Hello, colleagues!

For the Euro/Dollar pair, we follow the formation of the initial conditions for the upward cycle from February 20 and the level of 1.0868 is the key resistance. For the Pound/Dollar pair, the price formed a pronounced upward structure for the top of February 20 and the level of 1.2876 is the key support. For the Dollar/Franc pair, we follow the formation of the downward structure from February 20 and the level of 0.9768 is the key resistance. For the Dollar/Yen pair, we expect a resumption of the upward trend after the breakdown of 111.98. For the Euro/Yen pair, we follow the initial conditions for the top from February 18 and the level of 121.25 is the key resistance. For the Pound/Yen pair, we expect the continuation of the upward movement after the breakdown of 144.60 and the level of 143.90 is the key support.

Forecast for February 24:

Analytical review of currency pairs on the H1 scale:

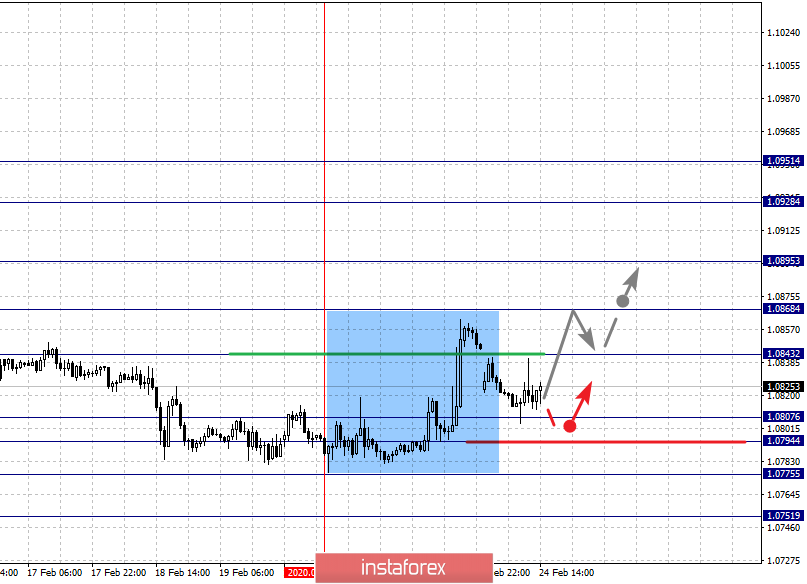

For the Euro/Dollar pair, the key levels on the H1 scale are: 1.0951, 1.0928, 1.0895, 1.0868, 1.0843, 1.0807, 1.0794, 1.0775, and 1.0751. Here, we follow the formation of the initial conditions for the top of February 20. We expect the continuation of the upward movement after the breakdown of 1.0843. In this case, the target is 1.0868 and the breakdown of which will lead to a movement to the level of 1.0895 (consolidation is near this level). The breakdown of 1.0895 should be accompanied by a pronounced upward movement. Here, the target is 1.0928. We consider the level of 1.0951 as a potential value for the top, upon reaching which, we expect a pullback to the bottom.

A short-term downward movement is expected in the range of 1.0807-1.0794 and a key reversal to the top is expected from this range. The breakdown of the level of 1.0794 will lead to the cancellation of the upward structure from February 20. In this case, the first target is 1.0775. We consider the level 1.0751 as a potential value for the bottom.

The main trend is the formation of initial conditions for the upward cycle from February 20.

Trading recommendations:

