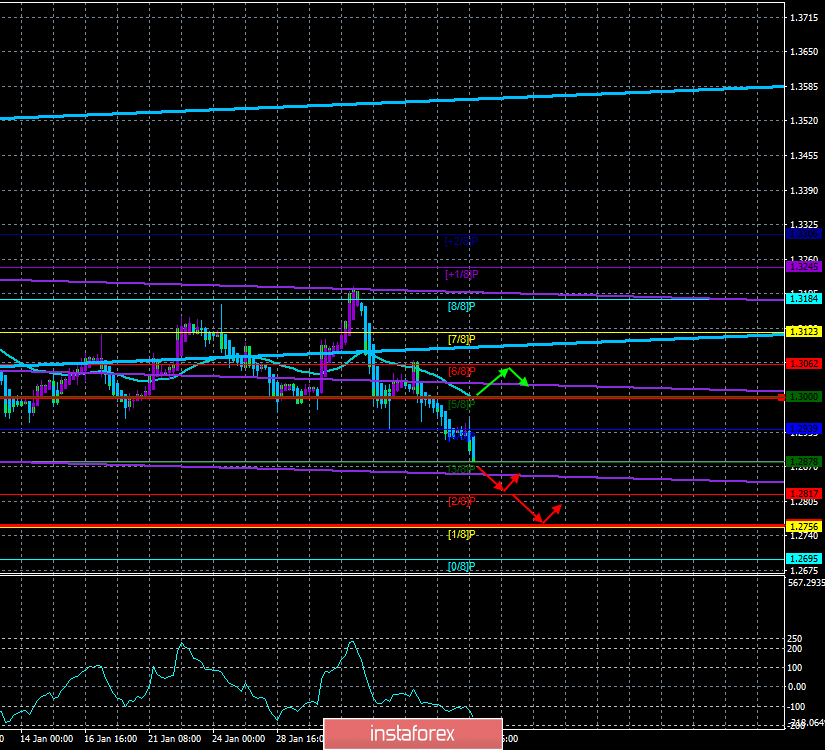

4-hour timeframe

Technical details:

Higher linear regression channel: direction - upward.

Lower channel of linear regression: direction - sideways.

Moving average (20; smoothed) - down.

CCI: -158.3364

The GBP/USD currency pair also continues its fall on February 10 and the pound may continue its fall on Monday, Tuesday, and Wednesday. No important macroeconomic reports or publications are scheduled for Monday in the UK. However, from our point of view, the pound remains overbought, given the current macroeconomic and fundamental backgrounds. Thus, on the first trading day of the week, the fall of the British currency may continue, and on Tuesday, data on GDP, industrial production, and retail sales will be published in Britain, which is likely to provoke even greater sales of the British currency, as forecasts predict another fall in the British economy.

Meanwhile, a growing number of experts are inclined to believe that London and Boris Johnson should not expect generous gifts from the European Union. Brussels is also interested in profitable trade with Britain but it is less dependent on it. So if anyone should be looking for a deal, it is London. However, Boris Johnson immediately showed that he was waiting for the agreement to be signed on the terms of London, and otherwise he could withdraw from the negotiations altogether. In this situation, many experts believe that the popularity of Boris Johnson in the UK will begin to decline sharply. If in the case of Brexit, he looks almost like a national hero, then in the case of the absence of an agreement with the European Union (which will mean a "hard" Brexit), he can become a national enemy. The problem is that the European Union is not going to discuss the same agreement with London as with Canada. Michel Barnier made an official statement in which he clearly presented the points that will be discussed with London. First, of course, economic and trade issues. According to Barnier, the EU is ready to provide an "extremely ambitious" agreement if London guarantees the absence of trade barriers and quotas for all goods that will enter the single European market. Second, the EU wants to work with London on terrorism, organized crime and cybercrime. Third, Barnier wants to develop a clear mechanism for managing all agreements and resolving disputes to resolve differences. In other words, London and Brussels will have to agree in which and whose court all disputed points will be considered. Naturally, the EU wants it to be the European Court of Justice, which Boris Johnson opposed. "If certain obligations are not met by one of the parties, the other party should be able to act quickly and effectively, including by autonomous measures in case of violation of the main provisions of the agreement," Barnier said. In other words, the European Union fears that London will not fully adhere to the agreement and wants to have tools at its disposal to influence London. Brussels also wants a comprehensive agreement that will define relations with Britain in almost all areas of life.

From a technical point of view, the fall in the British pound continues and there are no signs of the beginning of correction now. By the way, none of the linear regression channels is directed downwards. Nevertheless, the pound/dollar pair overcame the important support level of 1.2975, from which it previously made at least 6 rebounds. Thus, the chances of a downward movement have increased significantly.

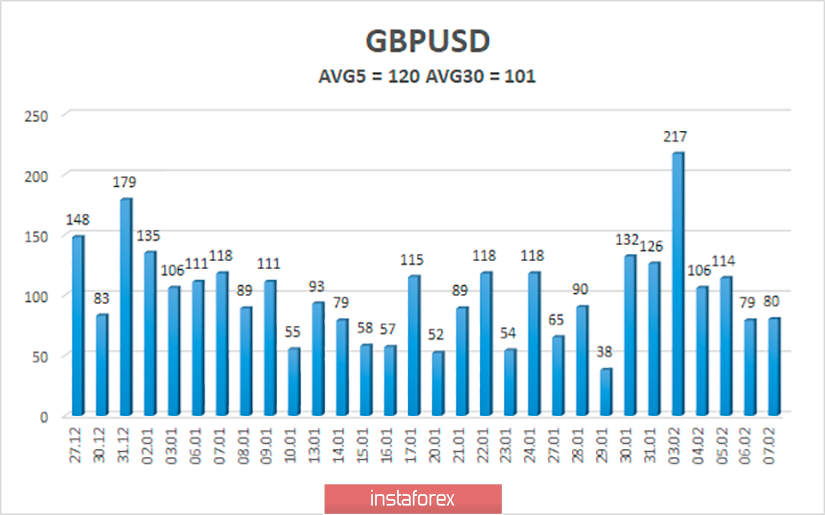

The average volatility of the pound/dollar pair has increased to 120 points over the past 5 days. According to the current volatility level, the working channel on February 10 will be limited to the levels of 1.2760 and 1.3000. The continued downward movement would be very logical. A reversal of the Heiken Ashi indicator to the top will indicate a round of corrective movement.

Nearest support levels:

S1 - 1.2878

S2 - 1.2817

S3 - 1.2756

Nearest resistance levels:

R1 - 1.2939

R2 - 1.3000

R3 - 1.3062

Trading recommendations:

The GBP/USD pair continues to move down. Thus, traders are now advised to stay in the sales of the pound with targets of 1.2817 and 1.2756 until the Heiken Ashi indicator turns up. It is recommended to return to buying the British currency after the pair reverses above the moving average line with the first targets of 1.3062 and 1.3123.

In addition to the technical picture, you should also take into account the fundamental data and the time of their release.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible price movements:

Red and green arrows.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română