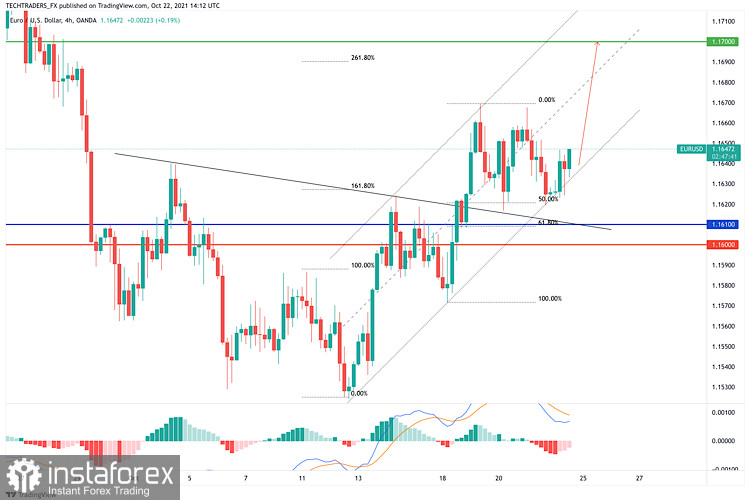

The persevering selling pressure on the greenback helps EUR/USD to advance to the area of daily highs near 1.1650 on Friday. The data from the US showed on Friday that the economic activity in the private sector continued to expand at a robust pace in early October.

Mirroring EUR/USD's indecisiveness in the near term, the Relative Strength Index (RSI) indicator is moving sideways a little above 50 on the four-hour chart.

On the downside, the initial support is located at 1.1620 (Fibonacci 23.6% retracement of September downtrend). A daily close below that level could open the door for another leg lower towards 1.1600 (psychological level, 100-period SMA) and 1.1560 (static level).

As mentioned above, 1.1670 (Fibonacci 38.2% retracement, 200-period SMA) aligns as a significant hurdle. With a decisive break above that level, 1.1700 (psychological level) and 1.1720 (Fibonacci 50% retracement) could be targeted.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română