Economic calendar (Universal time)

The economic calendar today does not contain important indicators that can affect market activity.

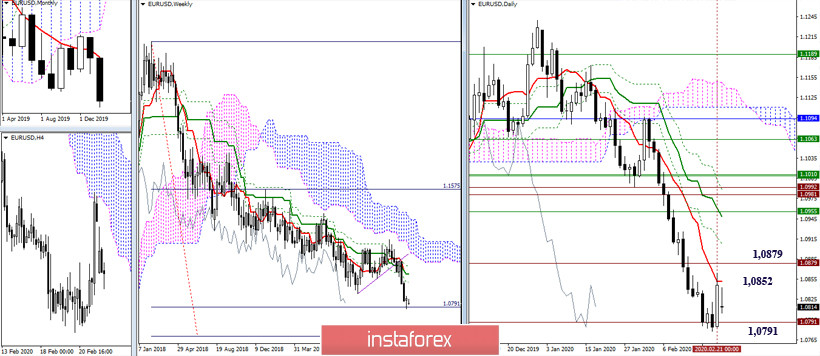

EUR / USD

The pair managed to fix the slowing down on the weekly time frame, which was indicated after working out the weekly target for the breakdown of the cloud according to the first target (1.0791). At the same time, a daily correction was made to a short-term trend (1.0852). This week, the question will be decided whether the upward players will be able to confirm the breakdown and continue the development of the upward correction, or whether the increase will be limited by the daily short-term trend and the bears will overcome the level of support they have met (1.0791) in order to breakdown.

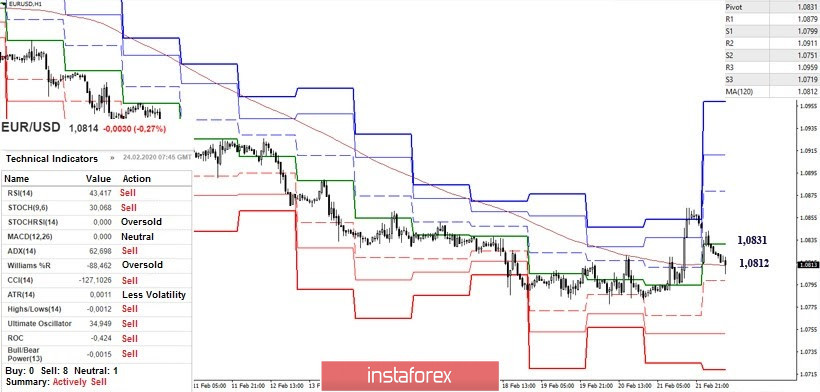

With the opening of trading, the players on the upside lost their positions won at the end of last week. At the moment, on H1, they have descended to the key support of the lower halves - the weekly long-term trend (1.0812). Thus, consolidation below the level will increase the chances of the bears to exit the correction zone and restore the downward trend (minimum extremum 1.0778). At the same time, the resumption of the decline will return relevance to the support of the classic Pivot levels, which are located today at 1.0751 (S2) - 1.0719 (S3). If the players on the increase now hold above support (1.0812) and are able to rise above the central Pivot level (1.0831), then their next interest will be focused on closing the descending hep formed at the opening of trading after the weekend, and updating the high of last week (1.0864).

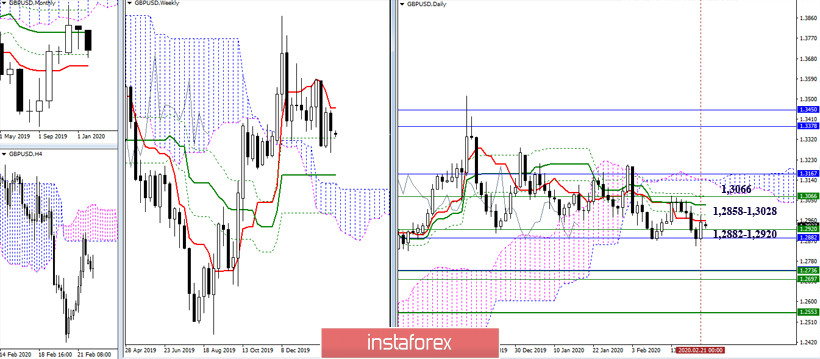

GBP / USD

The pair works at the lower boundaries of the consolidation zone 1.2882 - 1.2920 (Fibo Kijun of the week and month), however, it did not work out again last week. The resistance within the confrontation zone is now provided by the daily cross (Tenkan 1.2958 + Kijun 1.3028) and the weekly Tenkan (1.3066). I think that maximum relevance will continue to belong in the coming days to the support and resistance levels listed above.

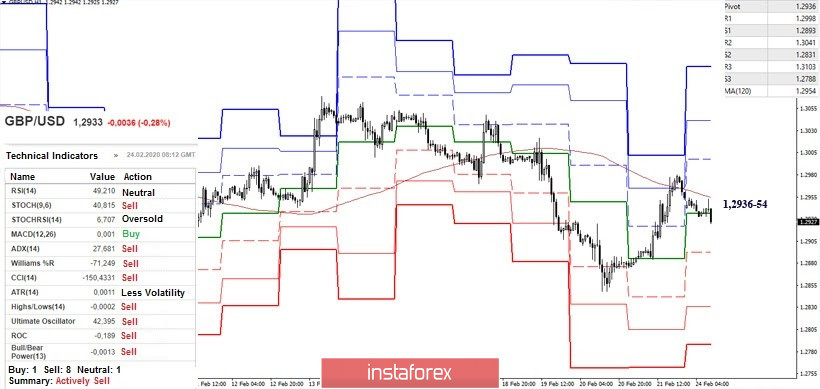

In the lower halves, there is currently a struggle for key levels that have joined forces today in the region of 1.2936 (central Pivot level) - 1.2954 (weekly long-term trend). The breakdown and consolidation above will strengthen the position of players to increase, allowing them to continue the rise. The classic Pivot levels R1 (1.2998) - R2 (1.3041) - R3 (1.3103) can act as resistance within the day. Meanwhile, support today is located at 1.2893 (S1) - 1.2831 (S2) - 1.2788 (S3).

Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română