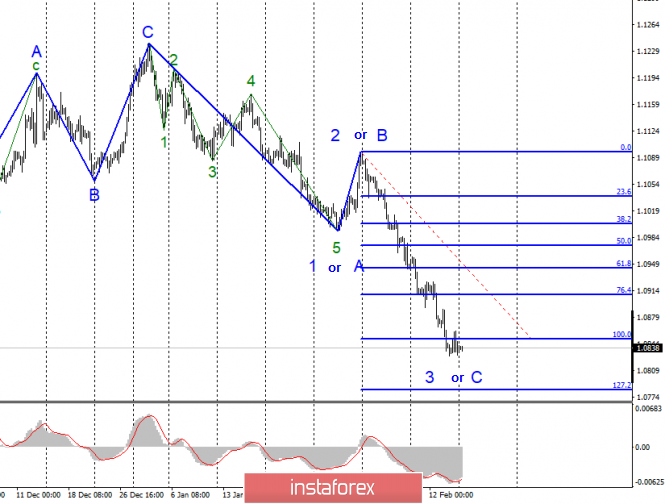

EUR / USD

On February 14, the EUR / USD pair lost about 10 basis points and continued; thus, building supposed wave 3 or C. The entire wave 3 or C acquires a very simple and extended appearance at the same time. For example, it completely lacks internal correctional waves or they do not exceed 23% of the correction. Thus, at the moment, I believe that wave 3 or C is nearing completion. An alternative option involves a very complication of this wave with the transformation into a full-fledged 5-wave structure. In this case, the objectives of this entire wave will be located much lower than the current levels.

Fundamental component:

The news background for the EUR / USD instrument on February 14 was quite extensive and interesting again. For example, reports on Gross Domestic Product in Germany and the European Union were released for the fourth quarter of 2019. And although these values are not final, they still showed a slowdown in the growth of the economies of the EU and Germany. German GDP was only + 0.4% y / y, while European GDP was + 0.9% y / y. Thus, I can state the fact that both economies continue to slow down, which does not forecast for the European currency. For the past two weeks, the euro has been under massive pressure from the currency market. There is no demand for the euro; however, economic reports only aggravate the situation and further reduce the desire of markets to invest in euros. In America, by the way, economic statistics on Friday were also not the strongest. Retail sales in January increased by 0.3% compared to December. Moreover, exactly the same dynamics was demonstrated by the indicator excluding car sales. Markets expected just such values but industrial production continued to remain in a negative trend and decreased in January by 0.3%. The less significant consumer confidence index turned out to be better than market expectations - 100.9 versus 99.5.

On Monday, the news background will be absent. The trading range may decrease.

General conclusions and recommendations:

The euro-dollar pair continues to build a downward set of waves. The current wave layout has undergone certain changes, so I recommend that those who are already in sales, stay in them with goals located near the calculated level of 1.0784, which corresponds to 127.2% Fibonacci. I don't recommend thinking about purchases, since the downward trend is too strong.

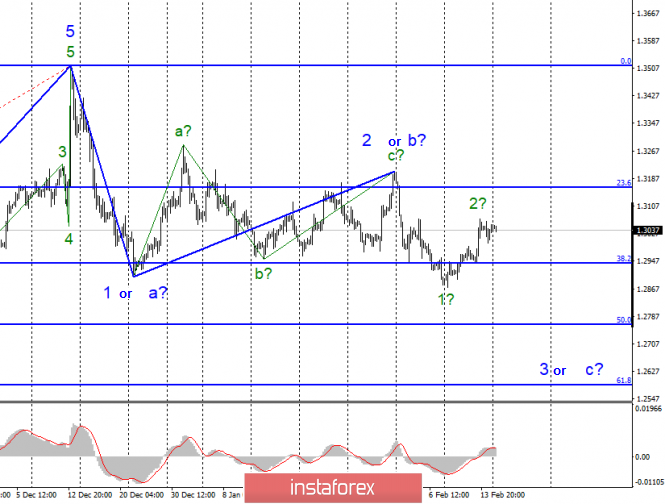

GBP / USD

On February 14, GBP / USD pair did not gain a single basis point at the end of the day, but remained at the stage of building the expected wave 2 in 3 or C. If this is true, then the decline in quotes will resume in the near future within the framework of wave 3 into 3 or C with targets located near the level of 50.0% and 61.8% Fibonacci. At the same time, the first wave of 3 or C took on a somewhat non-standard form, which suggests that the entire wave of 3 or C may turn out to be non-standard.

Fundamental component:

The news background for the GBP / USD instrument on Friday came down only to reports from America. Since the Briton did not have a negative factor, the reaction to economic statistics from the USA was restrained purchases in the afternoon. At the same time, no news came from Great Britain, which is undoubtedly very good for the pound. Basically, it is with British statistics that the main risks and dangers for the pound are associated. However, there will be a lot of news from Britain this week, but not on Monday. Today, markets can still enjoy the tranquility, and important data will begin to arrive tomorrow. And these important data can lead to another decline in the British currency, which will correspond to the nature of the current wave marking.

General conclusions and recommendations:

The pound-dollar instrument construction continues downward wave 3 or C. Thus, I recommend resuming sales of the instrument by the MACD signal "down" with targets located near the level of 1.2767, which corresponds to 50.0% Fibonacci.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română