Buy: 1.0843 Take profit: 1.0866

Buy: 1.0869 Take profit: 1.0895

Sell: 1.0794 Take profit: 1.0775

Sell: 1.0773 Take profit: 1.0752

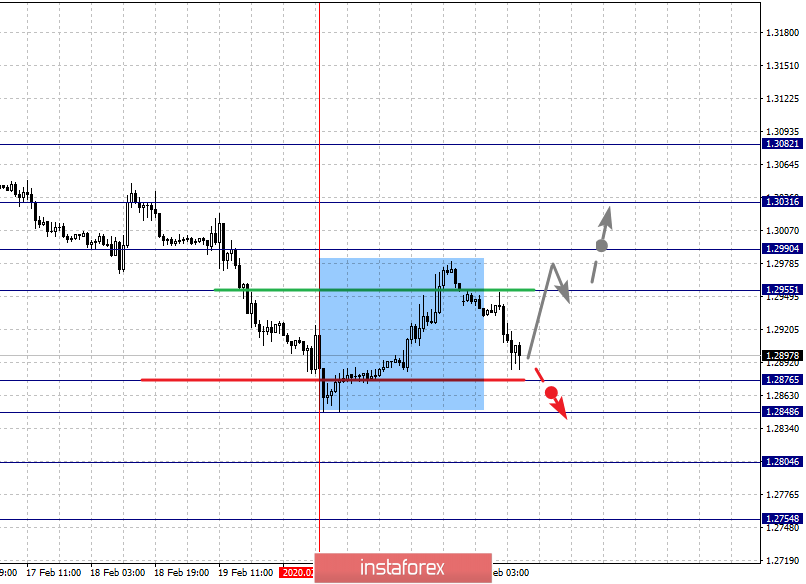

For the Pound/Dollar pair, the key levels on the H1 scale are: 1.3082, 1.3031, 1.2990, 1.2955, 1.2876, 1.2848, 1.2804, and 1.2754. Here, we follow the formation of the ascending structure from February 20. We expect the continuation of the upward movement after the breakdown of 1.2955. In this case, the target is 1.2990 (consolidation is near this level ). The breakdown of which will lead to the development of an upward cycle. Here, the first target is 1.3031. We consider the level of 1.3082 as a potential value for the top, upon reaching which, we expect consolidation, as well as a pullback to the bottom.

The level of 1.2876 is the key support for the ascending structure. Its passage at the price will lead to a movement to the level of 1.2848 and the breakdown of which will continue to develop a downward trend on the H1 scale. In this case, the target is 1.2804. We consider the level of 1.2754 as a potential value for the bottom.

The main trend is the formation of an upward structure from February 20.

Trading recommendations:

Buy: 1.2955 Take profit: 1.2990

Buy: 1.2992 Take profit: 1.3030

Sell: 1.2876 Take profit: 1.2848

Sell: 1.2846 Take profit: 1.2806

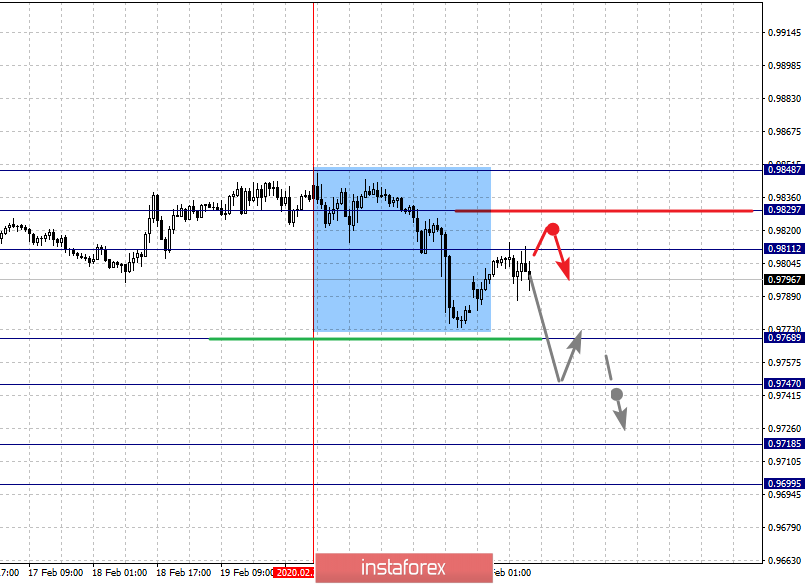

For the Dollar/Franc pair, the key levels on the H1 scale are: 0.9848, 0.9829, 0.9811, 0.9768, 0.9747, 0.9718, and 0.9699. Here, we follow the formation of the descending structure from February 20. We expect a continuation of the downward movement after the breakdown of 0.9768. In this case, the target is 0.9747 (consolidation is near this level). A break of 0.9745 will lead to the development of a pronounced movement. Here, the target is 0.9718. We consider the level of 0.9699 as a potential value for the bottom, upon reaching which, we expect a pullback to the top.

A short-term upward movement is possible in the corridor of 0.9811-0.9829. The breakdown of the last value will lead to the cancellation of the downward structure from February 20. In this case, the first potential target is 0.9848.

The main trend is the formation of initial conditions for the downward cycle from February 20.

