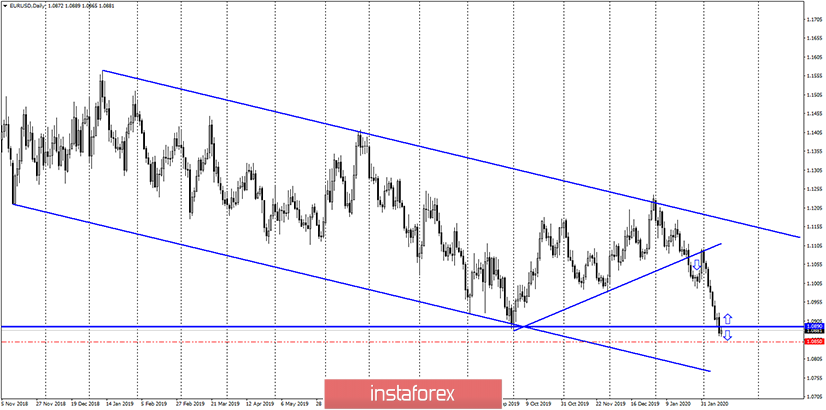

EUR/USD – 24H.

EUR/USD – 4H.

Good day, dear traders!

The current situation is as follows. On the two most important time charts, descending trend corridors are clearly visible. On the 4-hour chart, the pair's quotes even closed under the lower border of the corridor. This means only one thing: the "bearish" mood is fully preserved for the euro/dollar pair. In such circumstances, it is not entirely appropriate to open buy orders despite the fact that the signals can be very attractive. For example, on the 4-hour chart, there is a signal from the bullish divergence of the MACD indicator, which allows you to count on a reversal in favor of the European currency and some growth in the direction of the corrective levels of 38.2% (1.0954), 50.0% (1.0981) and 61.8% (1.1008). However, as last time, bear traders can safely continue to sell the European currency if the information background remains as weak for the euro currency. Today, the report on inflation in Germany did not please traders, although it did not disappoint since the indicator coincided with the forecast - 1.7% y/y and -0.6% m/m. In the second half of the day, a report on US inflation is expected, which in case of its weakness can support bull traders. However, traders may open any purchase orders in the current situation at their own risk.

On the 24-hour chart, on February 12, the EUR/USD pair closed under the important support of 1.0890, which increases the probability of a further drop in quotes to the lower border of the downward trend corridor.

Forecast for EUR/USD and trading recommendations:

The trading idea is to buy the euro with the targets of 1.0954 and 1.0981. However, I must say that the trading idea is counter-trend, which means that it has increased risks. Stop Loss - short - below the level of 0.0% (1.0864), the potential profit can be many times greater than the possible losses. Alternative option: closing below the Fibo level of 0.0% will allow small sales "on trend". Watch out for the US inflation report!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română