The way events developed yesterday clearly shows that there is a steady trend in the market to strengthen the dollar. Investors do not pay attention to negative statistics from the United States, which the maximum they can do is to suspend the strengthening of the dollar. At the same time, market participants instantly cling to any negative news from the Old World.

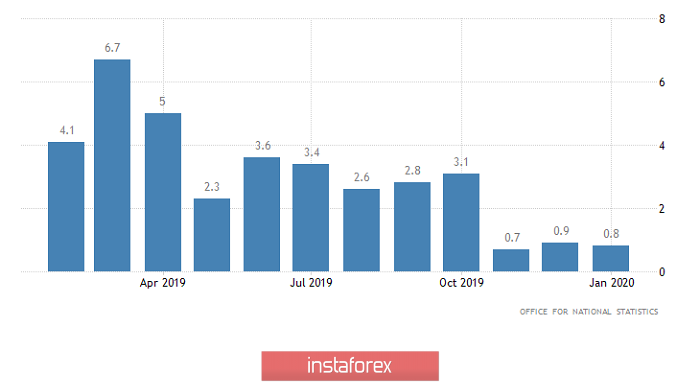

The story with the pound turned out to be indicative, which began to decline almost immediately after the publication of retail sales data, which showed a slowdown in growth from 0.9% to 0.8%. At the same time, the data turned out to be not so bad, since it was not just a slowdown that was purely symbolic, they also expected a stronger reduction, to 0.5%. At the same time, CBI data on industrial orders in general turned out to be good, as their index rose from -22 to -18. Another thing is that they were waiting for growth to -14. Nevertheless, the pound confidently went down.

Retail Sales (UK):

The market ignored European data altogether, although generally good information came from Germany and France. But the main European event was the publication of the text of the minutes of the meeting of the European Central Bank. However, he did not bring anything new. Not only did it entirely repeat Christine Lagarde's words about the regulator's intention to consider changing the parameters of monetary policy, but it does not contain any specifics on this issue. But this very specificity is not enough for investors. Thus, it is not surprising that the text of the minutes of the meeting, in fact, remained without attention. Well, if we talk about pan-European statistics, the consumer confidence index rose from -8.1 to -6.6 with a forecast of -8.0. In other words, there is some improvement in the situation. At least hints of it.

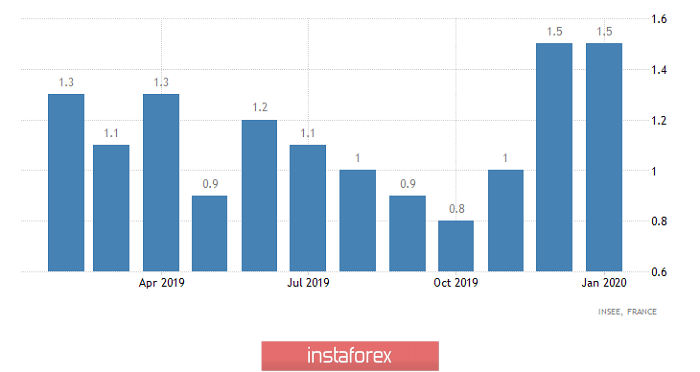

At the same time, the final inflation data in France confirmed the fact of its stability at the level of 1.5%, where it has been for the second month in a row and this is the highest value since the end of 2018. Now, since we are talking about the second economy of the euro area, it means that the probability of a decrease in inflation throughout Europe is clearly small. Another thing is that government bond yields continue to go down. Thus, the yield on 3-year bonds decreased from -0.53% to -0.59%. Well, for 5-year bonds from -0.38% right up to -0.50%.

Inflation (France):

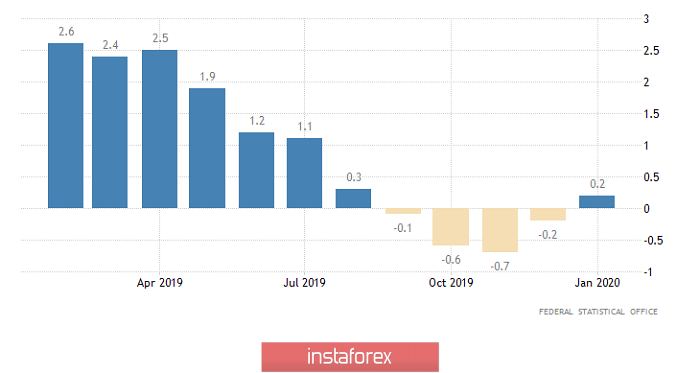

Data is still better In Germany, since producer prices, which showed a decline of -0.2% until recently, showed an increase of 0.2% instead of increasing it to -0.3%. And after all, we are talking about a clear inflationary factor, which means that inflation itself will increase in Germany. Moreover, the decline in producer prices lasted for four consecutive months, and now it was replaced by growth. Another thing is that the Gfk consumer confidence index declined from 9.9 to 9.8. Moreover, the indicator itself is clearly not as weighty as producer prices, so they also expected it to decline to 9.7. In other words, German statistics only pleased. However, this did not affect the single European currency.