Trading recommendations:

Buy: 0.9811 Take profit: 0.9827

Buy: 0.9831 Take profit: 0.9848

Sell: 0.9768 Take profit: 0.9749

Sell: 0.9746 Take profit: 0.9720

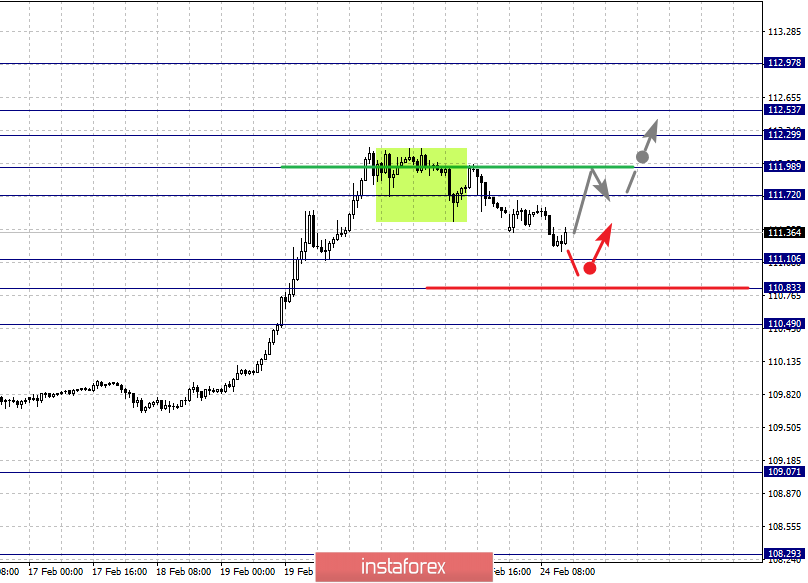

For the Dollar/Yen pair, the key levels in the H1 scale are: 112.97, 112.53, 112.29, 111.98, 111.72, 111.10, 110.83, and 110.49. Here, we follow the development of the ascending structure from January 31. At the moment, the price is in a correction. A short-term upward movement is expected in the range of 111.72-111.98. The breakdown of the last value will lead to the resumption of the upward trend. In this case, the first target is 112.29 and in the corridor of 112.29-112.53 is the consolidation. We consider the level of 112.97 as a potential value for the top, after which we expect a rollback to the bottom.

A short-term downward movement is possible in the corridor of 111.10-110.83 and the breakdown of the last value will lead to the development of a downward trend. Here, the first potential target is 110.50.

The main trend is the upward structure from January 31, the correction stage.

Trading recommendations:

Buy: 111.72 Take profit: 111.96

Buy: 112.00 Take profit: 112.29

Sell: 111.10 Take profit: 110.85

Sell: 110.80 Take profit: 110.50

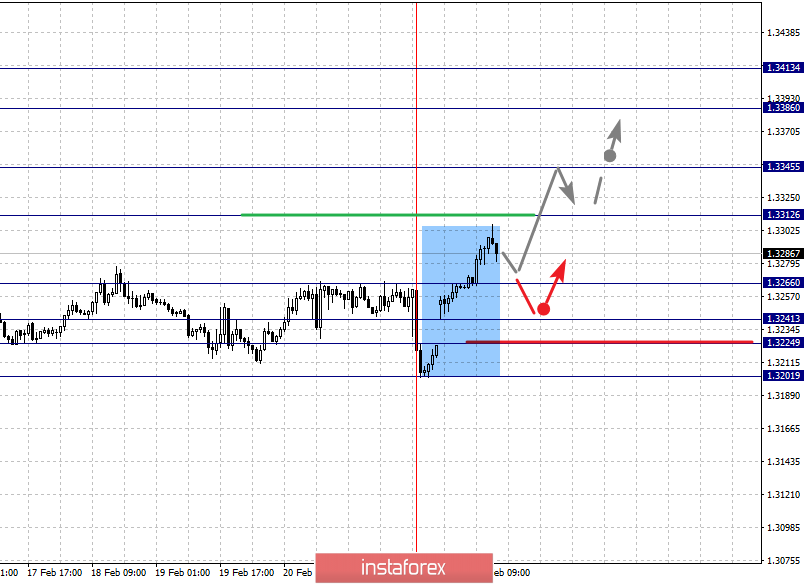

For the Canadian dollar/Dollar pair, the key levels on the H1 scale are: 1.3413, 1.3386, 1.3345, 1.3312, 1.3266, 1.3241, 1.3224, and 1.3201. Here, the price forms potential initial conditions for the top of February 21. The continuation of the upward movement is expected after the breakdown of 1.3312. In this case, the target is 1.3345 (consolidation is near this level). The breakdown of 1.3345 will lead to a pronounced movement. Here, the target is 1.3386. We consider the level of 1.3413 as a potential value for the top; upon reaching this value, we expect consolidation, as well as a correction.

