To open long positions on EURUSD, you need:

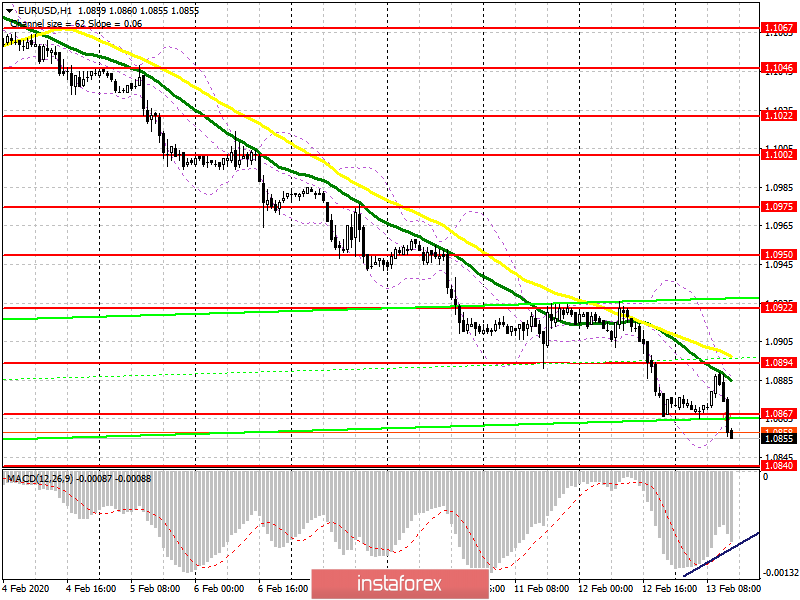

Even in the morning forecast, I drew attention to the German inflation report, which indicated a decline in the consumer price index in January of this year, which completely coincided with the expectations of economists. A failed attempt by buyers to regain the level of 1.0894 turned into a sale of the euro, which led to a breakdown of the support of 1.0867 and a test of another annual low. The primary task of the bulls in the second half of the day will be the formation of a false breakdown in the area of 1.0867 and the divergence that is formed on the MACD indicator can help in this. In the scenario of a return of 1.0867, which may occur after the US inflation data, you can count on a repeat test of the daily maximum of 1.0894, and then a larger jump of the euro up to the area of 1.0922, where I recommend fixing the profits. If the pressure on the euro persists in the North American session, then it is best to look at purchases at the test of the minimum of 1.0840 or open long positions immediately for a rebound from the area of 1.0804.

To open short positions on EURUSD, you need:

Sellers waited for the next weak data on the European economy and continued to push the euro down by using the level of 1.0894. The report of the European Commission, in which the forecasts remained unchanged, did not help buyers much. Currently, the bears are trying to gain a foothold below the minimum of 1.0867, which may lead to a larger sale of the euro in the area of 1.0840 and 1.0804, where I recommend taking the profits. However, as I mentioned in the morning forecast, all the attention will be paid to data on US inflation available to the big players, and with good indicators to take profits on short positions in EUR/USD, which will lead to a rebound in the pair. When the resistance returns to 1.0867, it is best to consider short positions from the daily high of 1.0894 on a false breakdown or sell immediately on a rebound from 1.0922. It is also difficult to expect a large drop below 1.0867 due to the emerging divergence on the MACD indicator, which may indicate the end of a short-term downward trend.

Signals of indicators:

Moving averages

Trading is conducted below the 30 and 50 moving averages, which indicates a further decline in the euro trend.

Bollinger Bands

The bears have tested the lower limit of the indicator, and the market is still under their control.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Convergence / Divergence Moving Average) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română