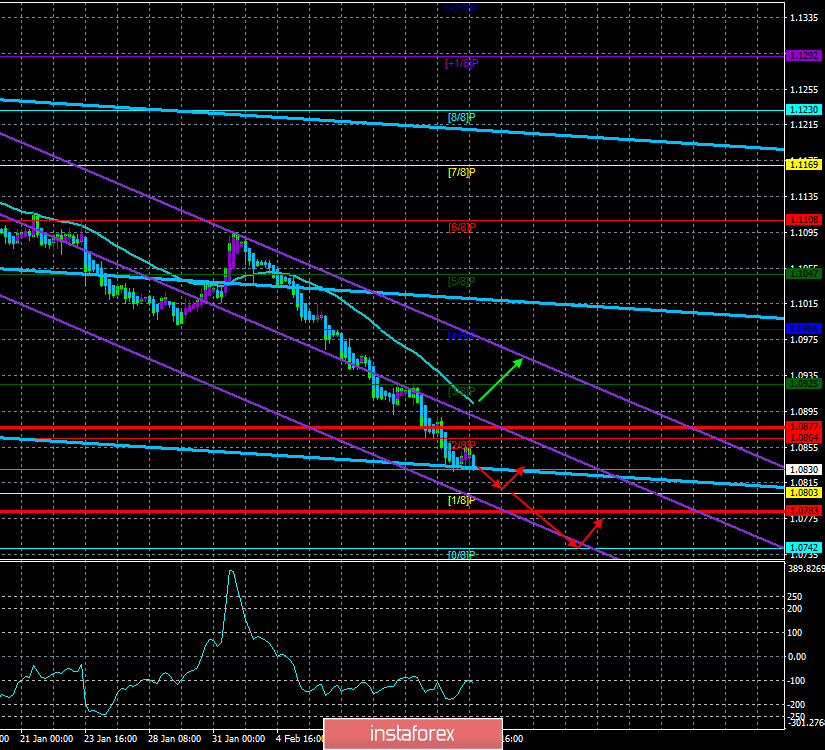

4-hour timeframe

Technical details:

Higher linear regression channel: direction - downward.

Lower linear regression channel: direction - downward.

Moving average (20; smoothed) - down.

CCI: -112.9899

For two weeks, the non-stop and recoilless fall of the European currency continues. A new week is beginning, and the main question now is how much longer the non-correction downward movement will continue. Unfortunately for the euro, the macroeconomic background is now completely on the side of the US dollar. However, it was a few months ago. Thus, nothing has changed fundamentally for the EUR/USD currency pair. Since the two-year lows were passed, the pair is now trading at three-year lows and will aim for 17-year lows near the level of 1.0340.

The new trading week will start with an empty Monday in macroeconomic terms. No important reports, speeches or events are scheduled for this day. Thus, the volatility of the pair may decrease even more. Often on empty Mondays, the pair begins to correct, but in this case, the downward movement continues for 10 days in a row, so the probability of an upward correction starting tomorrow is low. We would also like to draw the attention of traders to the fact that these are not too strong movements and are the longest. Thus, theoretically, the euro may well continue to depreciate on Monday, February 17.

Since there will be no fundamental factors on the first trading day of the week, we would like to once again compare the key indicators of the US and EU economies, so that no one has any doubts about why the US dollar is growing and why it will continue to strengthen in the long term.

GDP. According to the latest data for the fourth quarter, the indicator in the United States increased by 2.3% annually, in the European Union - for the same period, the increase was 0.9%. Inflation. In the United States, the CPI grew to a value of 2.5% in January 2020, and inflation in the EU is now 1.3%, and it may accelerate to 1.4% y/y in January. The Markit index of business activity in the manufacturing sector is 51.9 in the United States, and 47.9 in the European Union. Industrial production in the United States declined for the fifth consecutive month in annual terms, while in the European Union, it declined for 14 consecutive months. Thus, even without a detailed review of all statistical indicators, it is clear who owns the advantage and initiative. As for the outlook for the coming weeks or months, from our point of view, as long as the EU economy does not start to accelerate, and the US economy does not slow down, nothing in the balance of power between currencies will change. As we have repeatedly written, the euro will continue to strive for price parity with the US dollar.

In such a situation, when the euro has not acquired any real significant factor in favor of its growth over the past year and a half, we can only hope for a miracle. Or Donald Trump, who at the very beginning of his presidential term repeatedly insisted that he did not need an "expensive" dollar. Then, when the trade wars began, the US President poured out accusations of currency manipulation against China and the European Union. Thus, we can assume that the desire to lower the dollar rate remains with the American President. The only problem is that the Central Bank can influence the exchange rate. The wars with Jerome Powell did not lead to anything, but if Trump is re-elected for a second term, there is no doubt that he will return to the idea of reducing the US currency in the future. From our point of view, this is the most realistic opportunity for the euro to rise in price.

From a technical point of view, the downward movement continues and the Heiken Ashi indicator has turned down again. Thus, we recommend that you continue to be in short positions and not exit them ahead of time on such a strong downward trend.

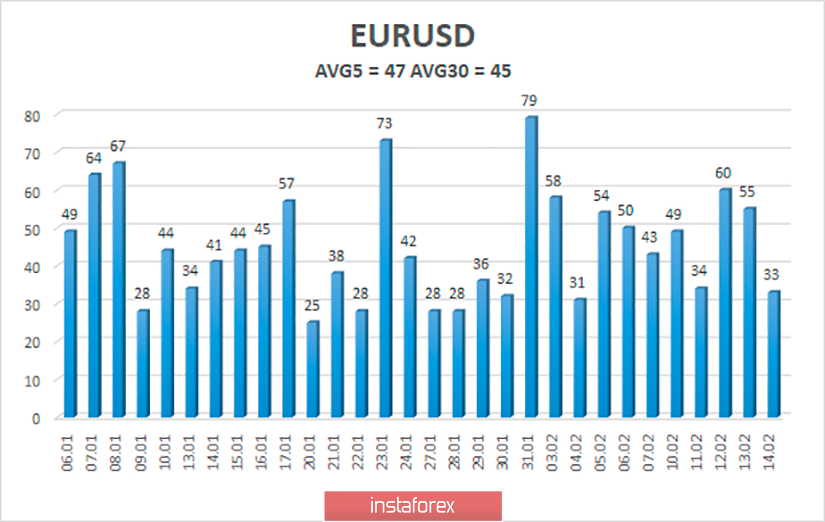

The average volatility of the euro/dollar currency pair decreased to 47 points per day, but in general, all changes in this indicator in recent weeks are minimal. On average, the pair passes 40-50 points per day. On Monday, we expect movement between the borders of the volatility corridor of 1.0783-1.0877. It doesn't make sense to close short positions before the Heiken Ashi indicator turns up.

Nearest support levels:

S1 - 1.0803

S2 - 1.0742

S3 - 1.0681

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0925

R3 - 1.1047

Trading recommendations:

The euro/dollar pair continues to move down. Thus, sales of the euro with the targets of 1.0803 and 1.0783 remain relevant now, which can be kept open until the Heiken Ashi indicator turns up. It is recommended to buy the EUR/USD pair not before the bulls cross the moving average line, which will change the current trend to an upward one, with the first target of 1.0986.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română