To open long positions on GBP/USD you need:

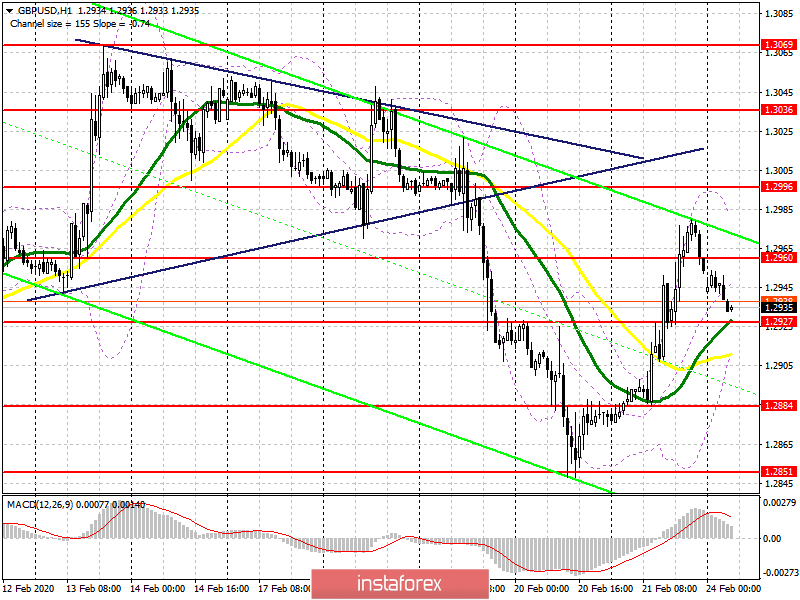

The UK PMI composite index showed growth, and the British pound managed to break in the afternoon of Friday above the resistance of 1.2927, which now acts as a support. An important task for the bulls today will be for a false breakout to form at this level, on which a further upward trend depends. Moving averages are also in this range, which may provide additional support to the pair. In the scenario of a breakthrough of this level, the pressure on the pound will increase, so it is best to postpone short positions until the test of a low of 1.2884, from which you can buy immediately for a rebound, since large players will try to build the lower boundary of the new rising channel there . An equally important task for the bulls will be to break through and consolidate above the resistance of 1.2960, which will allow us to count on the test of highs of 1.2996, where I recommend taking profits.

To open short positions on GBP/USD you need:

Bears will wait for the situation with the spread of coronavirus to worsen and the pair to consolidate below the support level of 1.2927, which will quickly push GBP/USD back to a low of 1.2884, where I recommend taking profits. If you find those who want to buy in the current conditions, it is best to wait for an upward correction and the formation of a false breakout in the resistance area of 1.2960, but I recommend selling the pound immediately for a rebound only after updating the high of 1.2996. Given that today important fundamental statistics on the UK economy are not published, attention should be paid to the statements of representatives of the Bank of England.

Signals of indicators:

Moving averages

Trading is slightly higher than 30 and 50 moving average, which saves the likelihood of continued upward correction.

Bollinger bands

In case the pair falls, the pound will be supported by the lower boundary of the indicator at 1.2913. You can sell immediately on the rebound after updating the upper boundary of the indicator in the area of 1.2980.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română