To open long positions on EURUSD, you need:

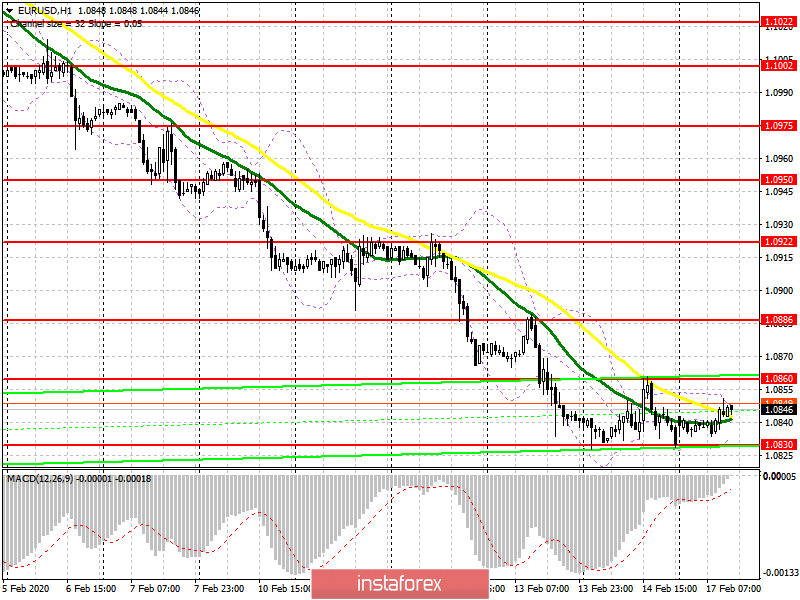

From a technical point of view, nothing changed in the first half of the day. The euro recovered while volatility remained extremely low. Presidential Day in the United States and low trading volume awaits us in the future. With purchases, you need to proceed carefully. Only the formation of a false breakdown at the level of 1.0830 will confirm the actual presence of buyers in the market, which will allow you to reach the resistance of 1.0860, a break of which will lead the pair to a maximum of 1.0886, where I recommend fixing the profits. In the scenario of a further fall in the euro, you can look at long positions for a rebound from the minimum of 1.0804 or even lower in the support area of 1.0773.

To open short positions on EURUSD, you need:

Sellers of the euro need a breakthrough of 1.0830, which will lead to a further sale in the area of the lows of 1.0804 and 1.0773, where I recommend fixing the profits. However, given the absence of important fundamental statistics today, the Eurogroup meeting and US Presidential Day, we can expect a small upward correction in EUR/USD to continue to the resistance area of 1.0860, where an unsuccessful attempt to consolidate above this range will be the first signal to open short positions. You can sell the euro immediately on a rebound from the maximum of 1.0886.

Signals of indicators:

Moving averages

Trading is conducted in the area of 30 and 50 moving averages, which indicates market uncertainty.

Bollinger Bands

Volatility remains extremely low, which does not give signals to enter the market.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence / divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română