A short-term downward movement is possible in the corridor of 1.3266-1.3241 and the range of 1.3241-1.3224 is the key support for the ascending structure. Its passage by the price will lead to the development of a downward movement. In this case, the target is 1.3201.

The main trend is the formation of an upward structure from February 21.

Trading recommendations:

Buy: 1.3312 Take profit: 1.3341

Buy: 1.3346 Take profit: 1.3386

Sell: 1.3266 Take profit: 1.3241

Sell: 1.3224 Take profit: 1.3201

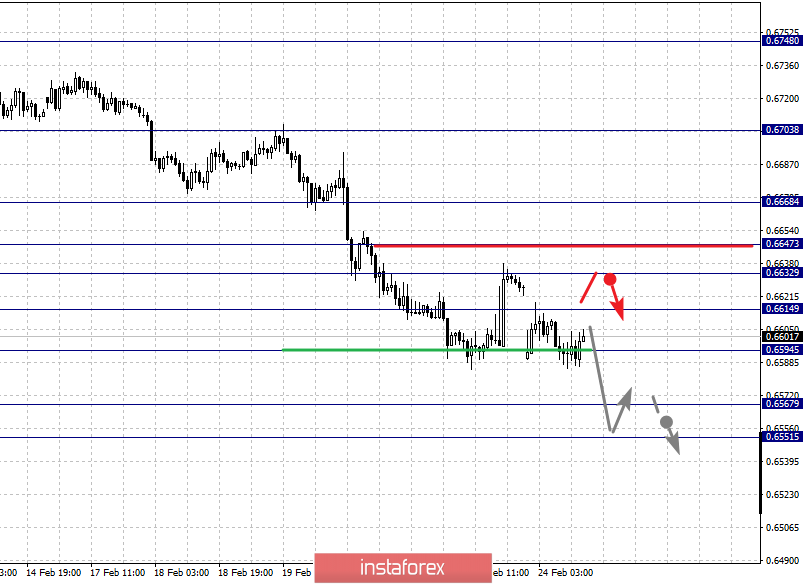

For the Australian dollar/Dollar pair, the key levels on the H1 scale are: 0.6668, 0.6647, 0.6632, 0.6614, 0.6594, 0.6567, and 0.6551. Here, we follow the downward structure from February 12. The consolidated movement is expected in the corridor of 0.6614-0.6594 and the breakdown of the last value will lead to a pronounced downward movement. Here, the target is 0.6567. We consider the level of 0.6551 as a potential value for the bottom, upon reaching which, we expect consolidation, as well as a rollback to the top.

A short-term upward movement is possible in the corridor of 0.6632-0.6647 and the breakdown of the last value will lead to a deep correction. Here, the target is 0.6668 and this level is the key support for the downward structure.

The main trend is the downward structure from February 12.

Trading recommendations:

