Hello, dear traders!

The last trading week again remained behind the US dollar, which strengthened against all major competitors. In particular, the main currency pair euro/dollar showed a rather impressive decline. Even the 0.1% increase in unemployment and weak wage growth (only 0.2%) in the United States did not help the single European currency.

This time, market participants preferred to focus on strong data on job creation in the non-agricultural sectors of the American economy, which significantly exceeded the expectations of economists: 225,000 against the forecast of 160,000.

In turn, over the past ten years, industrial production in Germany has shown the worst results. Here are some sad things for the single European currency, which declined by 1.34% against the US dollar at the auction on February 3-7.

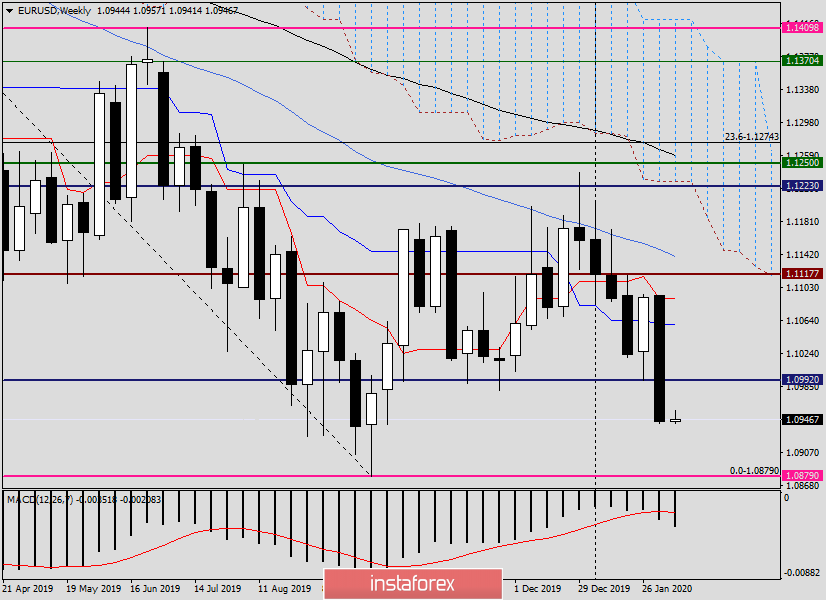

Weekly

As previously expected, in the event of a breakdown of 1.0992 and the week closing below this level, there will be little doubt about a bearish market for the euro/dollar. The breakdown was more than impressive, and the last five-day trading ended at 1.0943. According to the classics of technical analysis, now it would be nice to wait for a pullback to the broken level and consider options for opening short positions near 1.0992, where an additional signal will be a bearish model (or models) of Japanese candles on lower timeframes.

If the euro managed to find a strong driver for growth and the pair returns above 1.0992, where it will end trading on February 10-14, we can hope for a further rise in the price zone of 1.1060-1.1090, where the Kijun and Tenkan lines of the Ichimoku indicator are located, respectively.

If there is no correction and the downward trend continues, the pair will head to the September lows of last year at 1.0879. These are the options for the development of events seen on the weekly timeframe. Now let's analyze the situation at a smaller time interval.

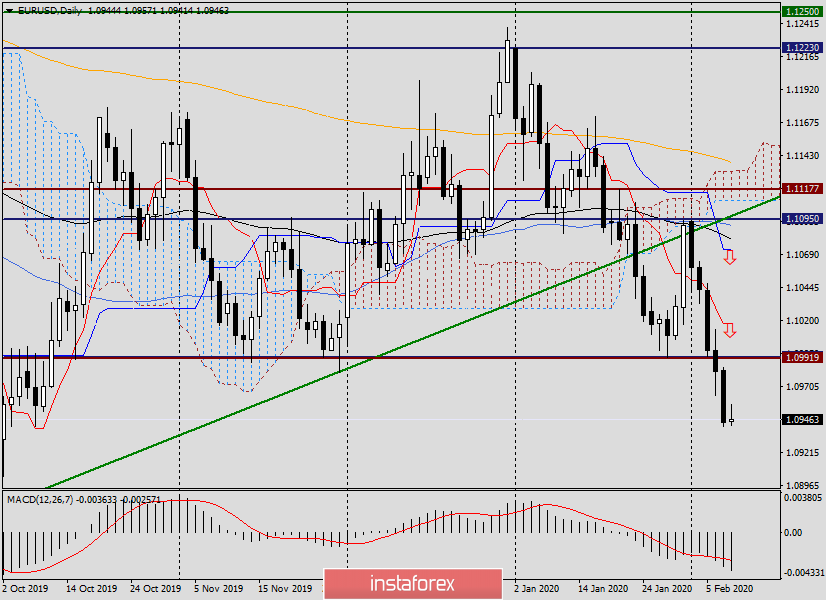

Daily

The pair had been declining throughout the previous week, and Friday was no exception in this regard. I'll note right away that you will rarely see growth or decrease that continues throughout the trading week (five consecutive days). We were lucky to see it.

But seriously, the daily chart shows not just the probability, but the need for a corrective recovery of EUR/USD. If market participants have a similar opinion, then the best option on this timeframe is to roll back to the broken support line of 1.0992.

With a deeper corrective recovery, the quote may rise to the Tenkan (1.1018) and Kijun (1.1073) lines. At the moment, the current bearish management of the euro/dollar pair with a rise as high as 1.1073 looks almost fantastic. However, many things don't happen on the market.

Thus, the trading plan consists of sales after corrective rollbacks in the area of 1.0990, 1.1010 and 1.1070. We will look at smaller charts tomorrow, but in the meantime, at the end of the review, we will briefly discuss the main macroeconomic data that may affect the price dynamics of EUR/USD.

Eurozone: industrial production, German GDP and the euro area as a whole.

USA: construction permits, the semi-annual monetary policy report of Fed Chairman Jerome Powell, the consumer price index, retail sales, industrial production, inventory in warehouses, and the consumer sentiment index from the University of Michigan.

As you can see, the week will be full of a large number of macroeconomic events, especially from the United States. Nevertheless, the semi-annual report on monetary policy by Fed Chairman Jerome Powell, as well as changes in consumer prices in the United States will be the central events of this week.

Have a nice day!

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română