Crypto Industry News:

Nigeria's President Muhammadu Buhari will officially introduce the Central Bank's Digital Currency (CBDC), eNaira.

The Central Bank of Nigeria (CBN) has published a document confirming its intention to introduce eNaira after a previous unsuccessful attempt on October 1. According to eNaira design document, CBN is now considered ready for Nigerian CBDC implementation.

CBN is working on a global cryptocurrency that will be used as a means of payment and custody, as well as a replacement for cash.

The bank in its own statement downplayed the risk of not meeting the deadline. Rather, he emphasized the importance of getting things right the first time and how this contributed to the long-term success of digital currencies. CBN stressed that instead of rushing to release a digital currency that has not yet obtained all the necessary approvals, a good start is needed.

The bank has published a document outlining the eNaira Design Principles along with an overview of what is expected of the Nigerian digital currency. Both documents are available on the bank's website in English as well as in Hausa and Yoruba.

According to CBN, instead of focusing all its efforts on getting eNairy on time, the bank focused on designing the token. The central bank said these key facts should reassure Nigerians that eNaira, which will be available to offline users, has been carefully planned and prepared for launch.

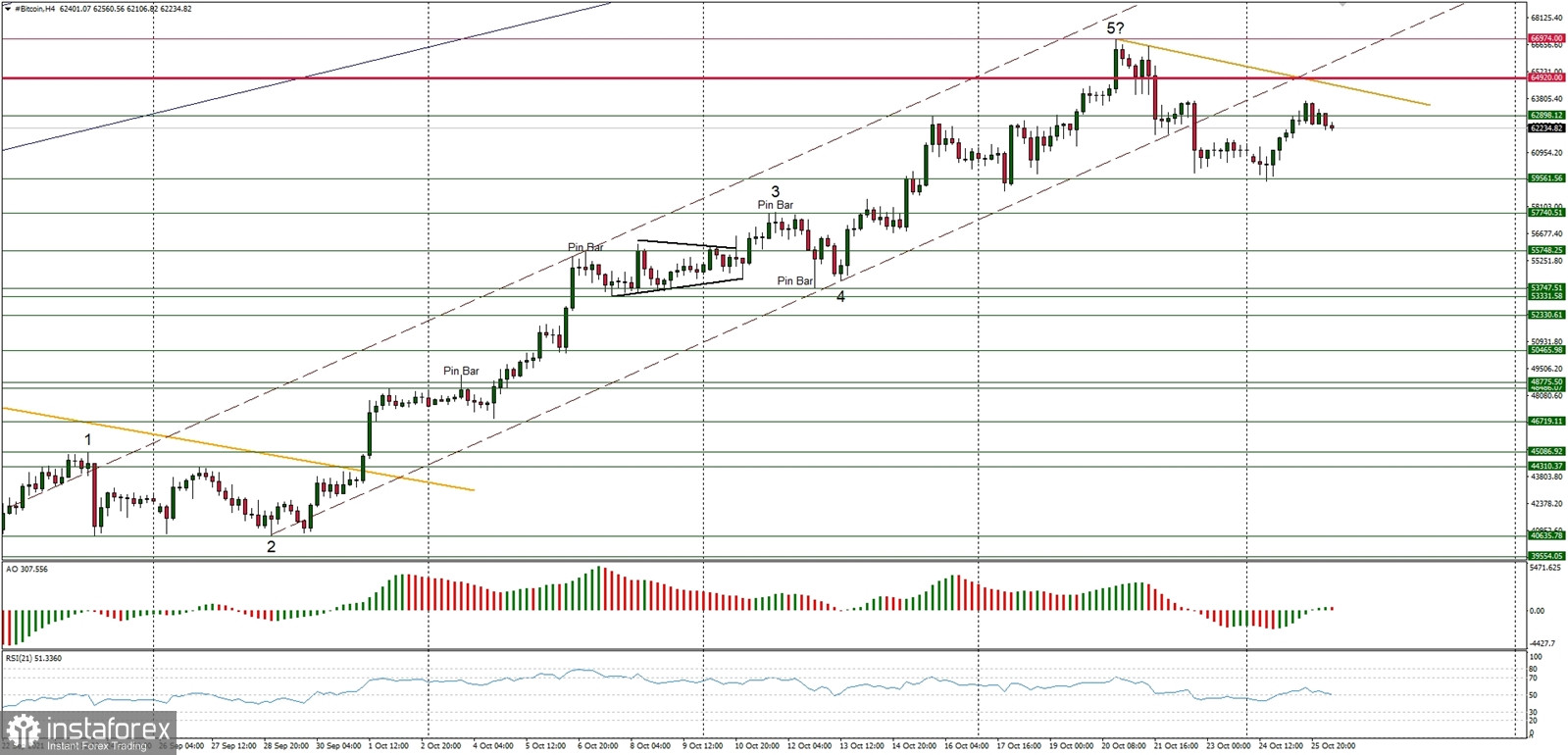

Technical Market Outlook

The BTC/USD pair had bounced from the technical support seen at the level of $59,561 and broke above the local technical resistance seen at $62,898. The next target for bulls is the technical resistance located at $63,966 and $64,920. The ultimate target for bulls is seen at the last ATH located at $66,974 and above. The positive momentum supports the short-term bullish outlook for BTC. The larger time frame trend is up.

Weekly Pivot Points:

WR3 - $72,680

WR2 - $69,750

WR1 - $64,343

Weekly Pivot - $61,785

WS1 - $57,070

WS2 - $54,248

WS3 - $49,247

Trading Outlook:

According to the long-term charts the bulls are still in control of the Bitcoin market, so the up trend continues and the next long term target for Bitcoin is seen at the level of $70,000. The next mid-term target is seen at the level of $66,974 (the previous ATH level). This scenario is valid as long as the level of $30,000 is clearly broken on the daily time frame chart (daily candle close below $30k).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română