Crypto Industry News:

Bitcoin's growth momentum is receiving a lot of support from bitcoin miners and long-term holders.

In the report, entitled "Shocktober", various data were revealed indicating that the market is expecting another wave of gains in the coming months. The ongoing accumulation of resources by major BTC miners and whales is creating a supply shock to the cryptocurrency market that drives a short-term price rise.

On the other hand, participants in the mining pools and small scale miners have made a profit, with the latter being more likely to sell due to market fluctuations. Analysis of coin traffic from long-term bitcoin holders indicates that these investors are not currently interested in selling their coins.

Another indicator, BTC Hodl Waves, which breaks down bitcoin sales by holder type, shows that early adopters of "old coins" (bitcoins that have been inactive for more than six months) saw a 10.9% ROI increase. Moreover, the biggest BTC miners such as Riot, Marathon, Bitfarms, Argo and Hut8 keep their resources even in tough market conditions.

In September, the statistics increased by around 50%. Large mining companies, which are now largely concentrated in the US, own more than 20.4 thousand. Bitcoins, which are also unlikely to be liquidated in the market in the foreseeable future.

Technical Market Outlook

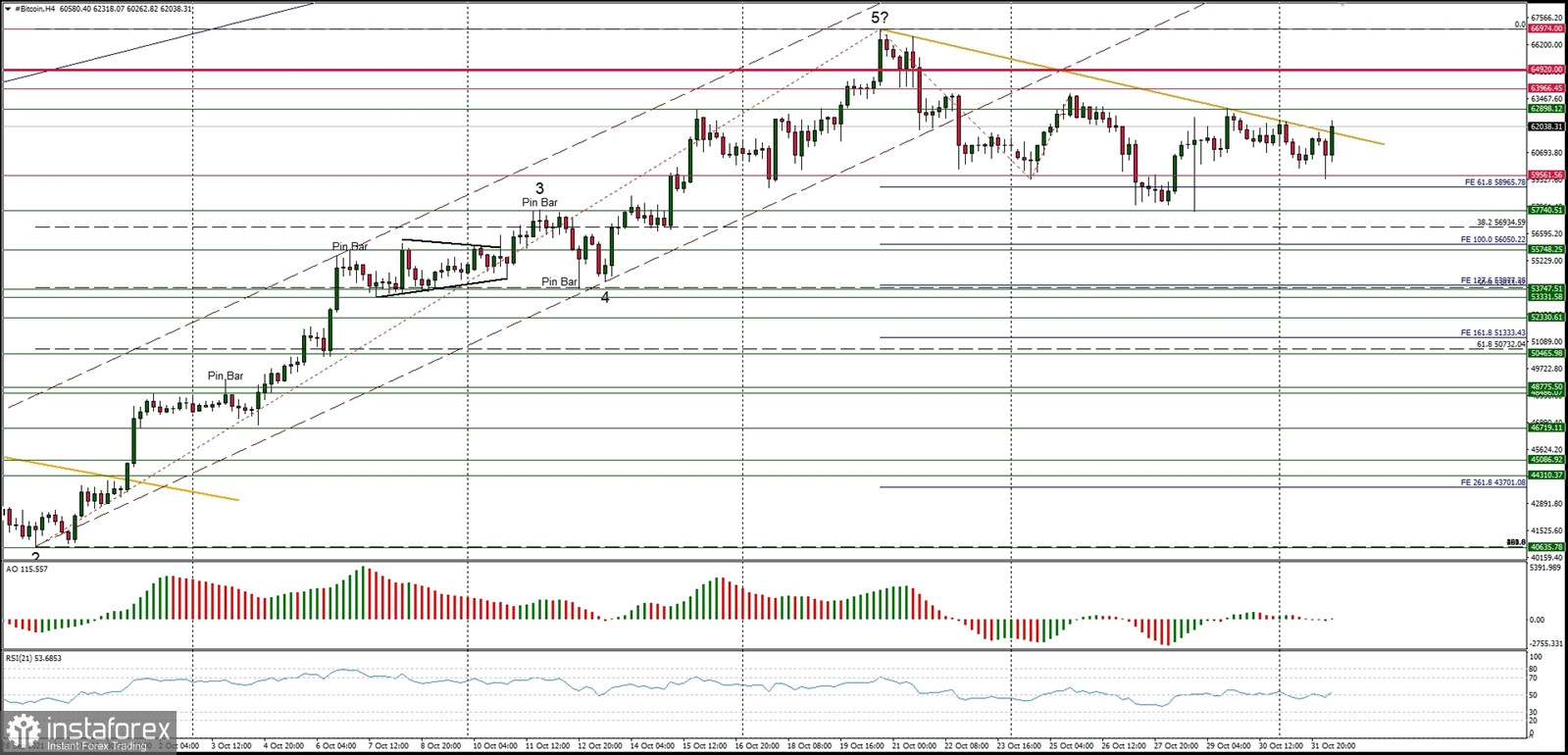

The BTC/USD pair has broke above the short-term trend line resistance around the level of $62,000 as the momentum starts to pick up again. The market made a local low at the level of $57,740 during an increased volatility session and since then the Bitcoin price is rising again. The next target for bulls is seen at the level of $62,898 and $63, 966. On the other hand, the first Fibonacci retracement level, the 38% level, is seen at $56,934.

Weekly Pivot Points:

WR3 - $70,127

WR2 - $66,705

WR1 - $64,387

Weekly Pivot - $60,937

WS1 - $58,287

WS2 - $54,685

WS3 - $52,480

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. The next mid-term target is seen at the level of $66,974 (the previous ATH level). This scenario is valid as long as the level of $30,000 is clearly broken on the daily time frame chart (daily candle close below $30k).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română