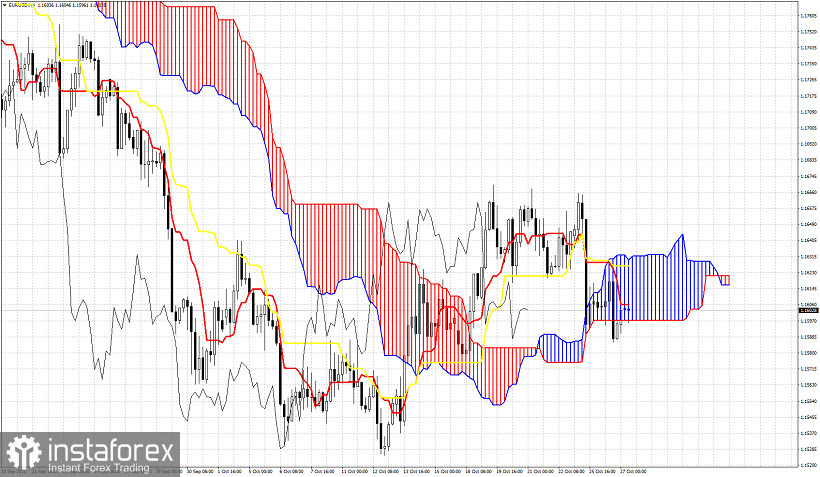

EURUSD is trading around 1.1610. In the 4hour chart according to the Ichimoku cloud indicator trend is neutral as price is inside the Kumo (cloud). In the Daily chart trend remains bearish and bulls have a lot of obstacles to overcome in order to reclaim control of the trend.

In the Daily chart price is below both the tenkan-sen (red line indicator) and kijun-sen (yellow line indicator). Resistance by the tenkan-sen and kijun-sen is at 1.1620-1.1640. Breaking above this resistance area will open the way for a move towards the Daily Kumo resistance at 1.1720-1.1750. Concluding, EURUSD as long as it trades below 1.1640 is vulnerable to more downside. Support is at 1.16. For a move towards 1.1720-1.1750 bulls will need to break first above 1.1640.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română