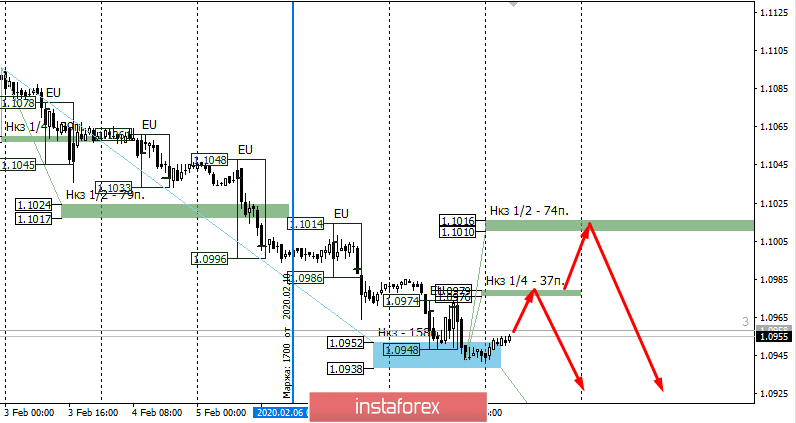

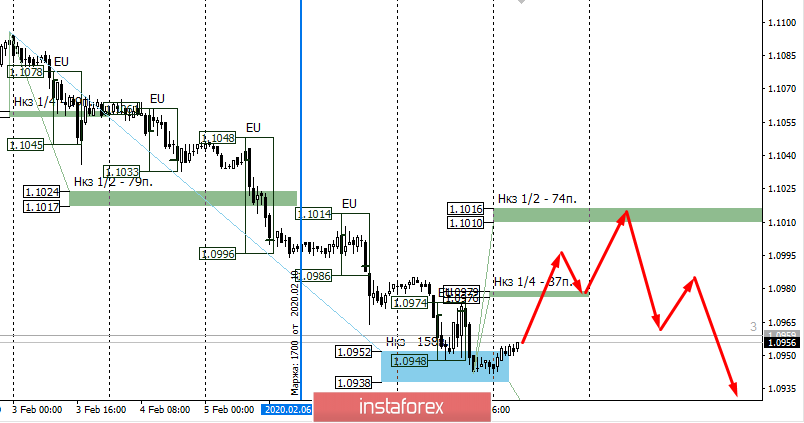

Today there was a change in margin requirements on the Chicago stock exchange, which affected the EUR / USD pair. It is necessary to resize control zones that have not yet been tested. The priority remains the fall, however, consolidation below the weekly control zone 1.0952-1.0938 has not yet occurred. This increases the likelihood of the formation of a correctional upward pattern to the nearest resistance zones.

Work towards a weakening euro is more profitable, so any growth should be considered for the formation of a pattern for sale. The nearest resistance is the weekly control zone in 1/4 which is 1.0979-1.0976.

An alternative model for the formation of a local accumulation zone will be developed if today's trading closes above Friday's high. This will allow you to get more favorable selling prices when testing the defining resistance of the weekly control zone in 1/2 which is 1.1016-1.1010.

Daily CZ - daily control zone. The area formed by important data from the futures market which changes several times a year.

Weekly CZ - weekly control zone. The zone formed by important marks of the futures market, which change several times a year.

Monthly CZ - monthly control zone. The area that reflects the average volatility over the past year.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română