EUR/USD

Analysis:

On the euro chart, the main pair against the US dollar is dominated by a bearish exchange rate. The last wave has been counting since July of last year. Its final section (C) started in early January. The price is approaching the upper limit of the preliminary completion zone. In recent days, the price rolls back up.

Forecast:

In the next trading sessions, the flat section is expected to be completed and the price will begin to decline. If the exchange rate changes, volatility is likely to increase. The upcoming decline is likely to take the form of an impulse.

Potential reversal zones

Resistance:

- 1.0830/1.0860

Support:

- 1.0740/1.0710

Recommendations:

There are no conditions for buying the euro today. We recommend that you pay full attention to the search for signals of the sale of the European currency.

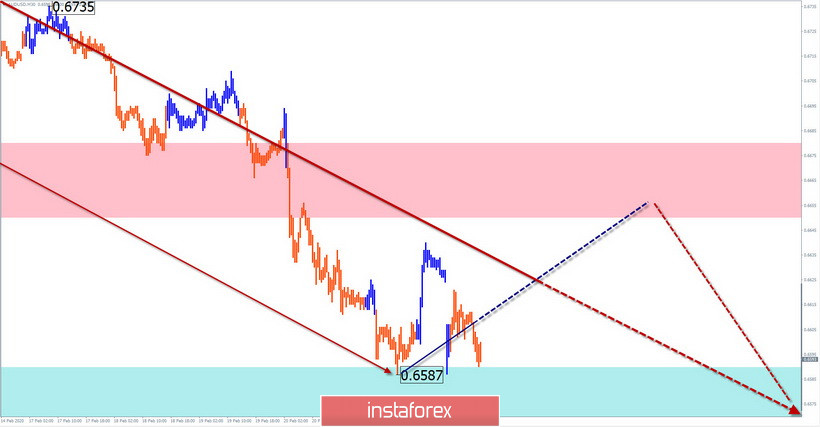

AUD/USD

Analysis:

In the last six months, a downward wave has been developing on the Australian dollar chart. Its final section started in early January. To date, the quotes have reached the upper limit of the preliminary settlement zone.

Forecast:

It is unlikely that the potential reversal zone can be broken through without first rolling back up. In the first half of the day, there may be pressure on the support zone. Next, the exchange rate is expected to change and the price rise is not higher than the calculated resistance area.

Potential reversal zones

Resistance:

- 0.6650/0.6680

Support:

- 0.6590/0.6560

Recommendations:

Trading on the pair's market today is possible only within the intraday style, according to the expected sequence. In these transactions, it is more reasonable to reduce the lot to a minimum. In the area of the resistance zone, it is recommended to track sell signals.

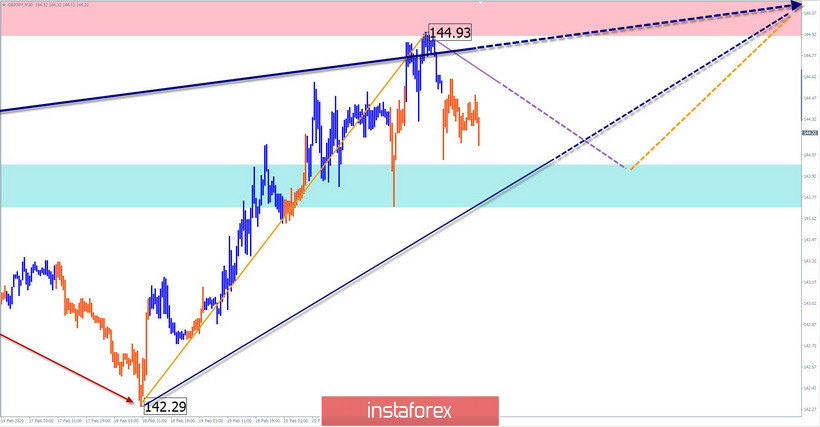

GBP/JPY

Analysis:

Since mid-December last year, a descending wave model has been formed on the cross chart. In its structure, the correction part (B) is nearing completion. The price is within the strong reversal zone of a large TF.

Forecast:

Today, the pair's upward trend is expected to continue until the current price movement is complete. The width of the reversal zone is quite large, so when changing the course, you can not exclude a puncture of the upper border of the calculated resistance zone.

Potential reversal zones

Resistance:

- 144.90/145.20

Support:

- 144.00/143.70

Recommendations:

Sales of the pair are now only possible within the intra-session trading style. Before the advent of the unequivocal signals of reversal, purchases of the pair remain a priority.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure and the dotted background shows the expected movements.

Note: The wave algorithm does not take into account the duration of the tool's movements in time!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română