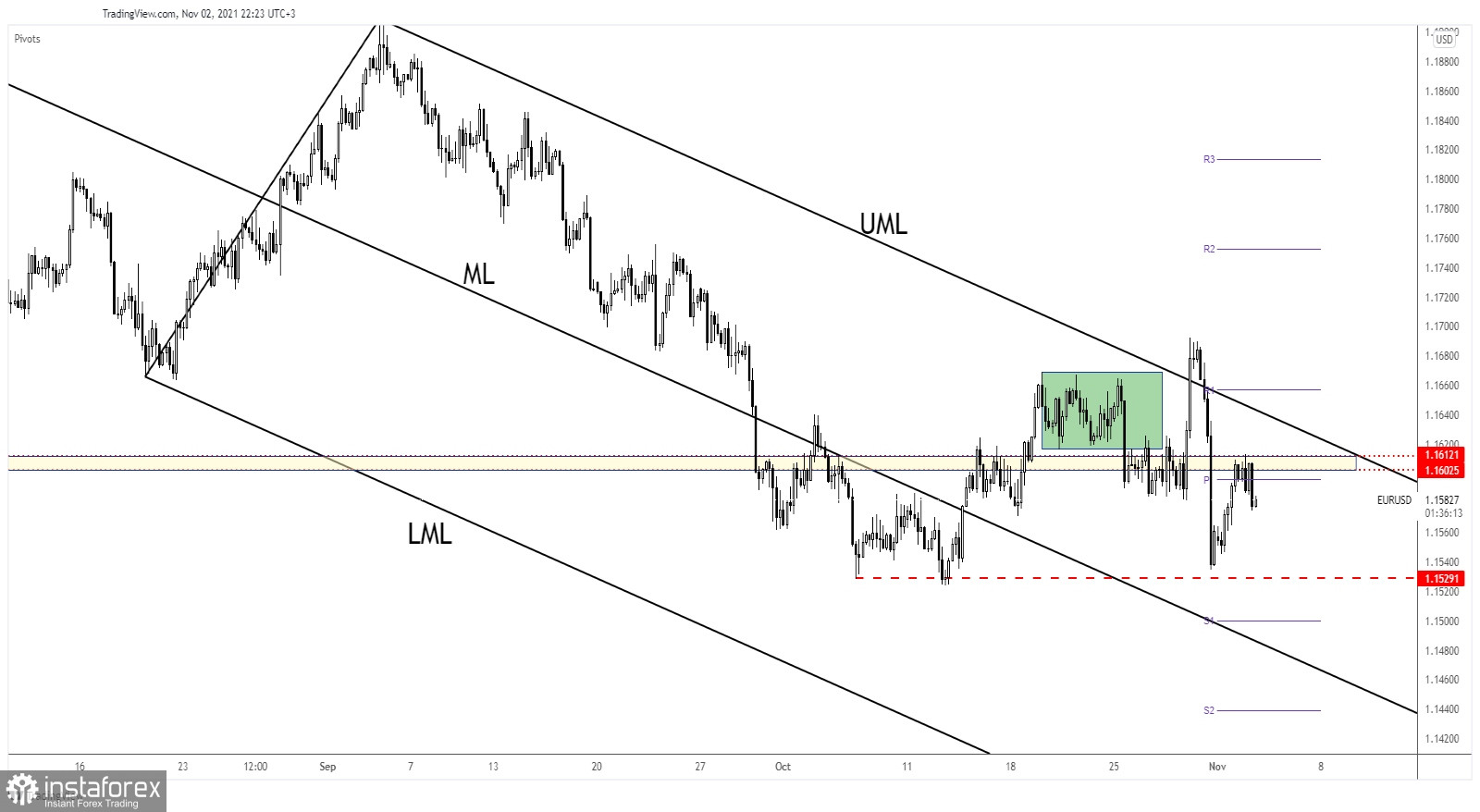

EUR/USD has increased a little to retest the 1.1602 - 1.1616 resistance area, where support has turned into resistance.

Failing to stay above the weekly pivot point (1.1596) signaled strong sellers. In the short term, EUR/USD could still come back to retest the weekly pivot point before resuming its sell-off.

EUR/USD prediction

After its failure to stabilize above the upper median line (UML), EUR/USD signaled a larger downside movement. It is likely to drop deeper as long as it stays below the 1.1596 weekly pivot point.

The level of 1.1529 stands as an important downside target if the rate drops further. It could approach and reach new lows if the Dollar Index jumps higher.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română