To open long positions on GBPUSD, you need:

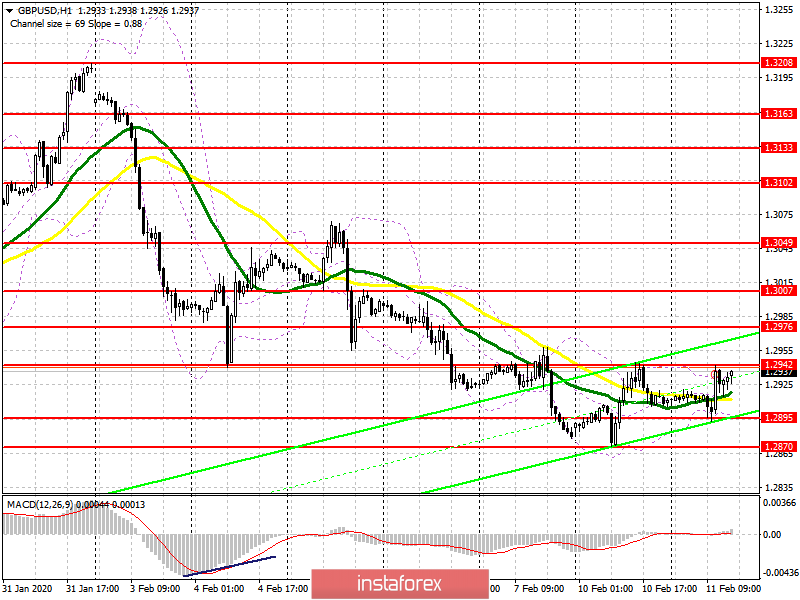

In the first half of the day, nothing changed for the pound, and buyers took advantage of a good report on the growth of the UK economy for the 4th quarter of 2019 and returned the pair to the resistance area of 1.2942, around which the main trade is currently being conducted. The bulls also achieved the formation of a false breakdown in the support area of 1.2906, which has now transformed into the area of 1.2895 and serves as the lower border of the new ascending channel, which I also described in detail in my morning forecast. A break above the resistance of 1.2942 in the second half of the day will lead to the continued growth of GBP/USD in the area of the highs of 1.2976 and 1.3007, where I recommend taking the profits. But do not forget that the North American session will feature a speech by the head of the Bank of England, Mark Carney, who may touch on the topic of interest rates. The return and breakthrough of the support of 1.2895 will cancel all buyers' plans to restore the pair. In this scenario, it is best to consider new long positions after an unsuccessful consolidation below 1.2870 or buy the pound immediately on a rebound from the minimum of 1.2830.

To open short positions on GBPUSD, you need:

Sellers will rely on hints from the Bank of England in the direction of easing monetary policy, which will weaken the position of the British pound. A break and consolidation below the level of 1.2895 will increase the pressure on the pair, which will lead to a sharp movement of the pound down to the support area of 1.2870, on which the further direction will depend. A break in this area will cause a larger drop in GBP/USD to the area of the lows of 1.2830 and 1.2799, where I recommend taking the profits. In the scenario of the pair's growth, you can look at short positions only after a false breakdown in the resistance area of 1.2942, but I recommend selling the pound immediately for a rebound only after testing the highs of 1.2976 and 1.3007.

Signals of indicators:

Moving averages

Trading is conducted above the 30 and 50 daily averages, which indicates the likely formation of an upward correction of the pound.

Bollinger Bands

The lower border of the indicator has fulfilled its role of support today and now the bulls are aimed at breaking the upper border of the indicator in the area of 1.2942.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - Convergence / Divergence Moving Average) Fast EMA Period 12. Slow EMA Period 26. SMA Period 9

- Bollinger Bands (Bollinger Bands). Period 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română