Buy: 0.6632 Take profit: 0.6645

Buy: 0.6649 Take profit: 0.6666

Sell: 0.6612 Take profit: 0.6596

Sell: 0.6592 Take profit: 0.6569

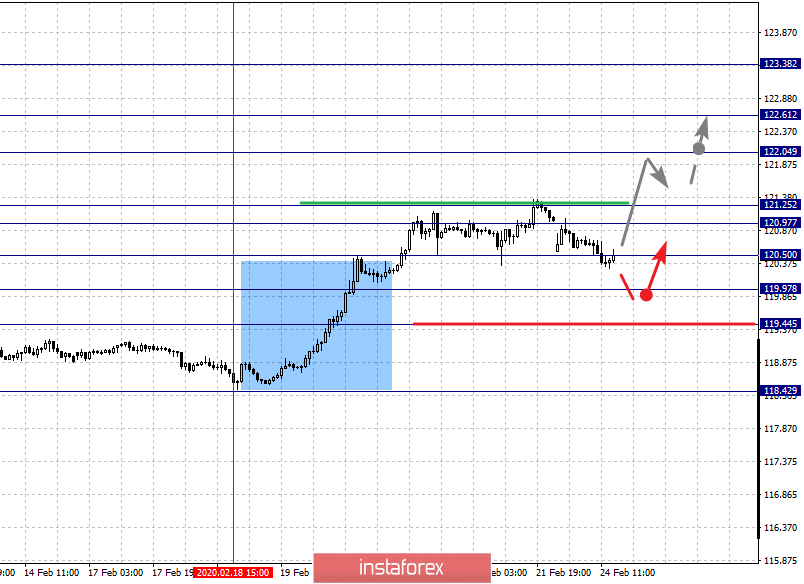

For the Euro/Yen pair, the key levels on the H1 scale are: 123.38, 122.61, 122.04, 121.25, 120.97, 120.50, 119.97, and 119.44. Here, we follow the initial conditions for the top from February 18. We expect a continuation of the upward movement after the price passes the range of 120.97-121.25. In this case, the target is 122.04 and in the corridor of 122.04-122.61 is the short-term upward movement, as well as consolidation. We consider the level of 123.38 as a potential value for the top, upon reaching which, we expect a pullback to the bottom.

A short-term downward movement is possible in the corridor of 120.50-119.97 and the breakdown of the last value will lead to a deep correction. Here, the target is 119.44 and this level is the key support for the ascending structure.

The main trend is the formation of initial conditions for the top from February 18.

Trading recommendations:

Buy: 121.25 Take profit: 122.04

Buy: 122.06 Take profit: 122.60

Sell: 120.50 Take profit: 120.00

Sell: 120.95 Take profit: 119.47

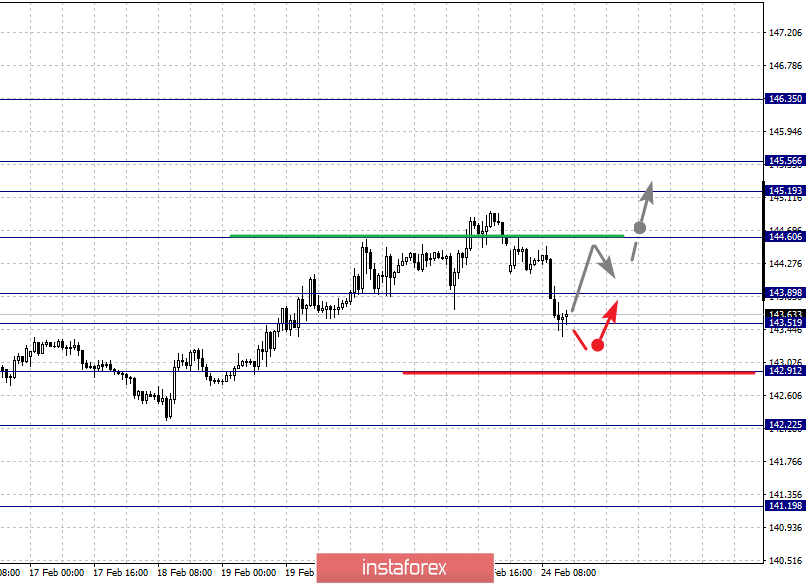

For the Pound/Yen pair, the key levels on the H1 scale are: 146.35, 145.56, 145.19, 144.60, 143.89, 143.51, and 142.91. Here, we follow the ascending structure from February 10. We expect a continuation of the upward movement after the breakdown of 144.60. In this case, the target is 145.19 and in the corridor of 145.19-145.56 is the short-term upward movement, as well as consolidation. We consider the level of 146.35 as a potential value for the top, upon reaching this value, we expect a pullback to the bottom.

A consolidated movement is possible in the corridor of 143.89-143.51, hence the high probability of a reversal to the top. The breakdown of the level of 143.50 will lead to an in-depth correction. Here, the target is 142.91 and this level is the key support for the top.

The main trend is the upward structure from February 10.

Trading recommendations:

Buy: 144.60 Take profit: 145.19

Buy: 145.21 Take profit: 145.54

Sell: 143.87 Take profit: 143.52

Sell: 143.49 Take profit: 142.95

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română