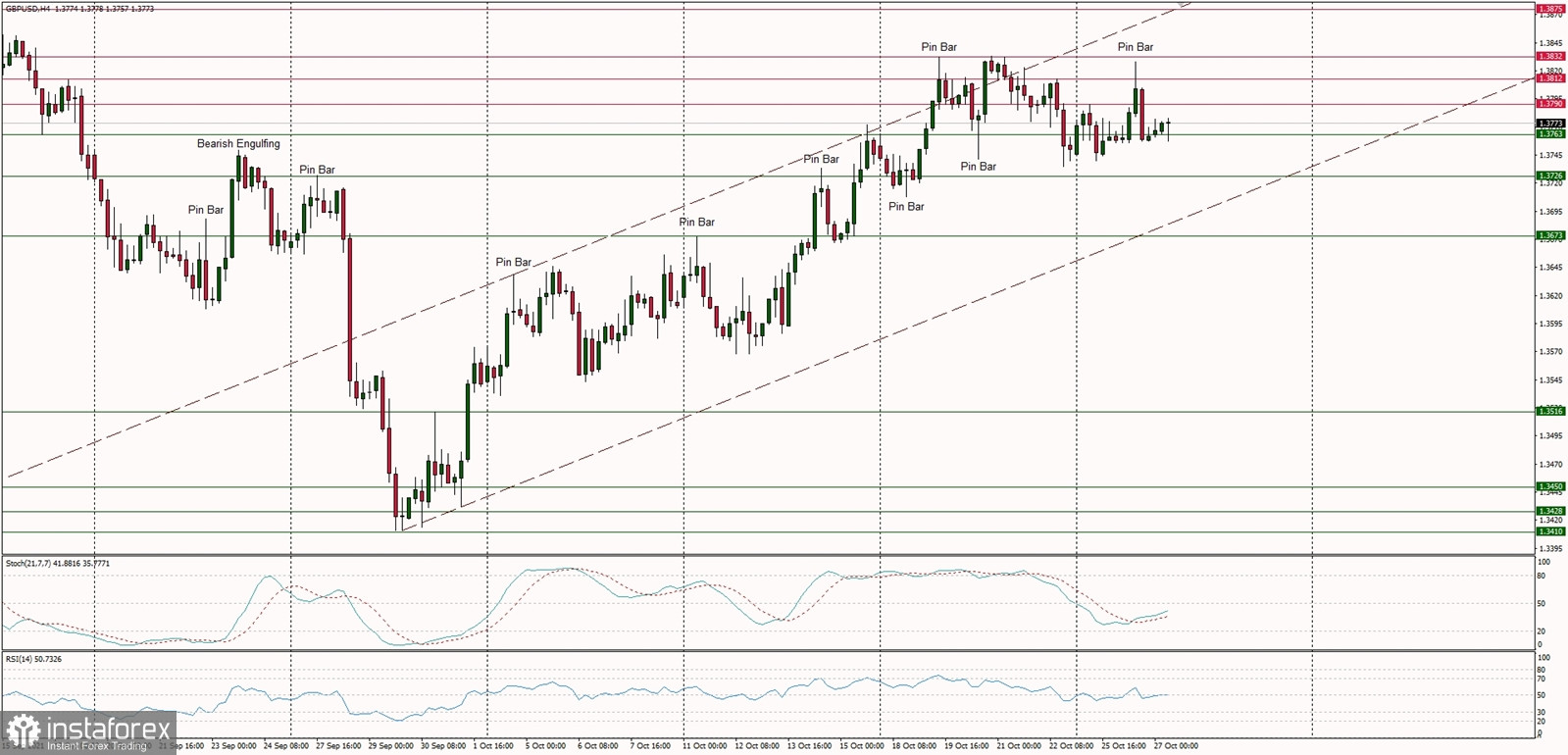

Technical Market Outlook

The GBP/USD pair has made a Pin Bar candlestick pattern at the level of 1.3812 and then the market reversed sharply towards the key short-term technical support located at 1.3726. The momentum is negative already and the market conditions are coming off the overbought levels, so the bearish pressure intensify. The immediate technical support is seen at the level of 1.3726, but if violated, then the next target for bears is located at 1.3673. The larger time frame trend remains up and the bulls have a chance to make a Bullish Engulfing candlestick pattern at the daily time frame chart.

Weekly Pivot Points:

WR3 - 1.3933

WR2 - 1.3884

WR1 - 1.3802

Weekly Pivot - 1.3757

WS1 - 1.3683

WS2 - 1.3629

WS3 - 1.3554

Trading Outlook:

The up trend on a larger time frame charts is being continued, but only a sustained breakout above the level of 1.4000 would improve the outlook to more bullish with a target at 1.4200. 100 DMA is located at the level of 1.3792 and 200 DMA is seen at 1.3846.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română