Producer prices (Germany):

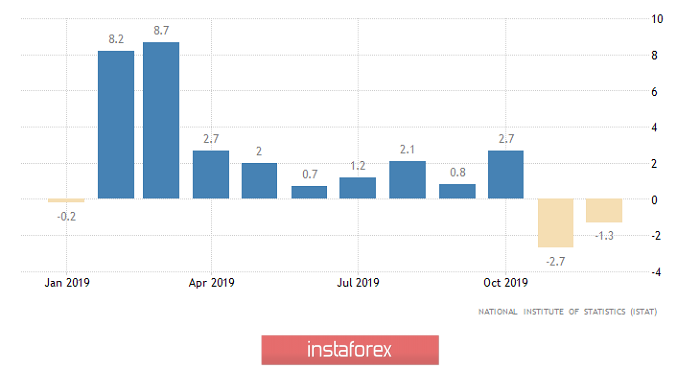

On the other hand, there is definitely only bad news that came only from Italy and Spain. So, in the third economy of the euro area, and this is Italy, the volume of construction is declining for the second month in a row. This time by another 1.3%. In Spain, the trade deficit amounted to -2.1 billion euros instead of the forecast of -1.8 billion euros. As in France, Spanish bond yields are down. In particular, for 10-year bonds now they give not 0.347%, but only 0.24%. Fortunately, the value is at least with a positive sign.

Scope of construction (Italy):

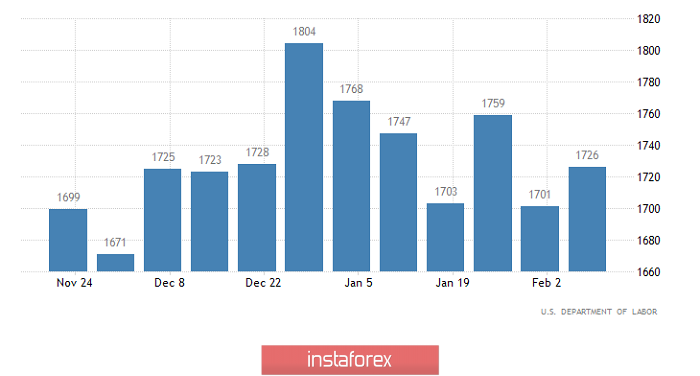

In theory, if the market didn't react at all to European statistics, at least some reaction to the US should have followed. And it followed, but only for the pound, which had ceased to decline, while the single European currency continued to stand still. At the same time, there were clearly enough reasons to weaken the dollar. Indeed, the total number of applications for unemployment benefits has increased not by 13 thousand, but by 29 thousand. Worst of all, that growth in all respects. In particular, the number of initial applications increased by 4 thousand. Another thing is that they expected growth by 9 thousand, but what is much more important is the increase in the number of repeated applications immediately by 25 thousand. Expected growth by 4 thousand. It is surprising that a significant increase in the number namely, repeated applications for unemployment benefits that show long-term unemployment, which means they indicate a high potential for increasing unemployment and worsening the situation on the labor market; it did not contribute to a weakening dollar. So, yes, investors are clearly focused on strengthening it.

Repeated Unemployment Insurance Claims (United States):

The picture yesterday, and not only it, clearly tells us that in the case of the publication of weak data on Europe, the dollar will increase, and only weak US statistics can stop it. And strangely enough, we can see this picture in all its glory today although the final data on inflation was already published in Europe, which should confirm the fact of its growth from 1.3% to 1.4%. However, the market even at the time of publication of preliminary data managed to lay this good news in the value of the single European currency. In addition, ignoring positive news from Europe today is a good form. Yet, preliminary data on business activity indices will be an excellent occasion for revitalizing the single European currency and it is in the direction of its decline. Thus, the production index may decline from 47.9 to 47.4, and in the service sector from 52, 5 to 52.0. Thus, the composite business activity index should decline from 51.3 to 50.7.

Inflation (Europe):

Things will not be the best in the UK, where business activity indexes are also forecast to decline. In particular, the production index may decline from 50.0 to 49.6, dropping below the mark separating growth from stagnation. In the service sector, the index should decrease from 53.9 to 53.2. Well, and as a consequence of all this disgrace, a composite index of business activity from 53.3 to 52.4 is inevitable. But in addition to this, public debt could increase by 11.9 billion pounds against the background of a decrease of 4.0 billion pounds in the previous month. Therefore, the pound will have plenty of reasons to decline.

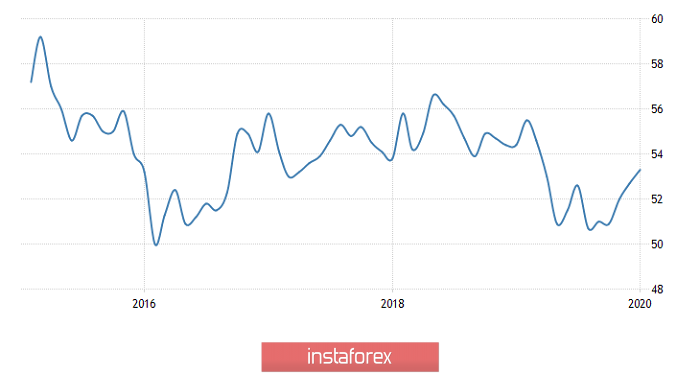

Composite Business Activity Index (UK):

Meanwhile, American statistics will only stop this process, but will not lead to the reverse movement of the pound or the single European currency. First, as in the Old World, a continuous decline in business activity indices is expected. For example, the manufacturing index may decline from 51.9 to 51.1. In turn, in the service sector, the index may decline from 53.4 to 53.2. So the composite index should decline from 53.3 to 52.8. Well, to complete this, we have the home sales in the secondary market, which may decrease by 2.2%.

Composite Business Activity Index (United States):

Thus, we should expect a gradual decline in the single European currency in the direction of 1.0750. However, it can already increase to the level of 1.0775 during the American session.

Similar thing will happen with the pound. But only the first decline in the direction of 1.2825, followed by growth to 1.2875.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română