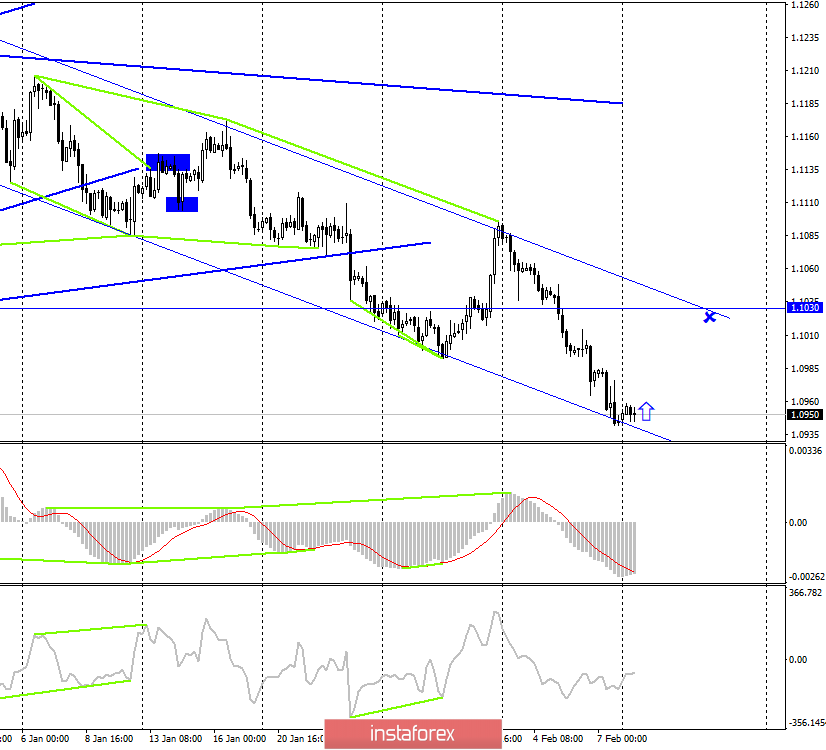

EUR/USD – 4H.

Good day, dear traders!

As seen on the 4-hour chart, the EUR/USD currency pair continued to fall instead of starting to rise towards the upper line of the downward trend corridor. However, as can be seen from the chart of the pair, the new fall was not strong. Thus, I still believe that today or tomorrow there will be a reversal in favor of the European currency and the growth process will begin in the direction of the level of 1.1030. This scenario would be the most logical and at the same time would completely preserve the current mood of traders – "bearish". I can't say that the current expectation for the growth of the euro currency is a signal or a trading idea. After the previous trading idea was worked out, no new ones were formed. There are no pending divergences, no rebounds from important correction levels. Thus, purchases (which, by the way, will be counter-trend) will be at the risk of each trader. At the same time, if the "bearish" mood among traders persists, it would be possible to assume a continued drop in quotes, but the lower line of the corridor may contain it.

Do not forget about the information background. On Friday, traders were happy to work out all the news and reports that were received in the news feeds. First of all, I note American Nonfarm Payrolls, which rose by 225,000 in January. Second, the US unemployment rate, which has also increased, but in the context of this indicator, growth is a negative phenomenon. However, there is absolutely nothing to worry about, since unemployment in America remains at 50-year lows. Today, traders learned about the level of industrial production in Italy - a drop of 4.3% y/y and 2.7% m/m, as well as inflation in Switzerland - 0.2% y/y and -0.2% m/m. As you can see, inflation is a headache not only in the entire European Union but also in many individual countries. Moreover, if the pan-European indicator still balances around 1.0-1.5% y/y, then in some countries, such as Switzerland, it threatens to fall into the "deflation zone". Well, bull traders do not want to talk again about industrial production, which in Germany showed a record reduction of 6.8% y/y last week. Official reports show that this is a disease not only in Germany but also in Italy, where the losses were slightly less.

Forecast for EUR/USD and trading recommendations:

The new trading idea is to buy the euro currency with an approximate target around the level of 1.1030 (about 50% of the drop in quotes between January 31 and February 7). However, the information background may continue to force traders to sell the euro currency, so counter-trend purchases are generally not a noble activity. If we consider them, then in small volumes and short stops.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română