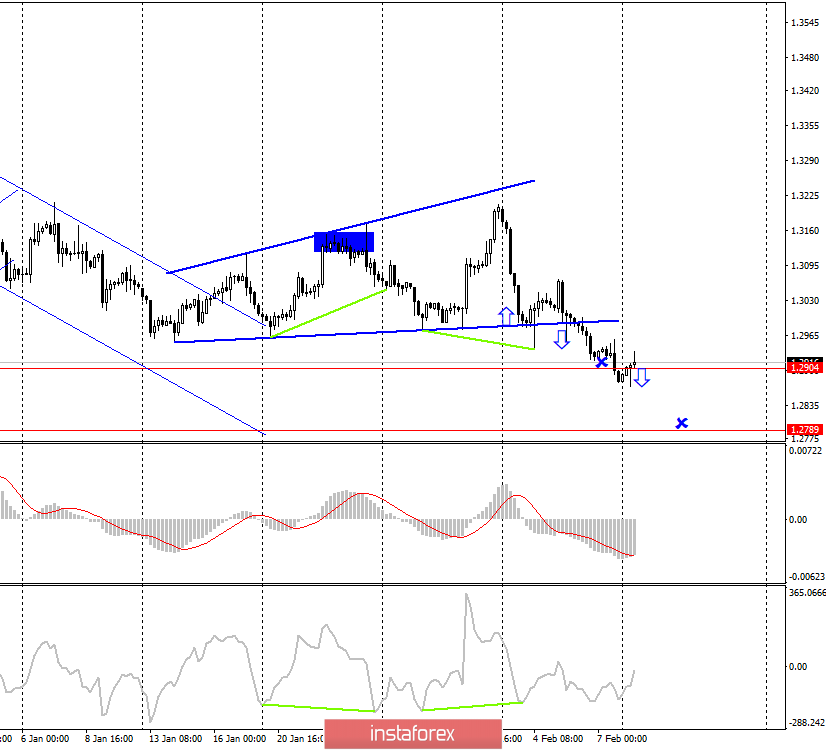

GBP/USD – 4H.

Good day, dear traders!

As seen on the 4-hour chart, the "Briton" worked out the low level - 1.2904, which I gave as the first goal for a new trading idea about the pair's exit from the expanding triangle or simply about closing under the global correction line. On February 10, the pair performed a reversal in favor of the British currency and began the process of growth in the direction of the same correction line, which now has every chance to work out from below. However, first of all, I believe that the fall of the GBP/USD pair will resume, and, secondly, although the "Briton" is growing today, there are not many reasons for traders to buy the pound. Thus, if the pound does not go too far up, then it will be possible to sell it at the new close under the low level of 1.2904. With a stronger and longer correction, I will consider other entry points to the market.

Information background. It's probably the one that means the most to the pound right now. The vast majority of traders believe that the UK will not be able to agree on a deal with the European Union until the end of 2020. Thus, bull traders are nervous and wary of buying the pound. British Prime Minister Boris Johnson also regularly adds fuel to the fire, saying that the country will not submit to the euro bloc after Brexit in any of the areas. London wants a fair trade agreement from the euro bloc but Brussels wants certain guarantees from London, cooperation in many areas, and not just agreement on trade terms. Traders are very concerned about the tough position of Boris Johnson in the negotiations and cannot consider long-term investments in the pound. By and large, Britain now continues to walk on a thin rope, because if the negotiations fail, then Brexit will be without a deal. Traders would like Boris Johnson to make every effort to ensure that there is a deal with the EU. Probably, this is what British investors, businessmen, entrepreneurs, and ordinary citizens would also like. However, Johnson clearly has his own plan of action.

Forecast for GBP/USD and trading recommendations:

The new trading idea is to sell the pound with a target of 1.2789. Now, the process of growth has begun, most likely corrective. Thus, I recommend selling the pound after the pair's quotes are re-anchored below the low level of 1.2904. Tomorrow, traders will need an extreme degree of caution, as reports on GDP and industrial production will be published in the UK. Also, Jerome Powell will give a speech. Thus, both strong growth and a strong drop in quotes are possible. Before you start receiving this information in the news feeds, I recommend that you secure all open transactions as much as possible.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română