New day - new highs. The US dollar daily updates for many months, and sometimes multi-year price highs in almost all pairs. The dollar index also crept to the boundaries of the 100th figure, reflecting the demand for US currency throughout the market. The last time the indicator was at such heights was back in the spring of 2017. In turn, the euro-dollar pair was also at such low price levels almost three years ago. The general strengthening of the greenback then coincided with a significant weakening of the euro - against the backdrop of French political events.

Let me remind you that the presidential elections were held in France then. The favorite of the pre-election race was a pro-European politician, former Minister of Economics Emmanuel Macron. This was the most optimal candidate from the market point of view. All other candidates took either too left or too right political position. The main fear was inspired by Marine Le Pen, who promised to withdraw the country from the EU and from the eurozone. Around her unusually high rating and desire to occupy cabinet number one in France, the main passions unfolded.

As a result, Macron won the election, after which the European currency gradually began to regain its position - if the EUR/USD pair was in the region of the fifth figure in March, then the pair ended the year at around 1.20. Naturally, other fundamental factors contributed to such price dynamics, but nevertheless, the result of the French elections acted as a trigger for a trend reversal.

And now, after almost three years, the pair returned to their previous positions. The downward momentum has clearly faded, but the EUR/USD bears continue to fight for the seventh figure, winning back point after point from the bulls. The pair nearly plunged without a pullback for three weeks, and the slowdown in the pace of decline is worrisome for sellers - after all, none of them want to catch the bottom of the price. On the other hand, the European currency has no good reason for its recovery - therefore, when the dollar stops growing everywhere for one reason or another, the EUR/USD bulls do not "pick up the banner" in order to develop a more or less significant correctional growth. Buyers of the pair can only hope for a large-scale weakening of the US currency throughout the market - only in this case will the pair be able to return at least to the area of the ninth figure.

If the French elections were the main source of uncertainty in 2017 (against the background of difficult negotiations on Brexit), then the coronavirus dictates its conditions to traders in 2020. The panic is caused not so much by the very spread of the new virus, but by the possible consequences for the global economy. Obviously, China will suffer the most - the next few months will become very painful for the PRC economy. According to some estimates, the loss of the second largest economy of the world will amount to more than $143 billion in the first quarter of this year, which is comparable to 1% of the country's GDP.

Such prospects drown out any interest in risk, while anti-risk instruments continue to be popular - for example, gold has risen in price to 7-year highs. Perhaps for the first time in a very long time, the yen cannot take advantage of the current situation. At the beginning of the panic over the spread of coronavirus, the Japanese currency grew by almost 300 points against the dollar. But now, the yen is actively losing its points, even despite the growth of anti-risk sentiment. After the release of extremely disappointing data on the growth of the Japanese economy in the fourth quarter and disappointing forecasts regarding the prospects for the first quarter of 2020, the yen began to get rid of, while investing in gold or the dollar. The risk of a technical recession and the high probability of easing monetary policy by the Bank of Japan allowed USD/JPY bulls to develop the rally - the pair jumped 250 points in just two days.

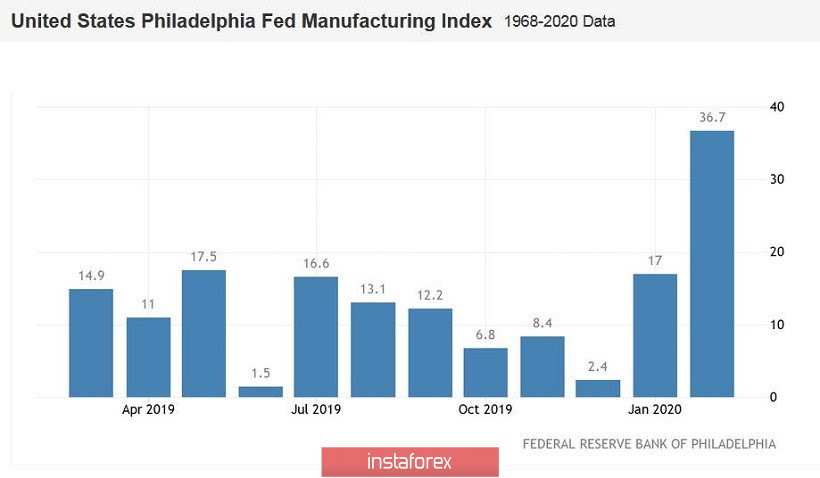

In other words, the yen has now lost the status of a defensive instrument. The "vacant niche" was occupied by the US dollar, which was previously used by investors as a safe haven. The flow of capital into the US currency allowed the EUR/USD bears to dominate the pair without any additional reasons for the fundamental picture. Although the US macroeconomic statistics recently provides additional support to the greenback. In particular, the producer price index rose to many-month highs in annual terms, and the Empire Manufacturing manufacturing index showed the best growth since May last year. I was pleasantly surprised by the Philadelphia Federal Reserve Bank's manufacturing activity indicator - instead of a projected decrease to 10 points, it jumped to 36 (a high since February 2017).

Thus, the euro-dollar pair retains the potential for further downward dynamics, although the bears are clearly not comfortable in the seventh figure - each item is given to them with difficulty, while a decline to 1.0770-1.0780 is already attracting buyers. But if another surge in anti-risk sentiment arises in the market, the pair is quite capable of gaining a foothold in the middle of the 7th figure - a temporary "vacation" of the yen allows the dollar to spread its wings.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română